Ca Form 588 2020

What is the Ca Form 588

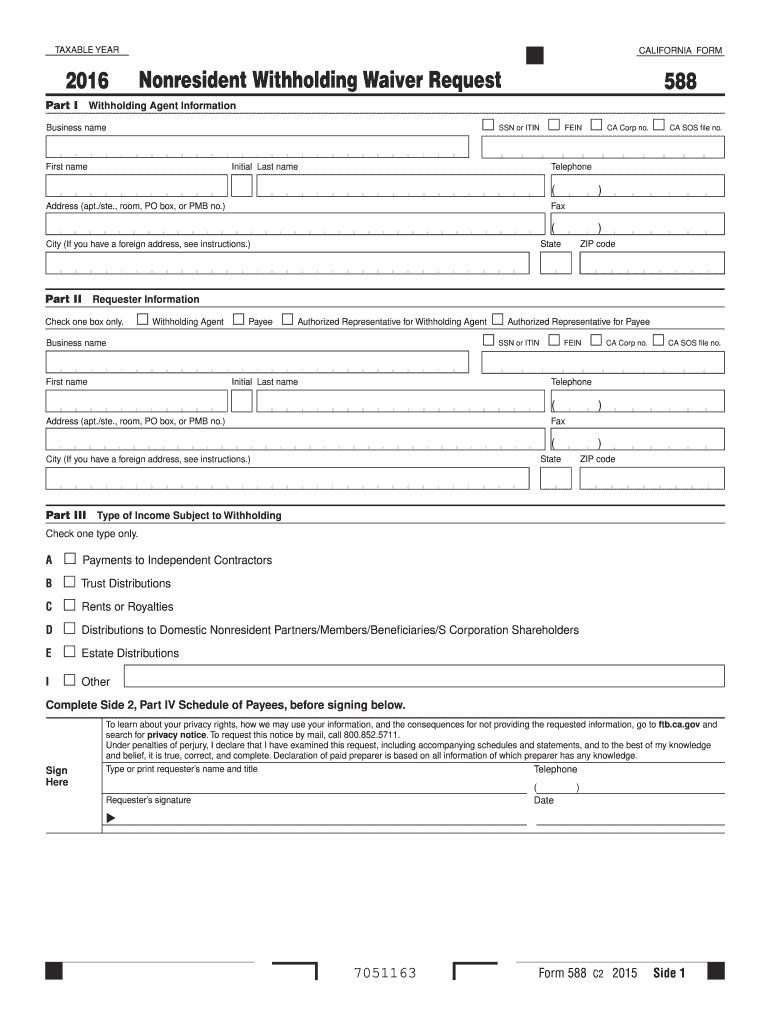

The Ca Form 588 is a tax form used in California, specifically for the purpose of reporting and paying withholding taxes for non-resident individuals and entities. This form is essential for businesses that engage in transactions with non-residents, ensuring compliance with state tax regulations. The form helps facilitate proper tax withholding and reporting, which is crucial for both the payer and the payee in maintaining accurate tax records.

How to use the Ca Form 588

To effectively use the Ca Form 588, individuals and businesses must first determine their eligibility and the specific circumstances that require the form. The form must be completed accurately, providing necessary details such as the payee’s information, the amount being paid, and the applicable withholding rates. Once completed, the form should be submitted to the California Franchise Tax Board along with the appropriate payment to ensure compliance with state tax laws.

Steps to complete the Ca Form 588

Completing the Ca Form 588 involves several key steps:

- Gather necessary information, including the payee's name, address, and taxpayer identification number.

- Determine the payment amount and applicable withholding rate based on the type of payment being made.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with payment to the California Franchise Tax Board.

Legal use of the Ca Form 588

The Ca Form 588 is legally binding when completed and submitted according to California tax laws. It serves as a formal declaration of withholding tax obligations and must be used in compliance with the California Revenue and Taxation Code. Failure to use the form correctly can result in penalties and interest on unpaid taxes, making it crucial for businesses to understand their responsibilities when dealing with non-resident payments.

Key elements of the Ca Form 588

Several key elements must be included when filling out the Ca Form 588:

- Payee Information: This includes the name, address, and taxpayer identification number of the non-resident payee.

- Payment Amount: Clearly state the total amount being paid to the non-resident.

- Withholding Rate: Indicate the appropriate withholding rate applicable to the payment.

- Signature: The form must be signed by the payer or an authorized representative to validate the information provided.

Form Submission Methods

The Ca Form 588 can be submitted through various methods to accommodate different preferences and situations. Options include:

- Online Submission: Many businesses opt to file electronically through the California Franchise Tax Board's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Franchise Tax Board.

- In-Person: For those who prefer face-to-face interactions, forms can be submitted in person at designated Franchise Tax Board offices.

Quick guide on how to complete 2016 ca form 588

Complete Ca Form 588 seamlessly on any device

Online document handling has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly and efficiently. Manage Ca Form 588 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Ca Form 588 effortlessly

- Obtain Ca Form 588 and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Ca Form 588 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 ca form 588

Create this form in 5 minutes!

How to create an eSignature for the 2016 ca form 588

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ca Form 588?

The Ca Form 588 is a form used for withholding tax purposes in California, particularly for non-residents. It is essential for businesses and individuals conducting activities in California to ensure tax compliance when making payments. Using airSlate SignNow simplifies the e-signing of the Ca Form 588, making the process faster and more secure.

-

How can airSlate SignNow help with filling out the Ca Form 588?

airSlate SignNow provides an intuitive platform that allows users to fill out and eSign the Ca Form 588 with ease. The software streamlines the process of completing the form, ensuring all necessary fields are filled correctly. This helps reduce errors and enhances efficiency, allowing you to focus on your core business activities.

-

Is there a cost associated with using airSlate SignNow for the Ca Form 588?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs and budgets. Users can choose a plan that suits their requirements, ensuring cost-effectiveness when managing forms like the Ca Form 588. Additionally, the platform provides a free trial for new users to explore its capabilities before committing.

-

Can I integrate airSlate SignNow with other software for managing the Ca Form 588?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, making it easier to manage documents like the Ca Form 588. This integration enhances workflow efficiency, allowing you to connect with your existing tools and streamline your business processes.

-

What benefits does airSlate SignNow offer for eSigning the Ca Form 588?

Using airSlate SignNow for eSigning the Ca Form 588 provides numerous benefits, including enhanced security, reduced turnaround time, and improved compliance. Users can sign documents remotely, ensuring that transactions happen quickly, while built-in audit trails keep records of changes and signatures for accountability.

-

Is airSlate SignNow compliant with California laws regarding the Ca Form 588?

Yes, airSlate SignNow complies with all relevant California laws and regulations regarding the execution of documents such as the Ca Form 588. The platform adheres to eSignature laws, ensuring that your digitally signed forms are legally binding. This compliance builds trust and ensures you meet all statutory requirements.

-

How secure is the data when signing the Ca Form 588 with airSlate SignNow?

airSlate SignNow prioritizes data security, employing advanced encryption and security protocols to protect your information during the signing process of the Ca Form 588. The platform's robust security measures help to safeguard sensitive data, ensuring privacy and compliance with industry standards.

Get more for Ca Form 588

- Air force academy transcript form

- Truck lease agreement form

- Printable school transportation form

- Photoshoot call sheet template form

- Panarottis hr form

- Cincinnati state transcript 5499748 form

- Printable nhs blood pressure recording chart form

- Contract management system overview for ccouco users form

Find out other Ca Form 588

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe