it 2 Form 2020

What is the It 2 Form

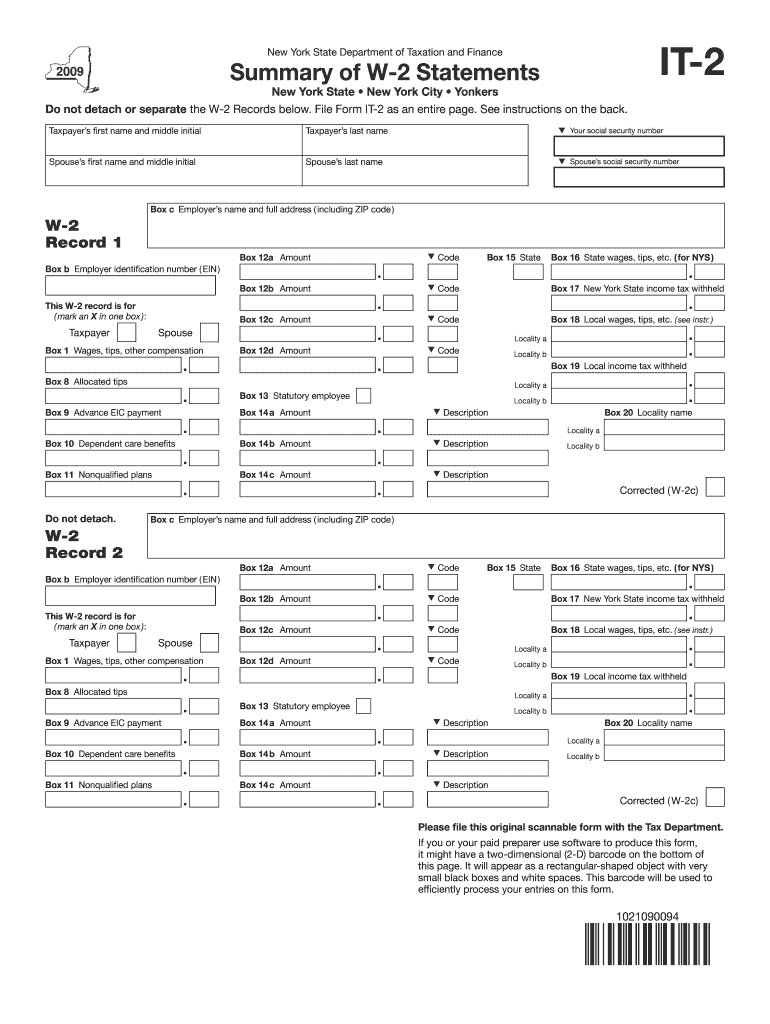

The New York Form IT-2 is a tax document used by employers to report the amount of wages paid and the taxes withheld from employees for the state of New York. This form is essential for ensuring that employees receive accurate information for their personal income tax returns. It provides a summary of wages and taxes withheld, which is crucial for employees when filing their annual tax returns. The IT-2 form is typically provided to employees by their employers by the end of January each year, reflecting the previous year's earnings.

How to use the It 2 Form

Using the New York Form IT-2 involves a few straightforward steps. First, employers must accurately complete the form with the necessary information, including the employee's name, Social Security number, total wages, and the amount of state tax withheld. Once completed, the form should be distributed to employees, who will use it to report their income when filing their taxes. Employees should ensure that the information matches their records to avoid discrepancies with the New York State Department of Taxation and Finance.

Steps to complete the It 2 Form

Completing the New York Form IT-2 requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary information, including employee details and wage records.

- Fill in the employee's name and Social Security number accurately.

- Report the total wages paid to the employee for the year.

- Indicate the total amount of New York state tax withheld from the employee's wages.

- Review the form for accuracy before submission.

- Distribute the completed forms to employees by the end of January.

Legal use of the It 2 Form

The legal use of the New York Form IT-2 is governed by state tax laws, which require employers to provide accurate wage and tax withholding information to employees. This form serves as a legal document that supports the employee's income tax filing. To ensure compliance, employers must adhere to the deadlines for distribution and maintain accurate records of all submitted forms. Failure to provide this form can result in penalties for both the employer and employee, making it vital to understand the legal obligations associated with the IT-2 form.

Filing Deadlines / Important Dates

Timely filing and distribution of the New York Form IT-2 is crucial for compliance. Employers must provide the completed forms to employees by January 31 of each year. Additionally, employers must file the IT-2 form with the New York State Department of Taxation and Finance as part of their annual tax reporting obligations. It is important to stay informed about any changes in deadlines or filing requirements to avoid penalties.

Who Issues the Form

The New York Form IT-2 is issued by the New York State Department of Taxation and Finance. Employers are responsible for generating and distributing this form to their employees. The department provides guidelines and resources to assist employers in completing the form accurately and understanding their responsibilities regarding tax reporting and compliance.

Quick guide on how to complete it 2 form 2020

Easily Prepare It 2 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without delays. Manage It 2 Form on any device with the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

Effortlessly Edit and eSign It 2 Form

- Obtain It 2 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method to share your form—by email, SMS, or invitation link—or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign It 2 Form to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 2 form 2020

Create this form in 5 minutes!

How to create an eSignature for the it 2 form 2020

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the New York Form IT-2 and how can airSlate SignNow help?

The New York Form IT-2 is used by employers to report information about withheld New York State personal income tax. With airSlate SignNow, you can easily complete, sign, and manage your New York Form IT-2 electronically, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for filing the New York Form IT-2?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. While there is a subscription cost, using airSlate SignNow to process your New York Form IT-2 can save on administrative expenses and reduce processing time.

-

What features does airSlate SignNow offer for the New York Form IT-2?

airSlate SignNow provides a user-friendly interface, customizable templates, and secure electronic signatures. These features streamline the process of completing the New York Form IT-2, making it easier to manage tax filings.

-

Can I store my New York Form IT-2 documents securely with airSlate SignNow?

Yes, airSlate SignNow offers secure document storage to keep your New York Form IT-2 and other important files safe. All documents are encrypted and can be accessed at any time, ensuring your sensitive information is protected.

-

Is airSlate SignNow compliant with New York tax regulations for Form IT-2?

Absolutely, airSlate SignNow is designed to comply with all New York tax regulations, including those specific to the New York Form IT-2. By using our platform, you can be confident that your filings meet state requirements.

-

What integrations does airSlate SignNow offer for managing the New York Form IT-2?

airSlate SignNow integrates seamlessly with various business applications and software tools, enhancing your workflow. Whether you use CRM, accounting, or financial software, you can easily link them to manage your New York Form IT-2 efficiently.

-

How can airSlate SignNow benefit my business when filing the New York Form IT-2?

Using airSlate SignNow for your New York Form IT-2 allows for faster processing and easier management of employee tax documentation. The platform also reduces paper usage, making it an eco-friendly choice for your business.

Get more for It 2 Form

- How to form a professional llcus legal forms

- Unmarried hereinafter referred to as grantor does hereby grant with quitclaim covenants to form

- Hereinafter referred to as grantor does hereby give grant bargain sell and confirm with warranty form

- Texas lady bird deed formget a ladybird deed online

- Know ye that a corporation organized under the form

- Laws of the state of hereinafter referred to as grantor does hereby give form

- Finding amp awarddismissal ruling on motion order dated form

- Laws of the state of hereinafter referred to as grantor does hereby grant form

Find out other It 2 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors