2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request 2022

Understanding Form 588: Nonresident Withholding Waiver Request

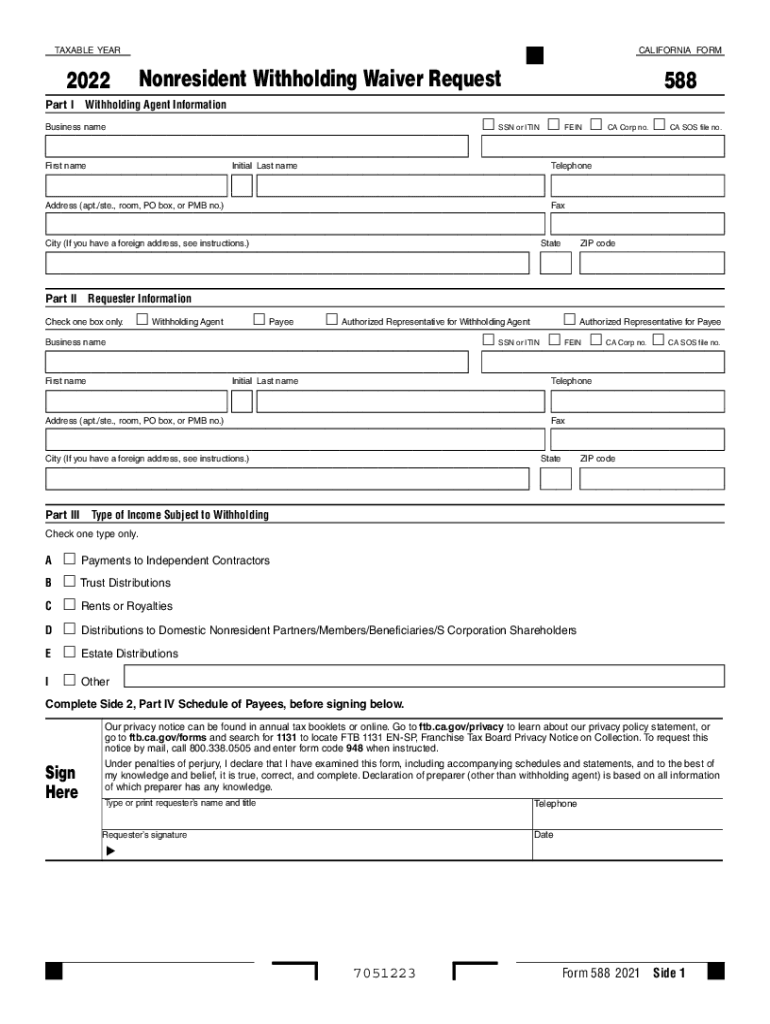

The 2021 Form 588, known as the Nonresident Withholding Waiver Request, is a crucial document for nonresident individuals and entities seeking to reduce or eliminate withholding on income earned in California. This form is particularly relevant for those who may qualify for a waiver based on specific criteria outlined by the California Franchise Tax Board (FTB). Understanding the purpose and implications of this form is essential for compliance with state tax regulations.

Steps to Complete Form 588

Completing the 2021 Form 588 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your tax identification number and details about the income source. Follow these steps:

- Provide your name, address, and taxpayer identification number in the designated sections.

- Specify the type of income you are receiving and the amount.

- Indicate the reason for the waiver request, referencing the appropriate section of California tax law.

- Sign and date the form, ensuring all information is accurate before submission.

Double-checking your entries can prevent delays in processing your request.

Eligibility Criteria for Form 588

To qualify for a waiver using Form 588, applicants must meet specific eligibility criteria. Generally, this includes:

- Nonresidents who are not subject to California withholding due to tax treaties or other exemptions.

- Entities that can demonstrate that the income is not effectively connected with a trade or business in California.

Reviewing the eligibility requirements carefully can help ensure that your waiver request is valid and increases the likelihood of approval.

