Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request 2021

What is the Form 588 Nonresident Withholding Waiver Request?

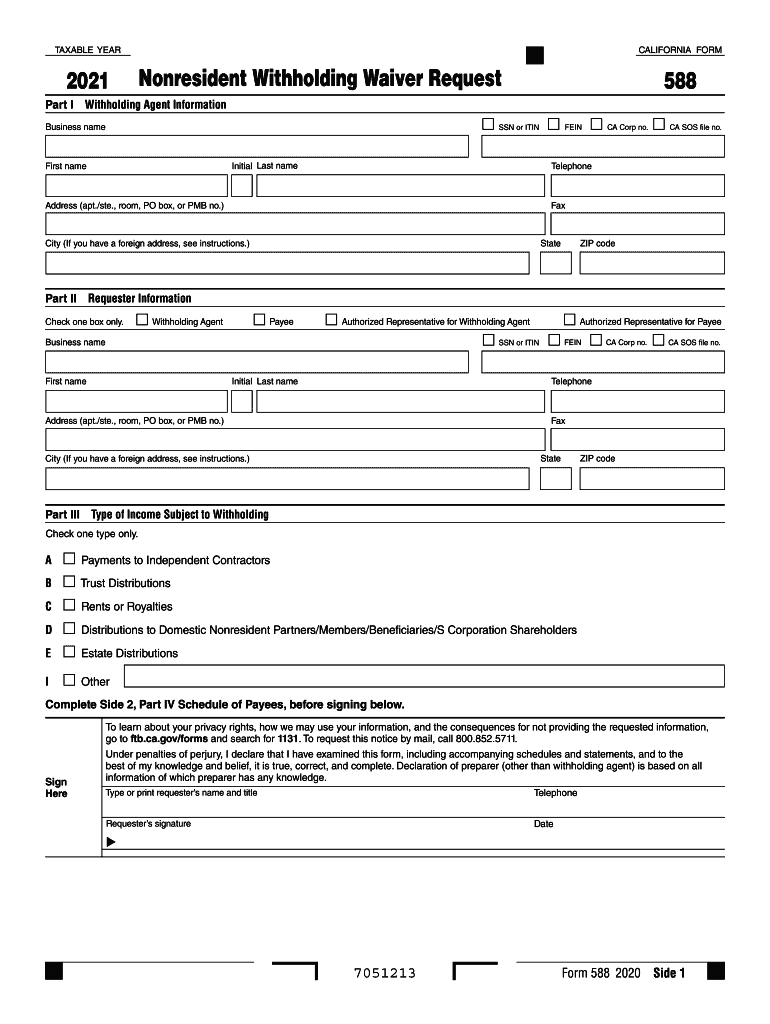

The Form 588, known as the Nonresident Withholding Waiver Request, is a document used by nonresident individuals or entities in California to request a waiver of withholding on certain types of income. This form is particularly relevant for those who may not be subject to California withholding tax due to their tax status or the nature of the income received. By submitting this form, taxpayers can potentially reduce their withholding obligations, ensuring that they retain more of their income for personal or business use.

Steps to Complete the Form 588 Nonresident Withholding Waiver Request

Completing the Form 588 involves several key steps to ensure accuracy and compliance with California tax regulations. First, gather all necessary information, including your identification details and the specifics of the income for which you are seeking a waiver. Next, fill out the form by providing your name, address, and the type of income involved. Be sure to clearly state the reason for the waiver request, as this will be crucial for the approval process. After completing the form, review it for any errors or omissions before submission.

Eligibility Criteria for the Form 588 Nonresident Withholding Waiver Request

To qualify for a waiver using Form 588, applicants must meet specific eligibility criteria set by the California Franchise Tax Board. Generally, nonresidents who can demonstrate that they are not subject to California withholding tax due to their residency status or the nature of the income may be eligible. Common scenarios include certain types of investment income or payments that fall under specific exemptions outlined in California tax law. It is important to review these criteria carefully to ensure that your waiver request is valid.

