Business Income & Receipts and Net Profits Taxes General Form

Understanding the Birt EZ Form

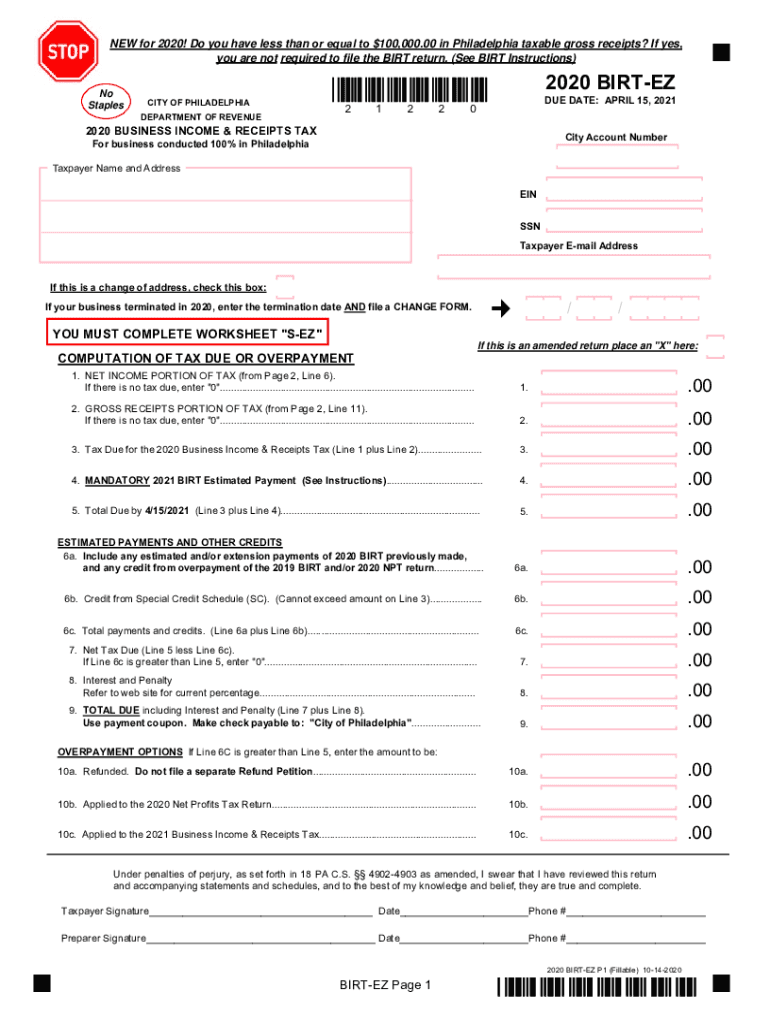

The Birt EZ form is a critical document for businesses operating in Pennsylvania, specifically designed for reporting business income and receipts. This form simplifies the process of calculating net profits taxes, making it easier for business owners to comply with state tax regulations. It is essential for businesses to accurately report their earnings to avoid penalties and ensure proper tax contributions.

Steps to Complete the Birt EZ Form

Filling out the Birt EZ form requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather all necessary financial documents, including income statements and receipts.

- Enter your business name, address, and identification number at the top of the form.

- Report total gross receipts and any allowable deductions.

- Calculate your net profits by subtracting deductions from gross receipts.

- Review your entries for accuracy before submitting the form.

Legal Use of the Birt EZ Form

To ensure the Birt EZ form is legally binding, it must be completed in compliance with Pennsylvania tax laws. This includes providing accurate financial information and adhering to submission deadlines. Utilizing a reliable eSignature solution, like signNow, can enhance the legality of the form by ensuring secure and verified signatures.

Filing Deadlines for the Birt EZ Form

Timely submission of the Birt EZ form is crucial to avoid penalties. The filing deadline typically aligns with the end of the tax year, which is December 31 for most businesses. It is advisable to check for any specific extensions or changes in deadlines that may apply to your business type.

Required Documents for the Birt EZ Form

When completing the Birt EZ form, you will need several supporting documents to substantiate your reported income and deductions. These may include:

- Income statements detailing all revenue streams.

- Receipts for business expenses that qualify for deductions.

- Previous tax returns for reference and accuracy.

Penalties for Non-Compliance with the Birt EZ Form

Failure to file the Birt EZ form accurately and on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential for business owners to understand their obligations and ensure compliance to avoid these consequences.

Quick guide on how to complete business income ampampamp receipts and net profits taxes general

Effortlessly Prepare Business Income & Receipts And Net Profits Taxes General on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without issues. Manage Business Income & Receipts And Net Profits Taxes General on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Edit and eSign Business Income & Receipts And Net Profits Taxes General with Ease

- Locate Business Income & Receipts And Net Profits Taxes General and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically available from airSlate SignNow.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or via invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Modify and eSign Business Income & Receipts And Net Profits Taxes General and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business income ampampamp receipts and net profits taxes general

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is a BIRT EZ form?

A BIRT EZ form is a simplified version of a business intelligence reporting tool, designed to streamline the creation and submission of tax documents. With airSlate SignNow, you can easily manage and eSign BIRT EZ forms, ensuring compliance and accuracy in your submissions. This provides a user-friendly way for businesses to handle their essential reporting requirements.

-

How does airSlate SignNow integrate with BIRT EZ forms?

airSlate SignNow seamlessly integrates with BIRT EZ forms, allowing users to prepare, send, and eSign their documents directly within the platform. This integration ensures that all necessary data is captured accurately and efficiently, reducing the risk of errors. It streamlines the entire process from creation to submission, making it easier for businesses to stay organized.

-

Is airSlate SignNow suitable for businesses of all sizes using BIRT EZ forms?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, whether you're a small startup or a large corporation, it can handle BIRT EZ forms with ease. Our platform offers flexible pricing plans to ensure accessibility for various budgets. This means that all types of businesses can benefit from our easy-to-use solutions.

-

What are the pricing options for airSlate SignNow when using BIRT EZ forms?

airSlate SignNow offers several pricing options that can be tailored to your needs when working with BIRT EZ forms. We provide various tiered plans based on the features required, starting from basic eSigning options to more comprehensive solutions with advanced functionalities. This flexibility ensures that you only pay for what you need.

-

What features does airSlate SignNow offer for BIRT EZ forms?

airSlate SignNow provides a range of essential features for BIRT EZ forms, including customizable templates, automated workflows, and real-time tracking. These features help streamline the document creation and signing process, enhancing efficiency and reducing turnaround times. Additionally, our platform offers robust security measures to protect your sensitive information.

-

Can I track the progress of my BIRT EZ forms in airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the progress of your BIRT EZ forms in real-time. You'll receive notifications when the document is opened, signed, or completed, ensuring you stay informed throughout the process. This feature enhances accountability and helps manage deadlines effectively.

-

What benefits does airSlate SignNow provide for handling BIRT EZ forms?

The main benefits of using airSlate SignNow for managing BIRT EZ forms include increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the entire signing process, allowing for faster turnaround and better coordination among team members. By reducing manual efforts, you can focus more on your core business functions.

Get more for Business Income & Receipts And Net Profits Taxes General

Find out other Business Income & Receipts And Net Profits Taxes General

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple