CDTFA 501 BM, Beer Manufacturer Tax Return 2022-2026

What is the CDTFA 501 BM, Beer Manufacturer Tax Return

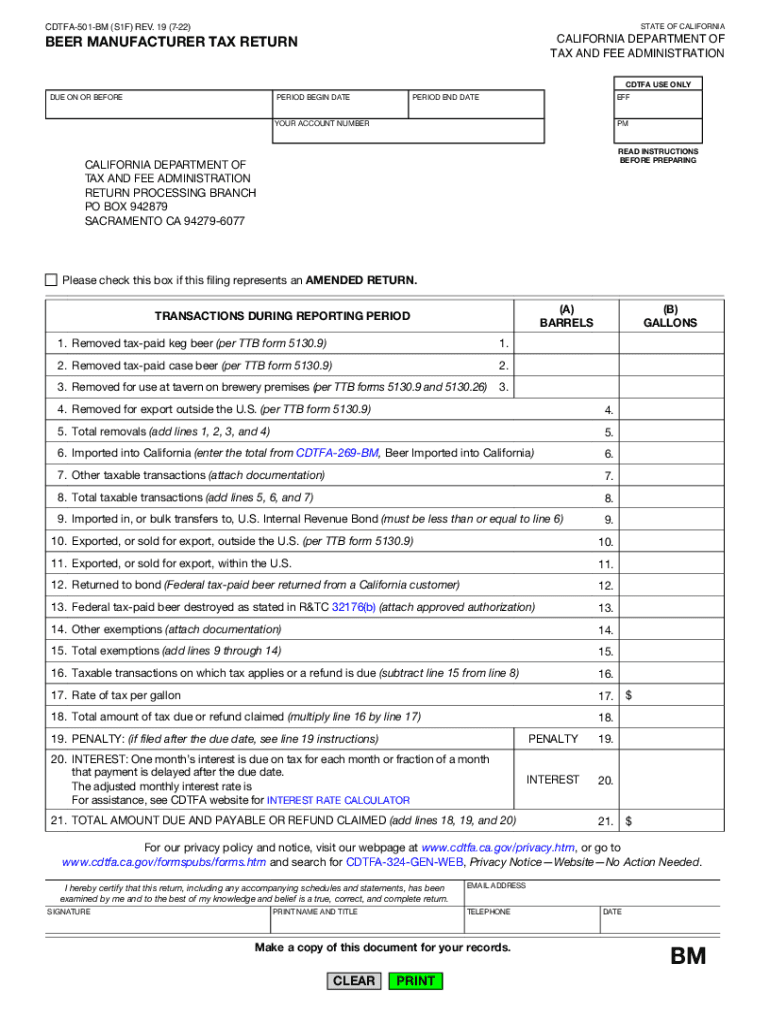

The CDTFA 501 BM, Beer Manufacturer Tax Return is a specific form used by beer manufacturers in California to report their production and sales of beer. This document is crucial for ensuring compliance with state tax regulations. It provides the California Department of Tax and Fee Administration (CDTFA) with detailed information regarding the quantity of beer produced, sold, and any applicable taxes owed. Understanding this form is essential for any business involved in beer manufacturing within the state.

How to use the CDTFA 501 BM, Beer Manufacturer Tax Return

Using the CDTFA 501 BM involves several steps to ensure accurate reporting. First, gather all necessary production and sales data for the reporting period. This includes the total volume of beer produced, sold, and any returns. Next, fill out the form with the required information, ensuring to double-check for accuracy. Once completed, the form can be submitted electronically or by mail, depending on your preference and compliance requirements. Utilizing digital tools can streamline this process, making it easier to manage and submit your tax return.

Steps to complete the CDTFA 501 BM, Beer Manufacturer Tax Return

Completing the CDTFA 501 BM requires careful attention to detail. Follow these steps:

- Collect all relevant production and sales data for the reporting period.

- Access the CDTFA 501 BM form through the CDTFA website or a trusted electronic document platform.

- Fill in the required fields, including production quantities, sales figures, and any applicable deductions.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically via a secure platform or mail it to the CDTFA office.

Legal use of the CDTFA 501 BM, Beer Manufacturer Tax Return

The CDTFA 501 BM is legally binding when completed and submitted according to state regulations. To ensure its validity, it must be filled out accurately and submitted on time. Utilizing electronic signature solutions can enhance the legal standing of the document, as they comply with the ESIGN and UETA acts. This means that as long as the form meets the necessary legal requirements, it can be considered a valid tax return.

