West Virginia State Tax Department Form 433B Collection

What is the West Virginia State Tax Department Form 433B Collection

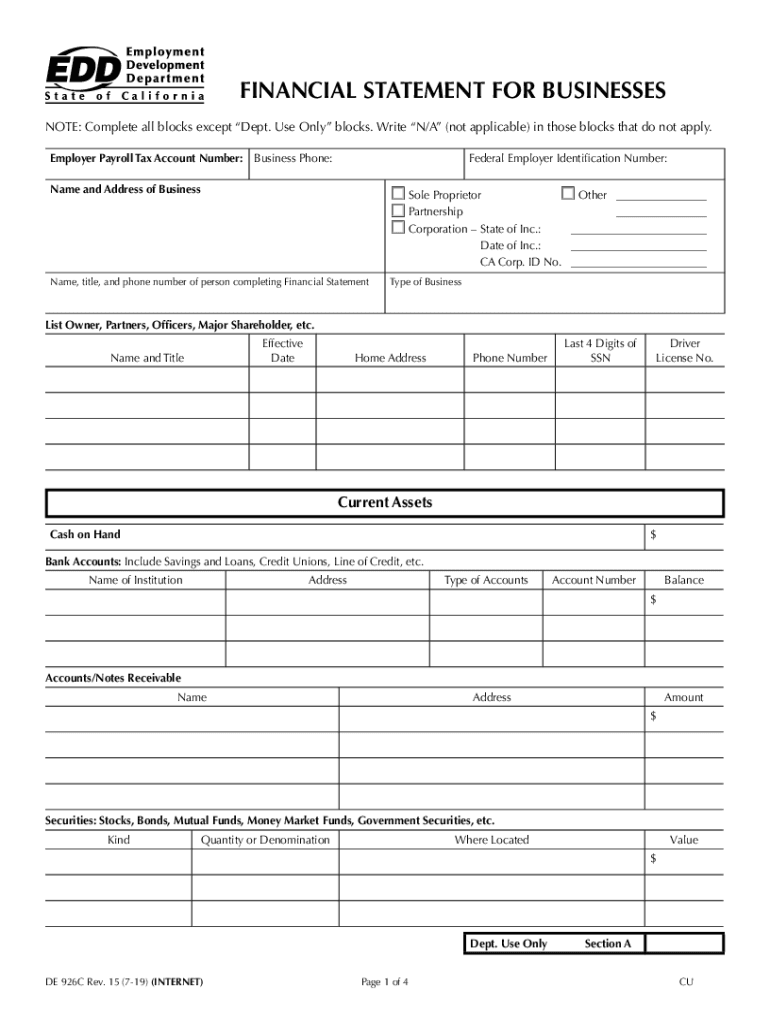

The West Virginia State Tax Department Form 433B Collection is a financial statement used by individuals to provide detailed information about their financial status to the state tax authorities. This form is typically utilized during the process of tax collection or negotiation, allowing taxpayers to disclose their income, expenses, assets, and liabilities. The information collected helps the state assess the taxpayer's ability to pay outstanding tax debts or negotiate payment plans.

How to use the West Virginia State Tax Department Form 433B Collection

To effectively use the Form 433B Collection, taxpayers should begin by gathering all necessary financial documents. This includes pay stubs, bank statements, and records of any other income sources. Once the financial data is compiled, the taxpayer can fill out the form accurately, ensuring all sections are completed. After filling out the form, it should be submitted to the appropriate state tax authority, either electronically or via mail, depending on the submission guidelines provided by the West Virginia State Tax Department.

Steps to complete the West Virginia State Tax Department Form 433B Collection

Completing the Form 433B Collection involves several key steps:

- Gather financial documents, including income statements and expense records.

- Fill out personal information, including name, address, and Social Security number.

- Detail income sources, including wages, business income, and any other earnings.

- List all monthly expenses, such as housing costs, utilities, and other necessary expenditures.

- Document assets, including bank accounts, real estate, and vehicles.

- Submit the completed form to the West Virginia State Tax Department.

