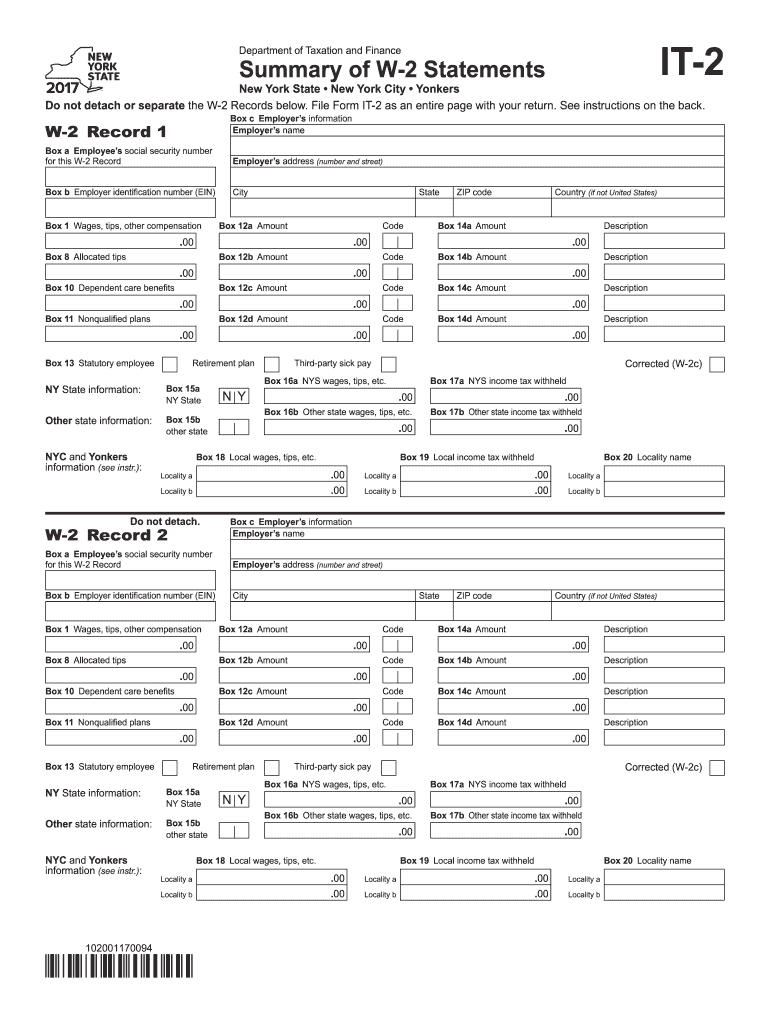

Form it 2 2017

What is the Form It 2

The Form It 2 is a specific tax document used primarily for reporting income and expenses related to certain business activities. This form is essential for individuals and entities who need to provide accurate financial information to the IRS. It includes fillable sections where users can input necessary data, ensuring compliance with federal tax regulations. The Form It 2 is designed to facilitate the reporting process, making it easier for taxpayers to fulfill their obligations while minimizing errors.

How to use the Form It 2

Using the Form It 2 involves several straightforward steps. First, ensure you have the latest version of the form, which can be obtained online. Next, gather all relevant financial documents, such as income statements and expense receipts. Fill out the form by entering your information accurately in the designated fields. Once completed, review the form for any errors or omissions. After ensuring everything is correct, you can eSign the document using a compliant eSignature solution, making the submission process efficient and secure.

Steps to complete the Form It 2

Completing the Form It 2 requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Form It 2 from a reliable source.

- Collect all necessary financial documents to support your entries.

- Fill in the form, ensuring all fields are completed accurately.

- Double-check your entries for any mistakes or missing information.

- Utilize an eSignature tool to sign the form electronically.

- Submit the completed form through the appropriate channels as per IRS guidelines.

Legal use of the Form It 2

The Form It 2 is legally recognized for reporting income and expenses to the IRS. To ensure its validity, taxpayers must adhere to specific guidelines provided by the IRS. This includes using the correct version of the form, providing accurate information, and signing the document as required. The IRS has also recognized electronic signatures as legally binding, which enhances the usability of the Form It 2 in a digital format. Compliance with these legal standards is crucial for avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form It 2 are critical for compliance with tax regulations. Typically, the form must be submitted by April fifteenth of the tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about any changes to deadlines, especially during tax season, to avoid late filing penalties. Keeping a calendar of important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Form It 2 can be submitted through various methods, providing flexibility for taxpayers. The most efficient way is to file online using an approved eSignature platform, which allows for quick processing and confirmation. Alternatively, taxpayers may choose to mail the completed form to the appropriate IRS address. In-person submissions are also an option at designated IRS offices, although this method may require an appointment. Each submission method has its own timeline for processing, so selecting the right one is important for timely compliance.