Required Documents

To complete the CDTFA 501 BM, certain documents are essential. These include:

- Records of beer production and sales for the reporting period.

- Any invoices or receipts related to beer sales.

- Documentation of any returns or refunds issued.

- Previous tax returns for reference, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 501 BM vary based on the reporting period. Generally, beer manufacturers must submit their returns on a quarterly basis. It is crucial to keep track of these deadlines to avoid penalties. Specific dates can be found on the CDTFA website or by consulting with a tax professional familiar with California tax regulations.

Quick guide on how to complete cdtfa 501 bm beer manufacturer tax return

Effortlessly Prepare CDTFA 501 BM, Beer Manufacturer Tax Return on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and without hassle. Manage CDTFA 501 BM, Beer Manufacturer Tax Return on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The Easiest Method to Edit and Electronically Sign CDTFA 501 BM, Beer Manufacturer Tax Return with Ease

- Find CDTFA 501 BM, Beer Manufacturer Tax Return and click Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize key sections of the documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all your information and click on the Done button to save your changes.

- Select your preferred method of sending the form, be it via email, text message (SMS), link invitation, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign CDTFA 501 BM, Beer Manufacturer Tax Return and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 501 bm beer manufacturer tax return

Create this form in 5 minutes!

People also ask

-

What is the CDTFA 501 BM, Beer Manufacturer Tax Return?

The CDTFA 501 BM, Beer Manufacturer Tax Return, is a required form for beer manufacturers in California to report their sales, production, and inventory. This tax return helps ensure compliance with state regulations and aids in the accurate calculation of taxes owed. Submitting this return is crucial for avoiding penalties and ensuring smooth operations for your brewery.

-

How can airSlate SignNow help with the CDTFA 501 BM, Beer Manufacturer Tax Return?

airSlate SignNow simplifies the process of completing and submitting the CDTFA 501 BM, Beer Manufacturer Tax Return with its user-friendly eSignature features. You can easily fill out the form, add necessary signatures, and securely send it directly to the relevant authorities. This streamlines compliance and saves you valuable time and effort.

-

What are the pricing options for using airSlate SignNow for CDTFA 501 BM, Beer Manufacturer Tax Return?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on the features you need for managing the CDTFA 501 BM, Beer Manufacturer Tax Return, you can choose from various subscription plans. Each plan is designed to provide the best value for eSigning and document management.

-

Are there any key features tailored for the CDTFA 501 BM, Beer Manufacturer Tax Return?

Yes, airSlate SignNow includes several features specifically aimed at helping users with the CDTFA 501 BM, Beer Manufacturer Tax Return. These features include customizable templates for easier form completion, secure cloud storage for your submitted documents, and real-time tracking to monitor your submissions status. These tools help ensure accurate and timely filings.

-

Can I integrate airSlate SignNow with other software for managing the CDTFA 501 BM, Beer Manufacturer Tax Return?

Certainly! airSlate SignNow offers easy integrations with various accounting and tax preparation software, enhancing your ability to manage the CDTFA 501 BM, Beer Manufacturer Tax Return efficiently. This means you can sync your data, streamline workflows, and reduce manual entry errors. Integration simplifies your overall financial management.

-

What are the benefits of using airSlate SignNow for the CDTFA 501 BM, Beer Manufacturer Tax Return?

Using airSlate SignNow for the CDTFA 501 BM, Beer Manufacturer Tax Return provides numerous benefits, including increased efficiency, improved accuracy, and enhanced compliance. Automated reminders and notifications ensure you never miss a submission deadline. Additionally, the secure platform guarantees the protection of your sensitive data.

-

Is airSlate SignNow secure for submitting the CDTFA 501 BM, Beer Manufacturer Tax Return?

Absolutely! airSlate SignNow employs advanced security measures, including end-to-end encryption and secure cloud storage, to protect your CDTFA 501 BM, Beer Manufacturer Tax Return information. This ensures that your data is safe from unauthorized access and bsignNowes, giving you peace of mind while handling sensitive tax documents.

Get more for CDTFA 501 BM, Beer Manufacturer Tax Return

- Letter from tenant to landlord with demand that landlord repair broken windows oklahoma form

- Ok tenant landlord 497323011 form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497323012 form

- Oklahoma letter demand form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings oklahoma form

- Oklahoma tenant landlord 497323015 form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles oklahoma form

- Letter from tenant to landlord about landlords failure to make repairs oklahoma form

Find out other CDTFA 501 BM, Beer Manufacturer Tax Return

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online