Www Uslegalforms Comform Library160310 Form S 240Form S 240 Fill and Sign Printable Template OnlineUS

Understanding the Wisconsin Form S-240

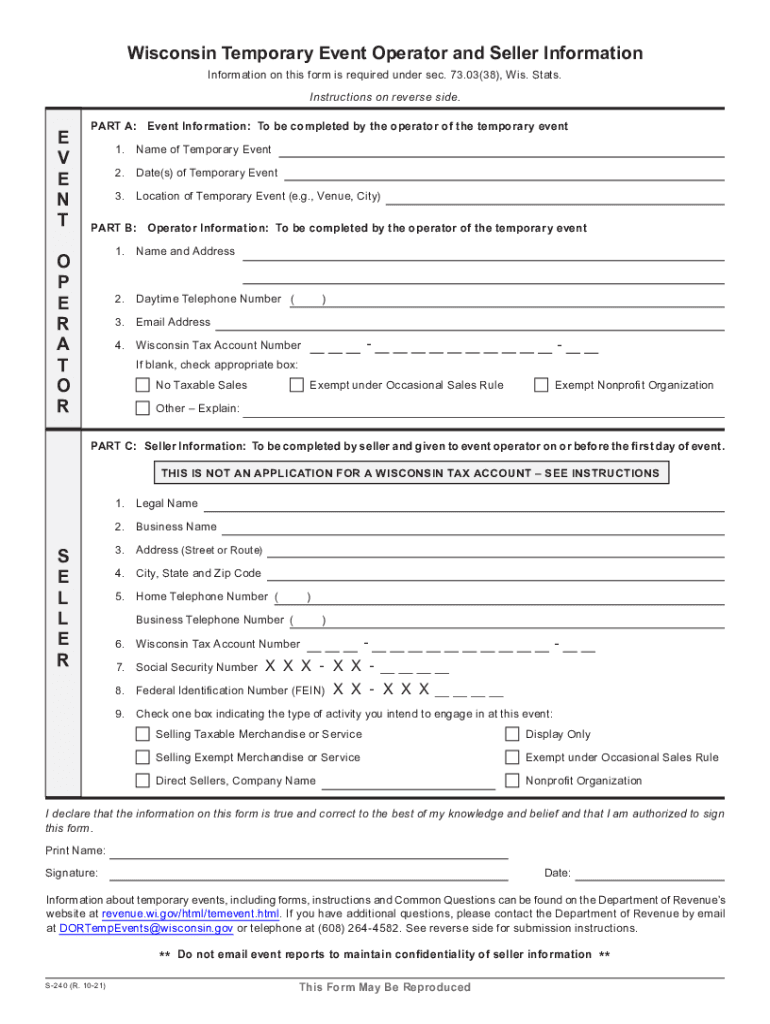

The Wisconsin Form S-240, also known as the department revenue 240, is a critical document used for reporting specific financial information to the state. This form is essential for individuals and businesses that need to comply with Wisconsin tax regulations. It serves as a temporary information form that captures necessary details about revenue, ensuring that all required data is accurately reported to the Wisconsin Department of Revenue. Understanding the purpose and requirements of this form is vital for maintaining compliance and avoiding potential penalties.

Steps to Complete the Wisconsin Form S-240

Completing the Wisconsin Form S-240 involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Follow these steps:

- Carefully read the instructions provided with the form to understand what information is required.

- Fill in your personal or business information, including name, address, and tax identification number.

- Report your total revenue and any applicable deductions or exemptions as outlined in the form.

- Review the completed form for accuracy and completeness before submission.

Using digital tools like signNow can simplify this process, allowing for easy filling and signing of the form online.

Legal Use of the Wisconsin Form S-240

The Wisconsin Form S-240 is legally recognized as a valid document for tax reporting purposes when completed correctly. To ensure its legal standing, it must meet specific requirements, including proper signatures and compliance with state regulations. Utilizing a secure eSignature solution, such as signNow, can enhance the legal validity of the form by providing a digital certificate that verifies the identity of the signer. This compliance with the ESIGN Act and UETA ensures that the form is treated as legally binding.

