Ct W4p Fillable 2013

What is the Ct W4p Fillable

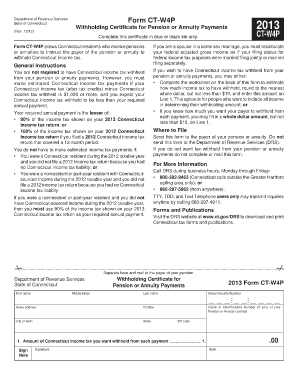

The Ct W4p fillable form is a state-specific document used in Connecticut for employees to provide their employers with information regarding their withholding allowances. This form is essential for determining the amount of state income tax to withhold from an employee’s paycheck. By completing the Ct W4p, employees can ensure that the correct amount of taxes is withheld based on their individual financial situations.

How to use the Ct W4p Fillable

Using the Ct W4p fillable form involves a few straightforward steps. First, access the fillable version of the form online, which allows for easy completion. Next, fill in your personal information, including your name, address, and Social Security number. After that, indicate your filing status and the number of allowances you are claiming. Once completed, you can save the form and submit it to your employer electronically or print it out for physical submission.

Steps to complete the Ct W4p Fillable

Completing the Ct W4p fillable form requires careful attention to detail. Follow these steps:

- Download the fillable form from a reliable source.

- Enter your full name and address in the designated fields.

- Provide your Social Security number for identification purposes.

- Select your filing status, such as single or married.

- Claim the appropriate number of allowances based on your personal circumstances.

- Review the information for accuracy before saving or printing the form.

- Submit the completed form to your employer as per their instructions.

Legal use of the Ct W4p Fillable

The Ct W4p fillable form is legally recognized for tax withholding purposes in Connecticut. To ensure its legal validity, it must be filled out accurately and submitted to the employer in a timely manner. Electronic signatures are accepted, provided that the eSignature complies with state and federal regulations. It is important to keep a copy of the submitted form for personal records, as it serves as proof of the allowances claimed.

Who Issues the Form

The Ct W4p fillable form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for providing tax-related forms and guidelines to residents and businesses. The form is updated periodically to reflect changes in tax laws and regulations, so it is essential to use the most current version when completing your tax information.

Filing Deadlines / Important Dates

Filing deadlines for the Ct W4p fillable form align with the start of employment or any changes in personal circumstances that may affect tax withholding. Employees should submit this form to their employer as soon as they begin a new job or when they wish to adjust their withholding allowances. Employers typically require the form to be submitted before the first paycheck is issued to ensure accurate withholding from the outset.

Quick guide on how to complete ct w4p fillable

Effortlessly Prepare Ct W4p Fillable on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Ct W4p Fillable on any platform through the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Ct W4p Fillable with Ease

- Find Ct W4p Fillable and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow offers for this specific purpose.

- Generate your electronic signature utilizing the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your PC.

No more lost or mislaid files, tedious form searching, or errors that necessitate reprinting documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ct W4p Fillable and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct w4p fillable

Create this form in 5 minutes!

People also ask

-

What is the form ct w4p fillable and why do I need it?

The form ct w4p fillable is a tax withholding form designed for employees in Connecticut. It allows you to specify your preferences for state income tax withholding. Using a fillable version makes it easier to complete and submit the form electronically, ensuring accuracy and saving time.

-

How can I complete the form ct w4p fillable using airSlate SignNow?

You can complete the form ct w4p fillable by accessing our platform and uploading the document. Our user-friendly interface allows you to fill in the required fields digitally, ensuring you fill out the form accurately and quickly, enabling you to eSign and submit it without any hassle.

-

Is there a cost associated with using the form ct w4p fillable on airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans to accommodate different business needs. While the basic features are available at no cost, accessing advanced functionalities for the form ct w4p fillable might require a subscription. It's beneficial to review our pricing page for detailed information.

-

What features does airSlate SignNow offer for the form ct w4p fillable?

AirSlate SignNow provides several features for the form ct w4p fillable, including easy editing, eSigning, and cloud storage. You can collaborate in real time, track the document’s status, and even integrate with other applications for a seamless workflow. This ensures that your document management is efficient and secure.

-

Can I integrate form ct w4p fillable with other tools?

Yes, airSlate SignNow integrates with various applications such as Google Drive, Salesforce, and other productivity tools. This allows you to handle the form ct w4p fillable in conjunction with your existing systems, streamlining your processes and improving overall efficiency.

-

What are the benefits of using a fillable form for the form ct w4p?

Using a fillable form for the form ct w4p provides several benefits, including enhanced accuracy by reducing manual errors and saving time through digital completion. Additionally, it allows for easy submission and storage, ensuring that your tax documentation is organized and readily available when needed.

-

Is the form ct w4p fillable secure on airSlate SignNow?

Absolutely! AirSlate SignNow prioritizes the security of your documents, including the form ct w4p fillable. We utilize industry-standard encryption and security measures to protect your data, ensuring that only authorized users can access and sign your documents.

Get more for Ct W4p Fillable

- What records are available to water researchers and where form

- And duty to the court form

- Instructions for making application for a permanent employee form

- Do not use this application if state of illinois form

- Montana wholesale food review form

- Waiver of attorney form

- Te 4911rev form

- Rb 3 application for bingo license rb 3 application for bingo license form

Find out other Ct W4p Fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors