Portal Ct Gov MediaDepartment of Revenue Services Form UCT 212 Portal Ct Gov 2021-2026

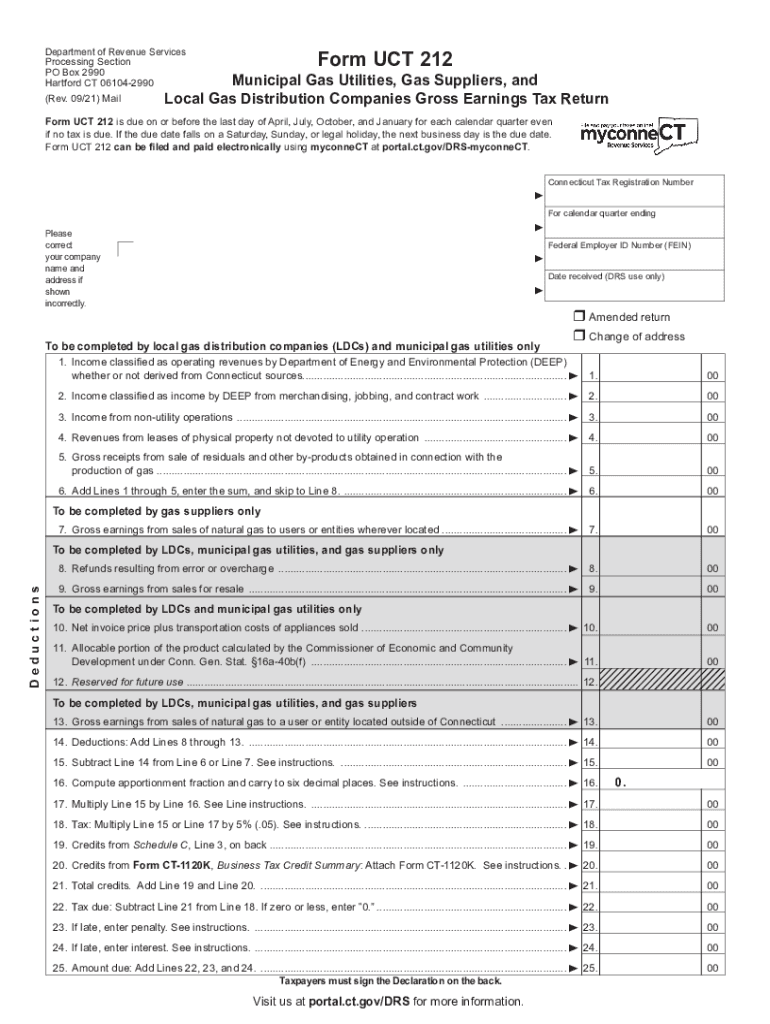

What is the CT UCT Online Form?

The CT UCT online form, officially known as Form UCT-212, is a document used by businesses in Connecticut to report and remit taxes related to certain transactions. This form is essential for compliance with state tax regulations and is utilized by various business entities, including corporations, partnerships, and limited liability companies. Understanding the purpose of this form helps ensure that businesses meet their tax obligations accurately and timely.

Steps to Complete the CT UCT Online Form

Completing the CT UCT online form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and data related to the transactions being reported. Next, access the form through the official Connecticut Department of Revenue Services website. Fill in the required fields with accurate information, including your business details and transaction amounts. Review the completed form for any errors before submission. Finally, submit the form electronically and keep a copy for your records.

Legal Use of the CT UCT Online Form

The legal use of the CT UCT online form is governed by Connecticut state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to comply with these regulations can result in penalties or interest charges. It is important for businesses to understand the legal implications of their submissions and to ensure that all information provided is truthful and complete.

Filing Deadlines and Important Dates

Filing deadlines for the CT UCT online form are crucial for businesses to avoid penalties. Typically, the form must be submitted by the end of the month following the close of the reporting period. For example, if reporting for the first quarter, the form is due by April 30. Businesses should keep track of these dates to ensure timely compliance and avoid any late fees that may apply.

