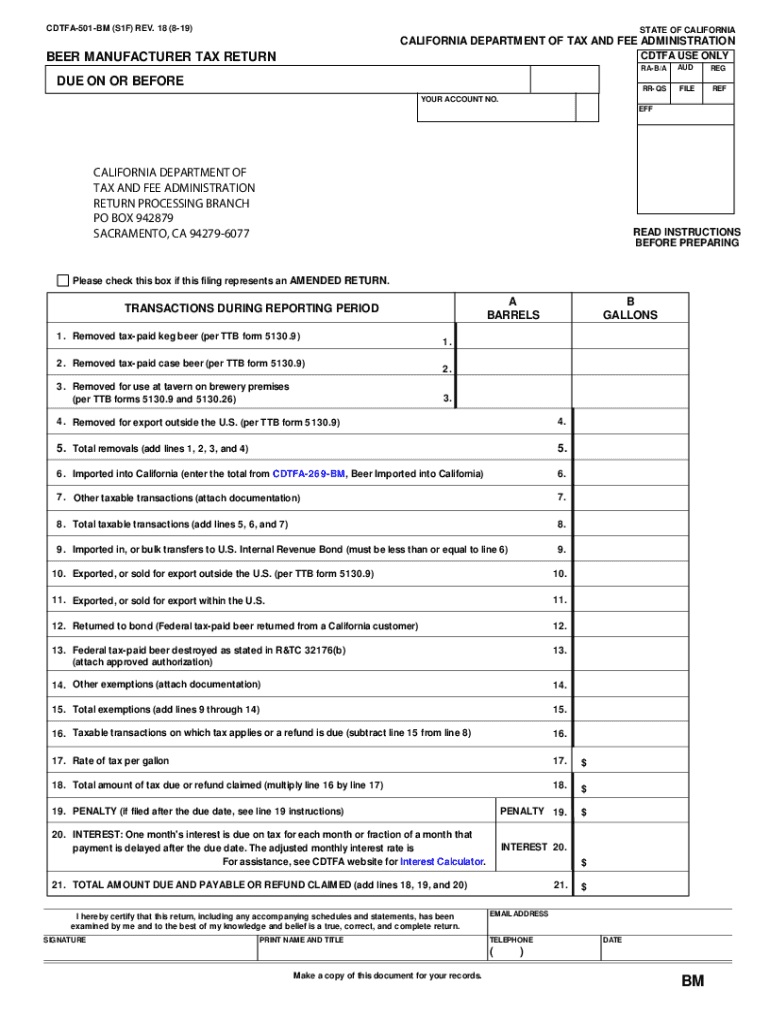

CALIFORNIA DEPARTMENT of TAX and FEE ADMINISTRATION RETURN 2019

What is the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN

The California Department of Tax and Fee Administration Return is a crucial document used by taxpayers to report various taxes and fees to the state of California. This form is essential for individuals and businesses to comply with state tax regulations, ensuring that they accurately report their income, sales, and other taxable activities. The return encompasses various tax types, including sales and use tax, fuel tax, and other specific fees mandated by state law. Understanding the purpose and requirements of this return is vital for maintaining compliance and avoiding potential penalties.

Steps to complete the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN

Completing the California Department of Tax and Fee Administration Return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements, sales records, and any relevant receipts. Next, identify the specific type of return you need to file based on your business activities or personal tax situation. Carefully fill out the form, ensuring that all information is complete and accurate. Double-check calculations to avoid errors that could lead to penalties. Finally, submit the completed return by the designated deadline, either electronically or by mail, as required.

Legal use of the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN

The legal use of the California Department of Tax and Fee Administration Return is governed by state tax laws and regulations. To be considered valid, the return must be filled out truthfully and accurately, reflecting the taxpayer's financial situation. Electronic submissions are legally recognized, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). It is essential to maintain records of submitted returns and any supporting documentation, as these may be required for audits or future reference.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the California Department of Tax and Fee Administration Return. The most efficient method is online submission, which allows for immediate processing and confirmation. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address provided by the California Department of Tax and Fee Administration. In-person submission is also an option, although it may require an appointment and is subject to office hours. Each method has its own advantages, and taxpayers should select the one that best suits their needs and circumstances.

Filing Deadlines / Important Dates

Filing deadlines for the California Department of Tax and Fee Administration Return vary depending on the type of tax or fee being reported. Generally, returns are due on a quarterly or annual basis, with specific dates established by the California Department of Tax and Fee Administration. It is crucial for taxpayers to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely filing and compliance with state regulations.

Key elements of the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN

The key elements of the California Department of Tax and Fee Administration Return include taxpayer identification information, details of taxable sales or income, applicable deductions, and the total amount of tax owed. Each section of the return must be completed accurately to reflect the taxpayer's financial activities. Additionally, taxpayers may need to provide supporting documentation, such as invoices or receipts, to substantiate their claims. Understanding these elements is essential for accurate reporting and compliance with state tax laws.

Quick guide on how to complete california department of tax and fee administration return

Complete CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents since you can find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centered operation today.

The easiest way to modify and eSign CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN with ease

- Obtain CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN and ensure excellent communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california department of tax and fee administration return

Create this form in 5 minutes!

How to create an eSignature for the california department of tax and fee administration return

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

The best way to create an e-signature for a PDF file on Android

People also ask

-

What is the importance of submitting the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN on time?

Submitting the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN on time is crucial to avoid penalties and interest charges. Timely submission ensures compliance with state regulations and helps maintain your business's good standing. Using airSlate SignNow can streamline this entire process by providing an efficient and organized way to manage your documents.

-

How does airSlate SignNow simplify the signing process for CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN?

airSlate SignNow simplifies the signing process for the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN by allowing users to eSign documents from anywhere at any time. The platform is user-friendly and enables quick access for all signatories, reducing turnaround time signNowly. This means that you can focus on your business while ensuring compliance with tax regulations.

-

Are there any integration options available with airSlate SignNow for preparing the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN?

Yes, airSlate SignNow offers several integration options that can help you efficiently prepare the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN. Integrating with popular tools such as Google Drive, Dropbox, and CRM systems can streamline your workflow. This allows for seamless document management and enhances collaboration across your team.

-

What features does airSlate SignNow offer for managing the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure eSigning specifically designed to manage the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN efficiently. These functionalities enable users to streamline document creation and approval processes. As a result, businesses can ensure they never miss an important tax deadline.

-

Is airSlate SignNow a cost-effective solution for filing the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN?

Yes, airSlate SignNow is a cost-effective solution designed to help businesses efficiently manage their documents, including the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN. The platform offers various pricing plans that can fit different budgets and needs. This efficiency not only saves money but also time, allowing businesses to allocate resources where they're needed most.

-

Can airSlate SignNow help with organizing documents related to the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN?

Absolutely! AirSlate SignNow allows you to organize all documents related to the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN in one secure location. The document management features provide easy retrieval and tracking, ensuring that you have everything you need at your fingertips. This makes the entire filing process smoother and less stressful.

-

What are the benefits of using airSlate SignNow for the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN?

Using airSlate SignNow for the CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN offers many benefits, including enhanced efficiency, reduced costs, and improved compliance. The platform ensures that all signatures are collected promptly, helping you meet filing deadlines. Furthermore, the secure environment ensures that your sensitive tax information is protected.

Get more for CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN

- Name change minor form

- Adult name change georgia form

- Georgia revocation of general durable power of attorney form

- Georgia revocation of anatomical gift act donation form

- Hawaii contract form

- Assignment deed form

- Hawaii corporation form

- Hawaii hawaii renunciation and disclaimer of property received by intestate succession form

Find out other CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION RETURN

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors