Colorado Approved Program Form 2021

What is the Colorado Approved Program Form

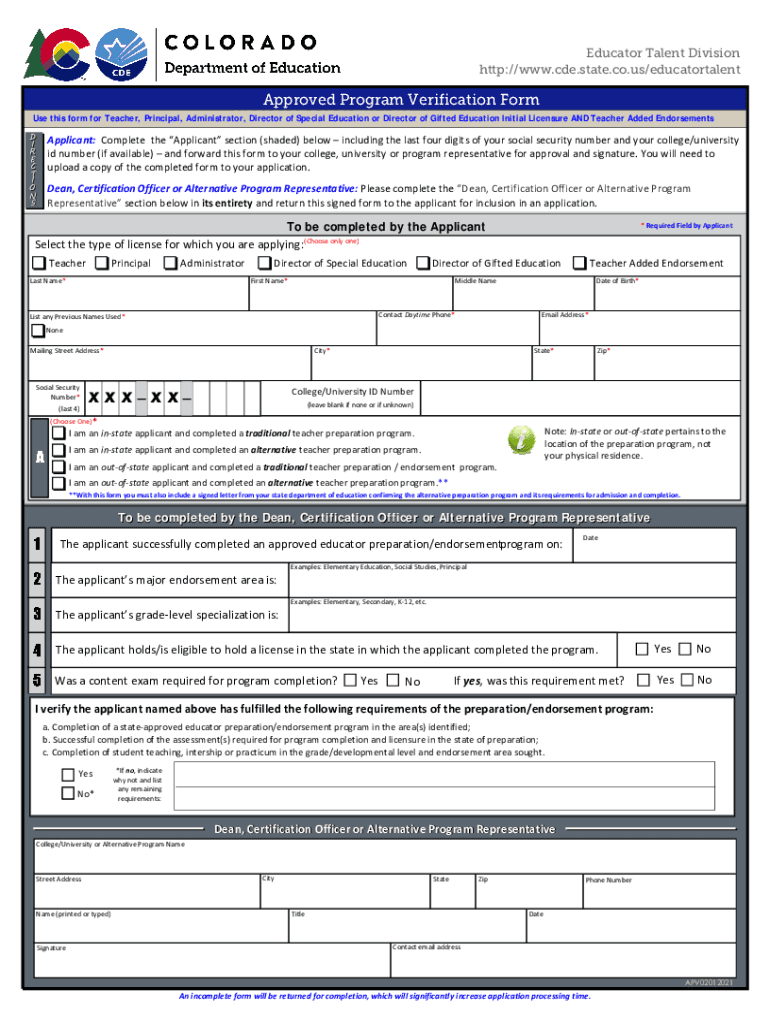

The Colorado Approved Program Form is a specific document required for various applications and processes within the state of Colorado. It is designed to ensure compliance with state regulations and to facilitate the approval of programs that meet certain criteria. This form is essential for organizations and individuals looking to establish programs that align with state standards, particularly in areas such as education, health, and social services.

How to use the Colorado Approved Program Form

Using the Colorado Approved Program Form involves several key steps. First, ensure you have the correct version of the form, as updates may occur. Next, carefully read the instructions provided with the form to understand the requirements and necessary information. Fill out the form accurately, providing all requested details. Once completed, review the form for any errors or omissions before submitting it according to the specified guidelines.

Steps to complete the Colorado Approved Program Form

Completing the Colorado Approved Program Form requires attention to detail. Here are the steps to follow:

- Download the most recent version of the form from an official source.

- Read through the instructions thoroughly to understand what information is required.

- Fill in your details, ensuring accuracy in all fields.

- Attach any required supporting documents as specified in the instructions.

- Review the completed form for any mistakes or missing information.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the Colorado Approved Program Form

The Colorado Approved Program Form is legally binding when completed in accordance with state laws. To ensure its legal validity, it must be filled out accurately and submitted through the proper channels. Compliance with relevant regulations is crucial, as any discrepancies may lead to delays or rejections of the application. Additionally, electronic signatures may be used if they comply with the ESIGN and UETA acts, enhancing the form's legal standing.