Required Documents for the CT UCT Online Form

When preparing to complete the CT UCT online form, several documents are required to provide accurate information. These may include financial statements, transaction records, and any relevant tax documents. Having these documents readily available will facilitate a smoother completion process and help ensure that all required information is reported correctly.

Penalties for Non-Compliance

Businesses that fail to file the CT UCT online form on time or provide inaccurate information may face various penalties. These can include monetary fines, interest on unpaid taxes, and potential legal repercussions. To mitigate these risks, it is advisable for businesses to stay informed about their filing obligations and maintain accurate records throughout the year.

Eligibility Criteria for the CT UCT Online Form

Eligibility to file the CT UCT online form generally applies to businesses operating within Connecticut that engage in taxable transactions. This includes corporations, partnerships, and limited liability companies. It is important for businesses to assess their eligibility based on their specific activities and ensure they are compliant with state tax laws before submitting the form.

Quick guide on how to complete portalctgov mediadepartment of revenue services form uct 212 portalctgov

Complete Portal ct gov MediaDepartment Of Revenue Services Form UCT 212 Portal ct gov effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Portal ct gov MediaDepartment Of Revenue Services Form UCT 212 Portal ct gov on any device using the airSlate SignNow Android or iOS apps and simplify any document-related task today.

How to adjust and eSign Portal ct gov MediaDepartment Of Revenue Services Form UCT 212 Portal ct gov with ease

- Find Portal ct gov MediaDepartment Of Revenue Services Form UCT 212 Portal ct gov and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Portal ct gov MediaDepartment Of Revenue Services Form UCT 212 Portal ct gov and ensure seamless communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgov mediadepartment of revenue services form uct 212 portalctgov

Create this form in 5 minutes!

How to create an eSignature for the portalctgov mediadepartment of revenue services form uct 212 portalctgov

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an e-signature for a PDF document on Android

People also ask

-

What is the uct application form, and how can airSlate SignNow help with it?

The uct application form is a crucial document for applicants looking to enroll at the University of Cape Town. AirSlate SignNow provides an efficient way to complete, eSign, and send your uct application form digitally, ensuring that you can manage your submissions hassle-free.

-

Is there a cost associated with using airSlate SignNow for the uct application form?

AirSlate SignNow offers a range of pricing plans that cater to different needs, making it a cost-effective solution for managing your uct application form. You can choose from monthly or annual subscriptions, with options that suit both individual users and businesses.

-

Can I track the status of my uct application form using airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your uct application form. Our platform provides real-time updates, allowing you to see when your document has been viewed, signed, and completed.

-

What features does airSlate SignNow offer for managing the uct application form?

AirSlate SignNow offers a variety of features for managing your uct application form, including customizable templates, secure eSigning, automated workflows, and collaboration tools. These features streamline the process and enhance your overall user experience.

-

How secure is using airSlate SignNow for my uct application form?

Security is a top priority at airSlate SignNow. When submitting your uct application form, you can rely on our advanced encryption and compliance with industry standards to protect your personal information throughout the signing process.

-

Does airSlate SignNow integrate with other applications for the uct application form?

Absolutely! AirSlate SignNow is designed to integrate seamlessly with a variety of applications, which can be beneficial when filling out your uct application form. This includes integrations with popular platforms like Google Drive, Dropbox, and CRM systems.

-

Can I edit my uct application form after submitting it through airSlate SignNow?

You cannot edit your uct application form once it's been finalized and signed. However, airSlate SignNow allows you to make changes to your document before sending it for eSignature, ensuring that all information is accurate before submission.

Get more for Portal ct gov MediaDepartment Of Revenue Services Form UCT 212 Portal ct gov

- Ak lis pendens 497293966 form

- Amount unpaid form

- Request to claimant regarding amount due and unpaid corporation or llc alaska form

- Response of claimant to request regarding amount due and unpaid individual alaska form

- Business credit application alaska form

- Unpaid corporation 497293974 form

- Waiver of lien individual alaska form

- Individual credit application alaska form

Find out other Portal ct gov MediaDepartment Of Revenue Services Form UCT 212 Portal ct gov

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free