Key elements of the West Virginia State Tax Department Form 433B Collection

The Form 433B Collection includes several key elements that are crucial for accurate completion:

- Personal Information: Name, address, and Social Security number.

- Income Details: Comprehensive breakdown of all income sources.

- Expense Information: Monthly expenses that impact financial standing.

- Asset Disclosure: A list of all significant assets owned by the taxpayer.

- Liabilities: Any outstanding debts or obligations that need to be reported.

Legal use of the West Virginia State Tax Department Form 433B Collection

The legal use of the Form 433B Collection is essential for ensuring compliance with state tax laws. When completed accurately and submitted on time, the form serves as a legally binding document that can influence negotiations regarding tax debts. It is important to be truthful and thorough when providing information, as discrepancies can lead to penalties or additional scrutiny from tax authorities.

Form Submission Methods

Taxpayers can submit the Form 433B Collection through various methods, including:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the West Virginia State Tax Department's online portal.

- Mail: The completed form can be printed and mailed to the designated address provided by the tax department.

- In-Person: Taxpayers may also choose to submit the form in person at local tax offices, where assistance may be available.

Quick guide on how to complete form 433b

Effortlessly Prepare form 433b on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and store them securely online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage form 433b on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Alter and Electronically Sign form 433b with Ease

- Find form 433b and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, be it through email, text message (SMS), or a sharing link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your preferred device. Edit and electronically sign form 433b to guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 433b

Create this form in 5 minutes!

How to create an eSignature for the form 433b

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask form 433b

-

What is Form 433B and how is it used?

Form 433B is a financial statement that the IRS uses to gather information about an individual's financial status. It’s crucial for those seeking to negotiate a payment plan or settle tax debts with the IRS. Utilizing airSlate SignNow can streamline the process of completing and submitting Form 433B securely.

-

How can airSlate SignNow assist with completing Form 433B?

airSlate SignNow offers an efficient platform for filling out Form 433B, allowing users to easily edit and electronically sign the document. The intuitive interface simplifies the completion of financial information, ensuring accuracy and compliance. With eSigning, you can submit Form 433B quickly without printing or scanning.

-

Is there a cost associated with using airSlate SignNow for Form 433B?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for businesses and individuals. The pricing is competitive and reflects the extensive features provided, including the ability to manage and send Form 433B seamlessly. You can choose a plan that fits your needs and budget.

-

What features does airSlate SignNow offer for Form 433B?

airSlate SignNow includes several features that enhance the management of Form 433B, such as templates, reusable fields, and document storage. Users can also track the status of their documents in real-time and receive alerts when their Form 433B is viewed or signed. This transparency and control facilitate a smooth process.

-

Can I integrate airSlate SignNow with other applications to manage Form 433B?

Yes, airSlate SignNow integrates seamlessly with various applications, enabling users to manage Form 433B alongside their preferred tools. Integrations with document management systems and accounting software enhance productivity and streamline workflow. This connectivity ensures that your financial documents remain organized and easily accessible.

-

What are the benefits of using airSlate SignNow for signing Form 433B?

Using airSlate SignNow to sign Form 433B provides several benefits, such as increased efficiency and improved security. The electronic signature is legally binding and helps reduce turnaround time, allowing for quicker submissions. Plus, the built-in compliance ensures that your document handling meets industry standards.

-

How does airSlate SignNow ensure the security of Form 433B?

airSlate SignNow prioritizes the security of all documents, including Form 433B, through encryption and secure cloud storage. This means your sensitive financial information is protected during transmission and storage. Additionally, the platform complies with industry regulations, offering peace of mind for users concerned about data security.

Get more for form 433b

- Missionary ventures canada form

- Quick issue term change application nn7011e complete this form to change a manulife quick issue term life insurance policy when

- Manulife quick issue term application for change form

- Supplementary welfare allowance rent supplement swa 3 022010 form

- Motion to set aside an ex parte order form s2 sjtogovonca

- Salvage vehicle statement form

- Rent supplement form

- The institute of chartered accountants of india in form

Find out other form 433b

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document