Key elements of the Colorado Approved Program Form

Several key elements are essential to the Colorado Approved Program Form. These include:

- Applicant Information: Details about the individual or organization submitting the form.

- Program Description: A clear explanation of the program being proposed or applied for.

- Compliance Statements: Affirmations that the program meets state requirements.

- Supporting Documentation: Any necessary attachments that substantiate the application.

- Signature Section: A place for the applicant to sign and date the form, confirming the accuracy of the information provided.

Form Submission Methods

The Colorado Approved Program Form can be submitted through various methods, depending on the specific requirements of the program. Common submission methods include:

- Online Submission: Many forms can be submitted electronically through designated state portals.

- Mail: Completed forms can be sent to the appropriate state office via postal service.

- In-Person Submission: Applicants may also have the option to submit the form directly at designated locations.

Quick guide on how to complete colorado approved program form 571906897

Effortlessly Prepare Colorado Approved Program Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Colorado Approved Program Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Colorado Approved Program Form with Ease

- Locate Colorado Approved Program Form and select Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for such tasks.

- Create your signature using the Sign tool, a process that takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending the form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and electronically sign Colorado Approved Program Form to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado approved program form 571906897

Create this form in 5 minutes!

How to create an eSignature for the colorado approved program form 571906897

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is a Colorado approved program form?

A Colorado approved program form is a specific document that complies with state regulations and is recognized for official use within Colorado. This form is essential for businesses and organizations to ensure legal compliance in their operations. Using tools like airSlate SignNow makes it easy to create and manage these forms efficiently.

-

How can airSlate SignNow help me with Colorado approved program forms?

airSlate SignNow provides an easy-to-use platform that allows you to create, send, and eSign Colorado approved program forms effortlessly. With its intuitive interface, you can streamline the document workflow, making it simpler to manage necessary approvals and signatures. This efficient process helps save time and reduce errors in documentation.

-

What features does airSlate SignNow offer for managing Colorado approved program forms?

airSlate SignNow offers several features to enhance the management of Colorado approved program forms, including customizable templates, real-time tracking, and secure storage. Additionally, you can integrate these forms into your existing workflows and automate notifications for approvals, ensuring a smooth process. These features make managing forms hassle-free and efficient.

-

Is airSlate SignNow cost-effective for handling Colorado approved program forms?

Yes, airSlate SignNow provides a cost-effective solution for managing Colorado approved program forms, offering various pricing plans tailored to different business needs. With its competitive pricing, businesses can access powerful features without breaking the bank. This value proposition makes it a preferred choice for companies looking to enhance their document management processes.

-

Can I integrate airSlate SignNow with other tools when working with Colorado approved program forms?

Absolutely! airSlate SignNow offers integrations with several popular tools and applications, facilitating smoother workflows for Colorado approved program forms. By connecting with platforms such as Google Drive, Salesforce, and Microsoft Teams, you can enhance collaboration and streamline your document management processes. This flexibility allows you to create a tailored solution that fits your business needs.

-

What benefits do businesses get by using airSlate SignNow for Colorado approved program forms?

Using airSlate SignNow for Colorado approved program forms provides businesses with numerous benefits, including reduced paper usage, improved transaction speed, and enhanced document security. By digitizing these forms, organizations can more efficiently track their submissions and approvals. This not only boosts productivity but also ensures compliance with Colorado's regulations.

-

How secure is airSlate SignNow for handling sensitive Colorado approved program forms?

airSlate SignNow employs advanced security measures to protect sensitive Colorado approved program forms, including encryption and secure storage options. This commitment to security helps ensure that your documents are safe from unauthorized access while complying with legal standards. With airSlate SignNow, you can have peace of mind when handling confidential information.

Get more for Colorado Approved Program Form

- Florida florida prenuptial premarital agreement without financial statements form

- Florida living trust for individual who is single divorced or widow or widower with children form

- North carolina wills last form

- Ga wills form

- Az wills last form

- California lease form

- Step arent adoption forms 325

- Texas texas installments fixed rate promissory note secured by residential real estate form

Find out other Colorado Approved Program Form

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document