Www Revenue Ieenpersonal Tax Credits ReliefsSpecial Assignee Relief Programme SARP Form

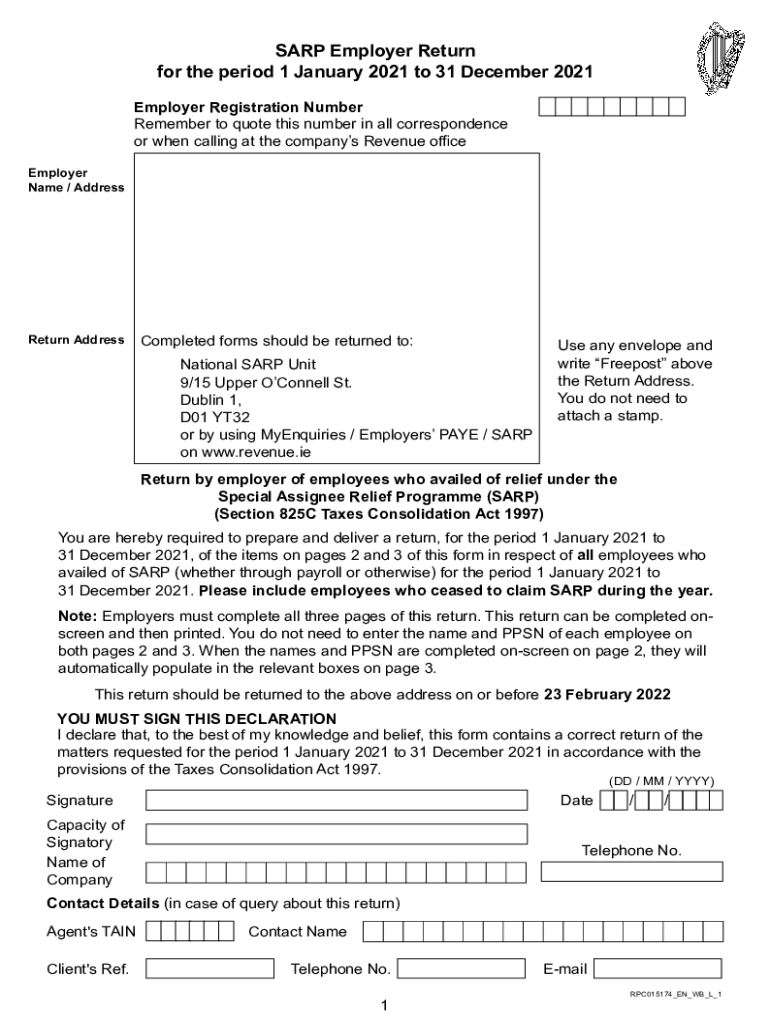

What is the SARP employer return?

The SARP employer return is a tax document associated with the Special Assignee Relief Programme (SARP) in the United States. This program is designed to provide tax relief for employees assigned to work in the U.S. from abroad. The return is crucial for employers to report the relevant tax credits and reliefs applicable to their employees under this program. Understanding the details of this return helps ensure compliance with IRS regulations while maximizing potential tax benefits for both employers and employees.

Steps to complete the SARP employer return

Completing the SARP employer return involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the employee's assignment, including their duration, location, and salary details. Next, fill out the SARP return form accurately, ensuring that all sections are completed as required. It is important to review the form for any errors before submission. Finally, submit the completed return to the appropriate tax authority, adhering to any specific submission guidelines provided by the IRS.

Eligibility criteria for the SARP employer return

To qualify for the SARP employer return, certain eligibility criteria must be met. The employee must be assigned to work in the U.S. from a foreign location and must meet specific residency requirements. Additionally, the employer must be a qualifying entity that can provide the necessary documentation to support the employee's claim for tax relief. Understanding these criteria is essential for employers to ensure that they and their employees can benefit from the program.

Required documents for the SARP employer return

When preparing the SARP employer return, several documents are required to support the claims made. These typically include proof of the employee's assignment, such as a letter from the employer detailing the assignment's duration and purpose. Additionally, salary statements and tax identification numbers may be needed to complete the return accurately. Collecting these documents in advance can streamline the process and help avoid delays in submission.