Required Documents for the Form 588 Nonresident Withholding Waiver Request

When submitting the Form 588, you may need to provide additional documentation to support your waiver request. This could include proof of your nonresident status, such as a tax identification number or other relevant tax forms. Additionally, if your income type has specific documentation requirements, ensure that you include those as well. Having all necessary documents ready can facilitate a smoother review process by the California Franchise Tax Board.

Form Submission Methods for the Form 588 Nonresident Withholding Waiver Request

The Form 588 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the California Franchise Tax Board's website, ensuring a quick and efficient submission process. Alternatively, the form can be mailed to the appropriate address specified on the form itself. For those who prefer in-person submissions, visiting a local Franchise Tax Board office may also be an option, although this should be confirmed in advance.

Penalties for Non-Compliance with the Form 588 Nonresident Withholding Waiver Request

Failure to comply with the requirements associated with the Form 588 can result in penalties imposed by the California Franchise Tax Board. These penalties may include additional withholding on income that was not reported correctly, as well as potential fines for late or incorrect submissions. It is essential to understand these consequences and ensure that all information provided is accurate and submitted in a timely manner to avoid any unnecessary penalties.

Quick guide on how to complete form 588 nonresident withholding waiver request form 588 nonresident withholding waiver request

Complete Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request effortlessly on any gadget

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to locate the proper form and securely store it on the web. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request with ease

- Obtain Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request and select Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a standard handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 588 nonresident withholding waiver request form 588 nonresident withholding waiver request

Create this form in 5 minutes!

How to create an eSignature for the form 588 nonresident withholding waiver request form 588 nonresident withholding waiver request

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the form 588 nonresident withholding waiver request?

The form 588 nonresident withholding waiver request is a document used by nonresident individuals or entities to request exemption from California income tax withholding on income sourced in California. This form is essential for those who believe they qualify for a withholding exemption under California tax laws.

-

How can airSlate SignNow help with the form 588 nonresident withholding waiver request?

airSlate SignNow streamlines the process of completing and submitting the form 588 nonresident withholding waiver request by providing an easy-to-use digital platform. Users can fill out the form, eSign it, and send it securely, all in one place, signNowly reducing the time and effort involved.

-

Is there a cost associated with using airSlate SignNow for the form 588 nonresident withholding waiver request?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs, which include features for managing documents like the form 588 nonresident withholding waiver request. The cost may vary based on the selected plan and required features, ensuring that users can choose budget-friendly options.

-

What features does airSlate SignNow offer for managing the form 588 nonresident withholding waiver request?

airSlate SignNow provides robust features for efficiently managing the form 588 nonresident withholding waiver request, including advanced editing tools, customizable templates, and secure eSigning capabilities. These features help ensure that users can complete and submit their forms without any hassles.

-

Can I integrate airSlate SignNow with other applications for handling the form 588 nonresident withholding waiver request?

Absolutely! airSlate SignNow offers various integrations with popular applications and platforms, allowing users to seamlessly manage their workflow, including handling the form 588 nonresident withholding waiver request. These integrations enhance productivity and ensure all documents are well-organized.

-

What benefits does using airSlate SignNow provide for the completion of the form 588 nonresident withholding waiver request?

Using airSlate SignNow simplifies the completion of the form 588 nonresident withholding waiver request by automating steps such as signature collection and document sharing. Additionally, it enhances security, ensures compliance, and allows for tracking document progress, giving users peace of mind.

-

Is there customer support available for questions about the form 588 nonresident withholding waiver request?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions related to the form 588 nonresident withholding waiver request. Whether you need help with form completion or troubleshooting, the support team is ready to assist you promptly.

Get more for Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request

Find out other Form 588 Nonresident Withholding Waiver Request Form 588, Nonresident Withholding Waiver Request

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title