Legal Use of Form 588

The legal standing of Form 588 is reinforced by its compliance with California tax laws. When submitted correctly, it serves as a formal request to the FTB for a waiver of withholding. It is important to note that submitting this form does not guarantee approval; the FTB will review each request based on the provided information and supporting documentation. Understanding the legal implications of this form is vital for nonresidents conducting business or earning income in California.

Form Submission Methods

Form 588 can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission through the California FTB website, if applicable.

- Mailing the completed form to the designated FTB address.

- In-person submission at a local FTB office, if preferred.

Choosing the right submission method can affect processing times and the overall experience of filing the waiver request.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for ensuring timely submission of Form 588. Typically, the form should be filed before the income payment is made to avoid unnecessary withholding. It is advisable to check the FTB’s official calendar for specific deadlines related to the current tax year, as these dates may vary annually. Staying informed about important dates can help nonresidents manage their tax obligations effectively.

Quick guide on how to complete 2022 form 588 nonresident withholding waiver request 2022 form 588 nonresident withholding waiver request

Complete 2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents quickly without interruptions. Manage 2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign 2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request without any hassle

- Find 2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request and guarantee superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 588 nonresident withholding waiver request 2022 form 588 nonresident withholding waiver request

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 588 nonresident withholding waiver request 2022 form 588 nonresident withholding waiver request

The way to make an e-signature for your PDF document online

The way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 588 and why is it important for businesses?

Form 588 is an essential document for businesses that need to signNow foreign tax status and prevent mistakes in tax reporting. Utilizing this form helps ensure compliance with IRS regulations, making it vital for any business engaging in international transactions. By understanding Form 588, businesses can streamline their tax processes and avoid potential penalties.

-

How can airSlate SignNow assist with filling out Form 588?

airSlate SignNow simplifies the process of filling out Form 588 by providing intuitive templates and an easy-to-use interface. Users can quickly enter the necessary information, eSign the document, and securely send it. This reduces the chances of errors and ensures that the form is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 588?

AirSlate SignNow offers various pricing plans suitable for businesses of all sizes, making it a cost-effective solution for managing forms like Form 588. Each plan provides different features, so users can select one that fits their needs without overspending. The ability to handle Form 588 and other documents electronically can also save businesses money in the long run.

-

What are the key features of airSlate SignNow for managing Form 588?

Key features of airSlate SignNow for managing Form 588 include customizable templates, an intuitive eSignature capability, comprehensive tracking, and secure cloud storage. With these features, businesses can streamline their document workflows, ensuring that Form 588 and other important documents are processed quickly and efficiently. Moreover, the platform's integration options enhance productivity by connecting users to other tools they rely on.

-

Can Form 588 be integrated with other software through airSlate SignNow?

Yes, airSlate SignNow provides various integration options allowing Form 588 and other documents to be linked with popular business applications. This compatibility enables users to seamlessly send and manage documents from their favorite CRM or accounting software. By integrating Form 588 into existing workflows, businesses can enhance efficiency and reduce the time it takes to complete essential paperwork.

-

What benefits does using airSlate SignNow provide for processing Form 588?

Using airSlate SignNow for processing Form 588 offers numerous benefits, including quicker turnaround times and improved accuracy. The eSigning feature ensures that documents are legally binding and eliminates the need for paper, saving both time and resources. Additionally, cloud storage provides easy access to all forms, helping businesses maintain organized records and comply with regulations.

-

How does eSigning work for Form 588 with airSlate SignNow?

eSigning with airSlate SignNow for Form 588 is straightforward and user-friendly. After filling out the form, users can send it for signatures via email, and recipients can sign electronically in just a few clicks. This process enhances document security while expediting the overall transaction, making it a smart choice for businesses looking to manage Form 588 efficiently.

Get more for 2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request

Find out other 2022, Form 588 Nonresident Withholding Waiver Request 2022; Form 588, Nonresident Withholding Waiver Request

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form