IRS Guidelines

IRS guidelines for the Form It 2 outline the requirements for accurate completion and submission. Taxpayers must ensure they are using the correct form version and understand the specific instructions provided by the IRS. This includes knowing what information is necessary to report and how to calculate any applicable deductions or credits. Familiarity with these guidelines is essential to avoid errors that could lead to audits or penalties. Regularly reviewing IRS updates can help taxpayers stay compliant with any changes to the filing process.

Quick guide on how to complete form it 2 2017 2019

Your assistance manual on preparing your Form It 2

If you’re curious about how to generate and submit your Form It 2, here are some quick tips to simplify the tax filing process.

To get started, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and robust document management tool that enables you to edit, draft, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and revisit to amend answers as necessary. Optimize your tax processing with advanced PDF editing, eSigning, and straightforward sharing.

Adhere to the steps below to complete your Form It 2 in no time:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Form It 2 in our editor.

- Populate the necessary fillable fields with your information (text, figures, check marks).

- Employ the Sign Tool to append your legally-valid electronic signature (if necessary).

- Examine your document and rectify any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Keep in mind that submitting on paper may lead to increased errors and delays in refunds. Before e-filing your taxes, be sure to review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form it 2 2017 2019

FAQs

-

How do I apply in IIIT from 2018 as an IIIT does not take part in the JEE Mains 2018?

There are only 3 IIIT who brings theirs own form for admission in their respective colleges.IIIT HyderabadFor admission in this college there are two ways .A. You need to to fill its separate form which comes just after Jee main exam. You need some what around 240 marks in Jee main.B. They take their separate exam also, which was on 28 or 30 April last year i.e 2017. The paper patterns is similar to paper 2 of Jee main.2. IIIT BANGALOREThere is only one way entry in this college. You need to fill its separate form which comes out in April. And a score of 170 to 180 in Jee mains is enough to be there.Now comes my college3. IIIT BHUBANESHWARFor admission in this college you need to fill its separate form which comes out in march.And you need a rank between 25k to 35k in Jee mains to fetch a good branch.Goood luckEdit 1: From this year IIIT BHUBANESWAR had decided that they will take non odisha students from jossa and for odisha students they will take admission through separate form.EDIT 2:24/5/2019My next answer will be about college comparison of Josaa on my blog Sachin Pathak.Comment the colleges and I will be comparing it.Sachin Pathak

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the form it 2 2017 2019

How to make an electronic signature for your Form It 2 2017 2019 online

How to make an eSignature for the Form It 2 2017 2019 in Chrome

How to generate an eSignature for putting it on the Form It 2 2017 2019 in Gmail

How to create an eSignature for the Form It 2 2017 2019 right from your smart phone

How to create an eSignature for the Form It 2 2017 2019 on iOS

How to generate an electronic signature for the Form It 2 2017 2019 on Android devices

People also ask

-

What is Form It 2 and how does it work?

Form It 2 is a powerful feature within airSlate SignNow that allows users to create and manage customizable forms seamlessly. It streamlines document workflows by enabling businesses to collect, sign, and store data efficiently. With Form It 2, you can enhance your document processes while ensuring security and compliance.

-

How much does Form It 2 cost?

Pricing for Form It 2 varies based on the chosen plan and the number of users. airSlate SignNow offers flexible pricing options designed to fit different business needs, ensuring that you find a cost-effective solution. For detailed pricing information, visit our pricing page or contact our sales team.

-

What are the key features of Form It 2?

Form It 2 includes features such as customizable templates, automated workflows, and real-time notifications. These capabilities empower businesses to enhance productivity and improve collaboration among team members. Additionally, the user-friendly interface of Form It 2 makes it easy for anyone to create and manage forms.

-

Can I integrate Form It 2 with other applications?

Yes, Form It 2 seamlessly integrates with various applications, including CRM systems, document management tools, and cloud storage services. This flexibility allows businesses to streamline their processes by connecting Form It 2 with their existing workflows. Explore our integrations page for a complete list of compatible applications.

-

What benefits does Form It 2 offer to businesses?

Form It 2 offers numerous benefits, including increased efficiency in document processing and reduced turnaround times for approvals. By automating form collection and eSigning, businesses can focus on more critical tasks. Additionally, Form It 2 enhances compliance by providing a secure environment for document management.

-

Is Form It 2 suitable for small businesses?

Absolutely! Form It 2 is designed to cater to businesses of all sizes, including small businesses. Its cost-effective pricing and user-friendly features make it an ideal choice for small teams looking to optimize their document workflows without a hefty investment.

-

How secure is Form It 2 for handling sensitive information?

Form It 2 prioritizes security by employing advanced encryption and compliance with industry standards. This ensures that all sensitive information is protected during transmission and storage. You can trust Form It 2 to manage your documents while maintaining confidentiality and integrity.

Get more for Form It 2

- Echelle de katz form

- Environmental clearance for undertakings within nmdot right of dot state nm form

- Prepopik instructions day before regimen form

- Arizona cc 218 order form to request des state legal forms

- A haccp flowchart for beef stew form

- Plea form city of sweeny texas

- Yvonne m williams texas state directory online form

- Probate client information worksheet

Find out other Form It 2

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online