Filing Deadlines for the Wisconsin Form S-240

Timely filing of the Wisconsin Form S-240 is crucial to avoid penalties. The specific deadlines may vary depending on the type of entity submitting the form. Generally, the form should be filed by the end of the tax year or as specified by the Wisconsin Department of Revenue. It is advisable to check for any updates or changes to deadlines annually to ensure compliance.

Required Documents for the Wisconsin Form S-240

To complete the Wisconsin Form S-240, you will need several supporting documents. These may include:

- Financial statements that detail income and expenses.

- Previous tax returns for reference.

- Any additional documentation required by the Wisconsin Department of Revenue.

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Penalties for Non-Compliance with the Wisconsin Form S-240

Failure to file the Wisconsin Form S-240 by the deadline may result in penalties imposed by the state. These penalties can include fines and interest on any unpaid taxes. It is essential to understand the implications of non-compliance and to take proactive steps to ensure timely filing. Utilizing digital solutions like signNow can help streamline the process and reduce the risk of errors that could lead to penalties.

Quick guide on how to complete wwwuslegalformscomform library160310 form s 240form s 240 fill and sign printable template onlineus

Effortlessly Prepare Www uslegalforms comform library160310 form s 240Form S 240 Fill And Sign Printable Template OnlineUS on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the correct format and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, edit, and electronically sign your documents swiftly and without interruptions. Manage Www uslegalforms comform library160310 form s 240Form S 240 Fill And Sign Printable Template OnlineUS on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and Electronically Sign Www uslegalforms comform library160310 form s 240Form S 240 Fill And Sign Printable Template OnlineUS with Ease

- Obtain Www uslegalforms comform library160310 form s 240Form S 240 Fill And Sign Printable Template OnlineUS and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact confidential information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to finalize your modifications.

- Choose your preferred method to send your document: via email, SMS, or a sharing link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Www uslegalforms comform library160310 form s 240Form S 240 Fill And Sign Printable Template OnlineUS while ensuring outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwuslegalformscomform library160310 form s 240form s 240 fill and sign printable template onlineus

The way to create an e-signature for a PDF in the online mode

The way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is department revenue 240 and how does airSlate SignNow support it?

Department revenue 240 refers to a specific financial metric used by businesses to assess performance. airSlate SignNow enhances this process by providing a seamless way to send and eSign essential documents, ensuring efficiency and accuracy in tracking department revenues.

-

How does airSlate SignNow improve document management for department revenue 240?

With airSlate SignNow, businesses can streamline document management related to department revenue 240. The platform allows for secure storage, easy access, and quick sharing of documents, which is crucial for tracking and optimizing revenue.

-

What are the pricing options for using airSlate SignNow to manage department revenue 240?

airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes focusing on department revenue 240. These plans include features designed to improve document workflows, ensuring you get maximum value for your investment.

-

Can airSlate SignNow integrate with other systems to track department revenue 240?

Yes, airSlate SignNow seamlessly integrates with various business systems such as CRM and accounting software. This capability ensures that all documents related to department revenue 240 are synchronized with your existing tools, enhancing workflow efficiency.

-

What features make airSlate SignNow the best choice for managing department revenue 240?

airSlate SignNow offers features like customizable templates, automatic reminders, and real-time tracking that are perfect for managing department revenue 240. These tools empower users to increase productivity and reduce errors in document management.

-

How does airSlate SignNow enhance compliance for department revenue 240?

Compliance is critical when managing department revenue 240, and airSlate SignNow addresses this need by providing audit trails and secure eSignatures. This ensures that all documents are compliant with regulations, reducing the risk of potential legal issues.

-

What are the benefits of using airSlate SignNow for my department's revenue tracking?

Using airSlate SignNow for department revenue 240 tracking provides enhanced visibility into document workflows. It simplifies the process of collecting signatures and approvals, allowing teams to focus on strategic revenue growth instead of administrative tasks.

Get more for Www uslegalforms comform library160310 form s 240Form S 240 Fill And Sign Printable Template OnlineUS

Find out other Www uslegalforms comform library160310 form s 240Form S 240 Fill And Sign Printable Template OnlineUS

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online