Penalties for non-compliance with the SARP employer return

Failure to comply with the requirements of the SARP employer return can result in significant penalties. Employers may face fines or additional tax liabilities if they do not accurately report the necessary information. Moreover, employees may lose their eligibility for tax relief, leading to unexpected tax burdens. It is crucial for employers to understand these risks and ensure that all returns are completed and submitted correctly and on time.

Form submission methods for the SARP employer return

The SARP employer return can be submitted through various methods, depending on the preferences of the employer and the requirements of the IRS. Options typically include online submission through the IRS e-filing system, mailing a physical copy of the return, or submitting it in person at designated tax offices. Each method has its own set of guidelines and deadlines, so it is important to choose the one that best fits the employer's needs while ensuring compliance with all regulations.

Quick guide on how to complete wwwrevenueieenpersonal tax credits reliefsspecial assignee relief programme sarp

Complete Www revenue ieenpersonal tax credits reliefsSpecial Assignee Relief Programme SARP effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Www revenue ieenpersonal tax credits reliefsSpecial Assignee Relief Programme SARP on any platform using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and eSign Www revenue ieenpersonal tax credits reliefsSpecial Assignee Relief Programme SARP with ease

- Obtain Www revenue ieenpersonal tax credits reliefsSpecial Assignee Relief Programme SARP and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all entries and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Www revenue ieenpersonal tax credits reliefsSpecial Assignee Relief Programme SARP to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwrevenueieenpersonal tax credits reliefsspecial assignee relief programme sarp

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an e-signature for a PDF on Android OS

People also ask

-

What is a SARP employer return?

A SARP employer return is a report that businesses must file to comply with specific tax regulations. It outlines the company's total employee compensation and tax withheld. Utilizing airSlate SignNow can simplify the process of preparing and submitting your SARP employer return, ensuring accuracy and compliance.

-

How does airSlate SignNow help with filing SARP employer returns?

airSlate SignNow streamlines the process of preparing and sending SARP employer returns by enabling electronic signatures and document management. This feature minimizes the risk of errors and speeds up the submission process. Moreover, our platform allows for seamless collaboration with your team to gather necessary documents efficiently.

-

Is airSlate SignNow cost-effective for managing SARP employer returns?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective choice for managing SARP employer returns. By reducing paperwork and increasing efficiency, businesses can save both time and money. Our platform ensures you only pay for the features you need, making it budget-friendly for companies of all sizes.

-

What features does airSlate SignNow offer for SARP employer return management?

airSlate SignNow provides features such as customizable templates, electronic signatures, and document tracking specifically designed for SARP employer returns. You can create templates that cater to your reporting needs, ensuring compliance with minimal manual effort. Additionally, advanced tracking features keep you updated on the status of your submissions.

-

Can I integrate airSlate SignNow with other tools for SARP employer return management?

Absolutely! airSlate SignNow integrates with various tools and platforms, enhancing your ability to manage SARP employer returns effectively. Whether you use accounting software or HR management systems, our integration capabilities ensure a seamless workflow. This reduces data entry and helps maintain accurate records.

-

What are the benefits of using airSlate SignNow for SARP employer returns?

Using airSlate SignNow for SARP employer returns offers several benefits, including enhanced efficiency, reduced manual errors, and improved compliance. The platform’s intuitive design allows users to easily prepare and sign documents electronically. Overall, it leads to a more organized approach to managing employer returns.

-

Is airSlate SignNow secure for handling sensitive SARP employer return information?

Yes, airSlate SignNow prioritizes security when handling sensitive information related to SARP employer returns. Our platform employs advanced encryption and authentication protocols to protect your data. You can trust that all documents signed and stored will be secure and compliant with industry standards.

Get more for Www revenue ieenpersonal tax credits reliefsSpecial Assignee Relief Programme SARP

Find out other Www revenue ieenpersonal tax credits reliefsSpecial Assignee Relief Programme SARP

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple