4506t Sba Form

What is the 4506-T SBA?

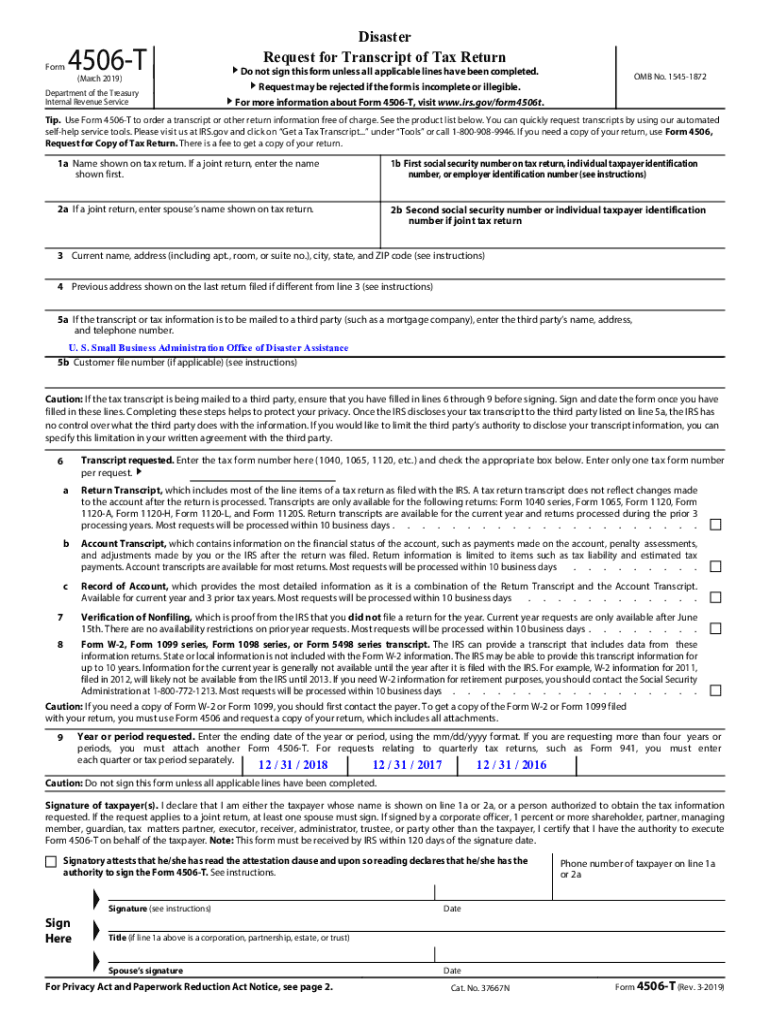

The IRS Form 4506-T, also known as the 4506-T SBA, is a request for the transcript of tax return information. This form is primarily used by businesses and individuals to obtain a copy of their tax returns or to authorize a third party to receive this information. It is especially important for Small Business Administration (SBA) loan applications, as lenders often require verification of income and tax history. The form allows for the retrieval of various types of transcripts, including tax return transcripts, account transcripts, and record of account transcripts, which can be crucial for financial assessments.

Steps to Complete the 4506-T SBA

Completing the IRS Form 4506-T for SBA purposes involves several straightforward steps:

- Gather Required Information: Collect your personal information, including your name, Social Security number, and the address used on your tax return.

- Fill Out the Form: Enter the requested details accurately. Specify the type of transcript needed and the years for which you are requesting the information.

- Sign and Date: Ensure that you sign and date the form. If you are authorizing a third party, include their information as well.

- Submit the Form: Send the completed form to the appropriate address provided in the instructions, or submit it electronically if applicable.

Legal Use of the 4506-T SBA

The legal use of the IRS Form 4506-T is governed by regulations that ensure the confidentiality and security of taxpayer information. When completed correctly, the form serves as a legal document that allows the IRS to disclose tax information to authorized parties. It is essential to understand that misuse of this form, such as falsifying information or unauthorized requests, can lead to legal penalties. Compliance with IRS guidelines is crucial to maintain the integrity of the process.

Who Issues the Form?

The IRS Form 4506-T is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The form is available directly from the IRS website, where users can access the most current version and instructions for completion. Ensuring that you are using the latest form is vital for compliance and accuracy in your requests.

Required Documents

When requesting information using the 4506-T SBA, you may need to provide additional documentation to support your request. This typically includes:

- Identification: A government-issued ID, such as a driver's license or passport, to verify your identity.

- Tax Information: Specific details about the tax returns you are requesting, including the tax years and types of transcripts needed.

- Authorization: If a third party is involved, a signed authorization must accompany the form to allow the IRS to release your information.

Form Submission Methods

The IRS Form 4506-T can be submitted through various methods, depending on your preference and the requirements of the requesting party:

- Mail: Print the completed form and send it to the designated IRS address based on your location and the type of request.

- Fax: Some requests can be submitted via fax, which may expedite processing times.

- Online Submission: If applicable, certain services allow for electronic submission of the form, which can simplify the process.

Quick guide on how to complete 4506t sba

Complete 4506t Sba effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, as you can acquire the necessary form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly and without delays. Manage 4506t Sba on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign 4506t Sba without hassle

- Find 4506t Sba and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 4506t Sba and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506t sba

The best way to generate an e-signature for a PDF document in the online mode

The best way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

The best way to create an e-signature for a PDF file on Android devices

People also ask

-

What is the IRS Form 4506-T SBA and how does it work?

The IRS Form 4506-T SBA is a tax document used by individuals and businesses to request a transcript of their tax return. This form is essential for verifying income or tax information, especially when applying for SBA loans. With airSlate SignNow, you can easily fill out, sign, and submit the IRS Form 4506-T SBA online, streamlining the process dramatically.

-

How can airSlate SignNow assist in completing the IRS Form 4506-T SBA?

AirSlate SignNow offers an intuitive platform for completing the IRS Form 4506-T SBA. Users can fill in the necessary fields, add signatures electronically, and manage documents effectively. This makes it easy for businesses to securely handle their forms while ensuring compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow to submit the IRS Form 4506-T SBA?

Yes, airSlate SignNow provides various pricing plans that are cost-effective for any size business. The platform allows for unlimited document signing and management, which can be particularly beneficial when handling the IRS Form 4506-T SBA. Depending on your needs, you can choose a plan that maximizes value without breaking your budget.

-

What features does airSlate SignNow offer for the IRS Form 4506-T SBA?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and real-time notifications, which are particularly helpful for managing the IRS Form 4506-T SBA. Additionally, you can integrate it with various third-party applications, simplifying your workflow and enhancing productivity.

-

Can I integrate airSlate SignNow with other software for processing the IRS Form 4506-T SBA?

Absolutely! AirSlate SignNow supports integration with a wide range of software applications, allowing you to manage the IRS Form 4506-T SBA and other documents seamlessly. This includes CRM systems, cloud storage solutions, and accounting software, making it a versatile tool for your business.

-

What are the benefits of using airSlate SignNow for the IRS Form 4506-T SBA?

Using airSlate SignNow for the IRS Form 4506-T SBA offers numerous benefits, including increased efficiency, enhanced security, and reduced paper waste. The easy-to-use interface allows for quick processing, while robust security measures ensure that your sensitive tax information is well-protected.

-

How does airSlate SignNow ensure the security of the IRS Form 4506-T SBA?

AirSlate SignNow prioritizes security and compliance, featuring end-to-end encryption for documents such as the IRS Form 4506-T SBA. Our platform implements stringent security measures to protect your data from unauthorized access, giving you peace of mind while managing sensitive information.

Get more for 4506t Sba

- Reaffirmation agreement motion and order form

- Cabinet and countertop contract agreement self employed form

- Outside project manager agreement self employed independent contractor form

- Repair contract agreement form

- Florist contract form

- Agreement independent contractor 481374605 form

- Design agreement 481374606 form

- Headhunter agreement template form

Find out other 4506t Sba

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement