Get the Form 1019, Notice of Assessment, Taxable 2020

Understanding the Michigan Notice Assessment

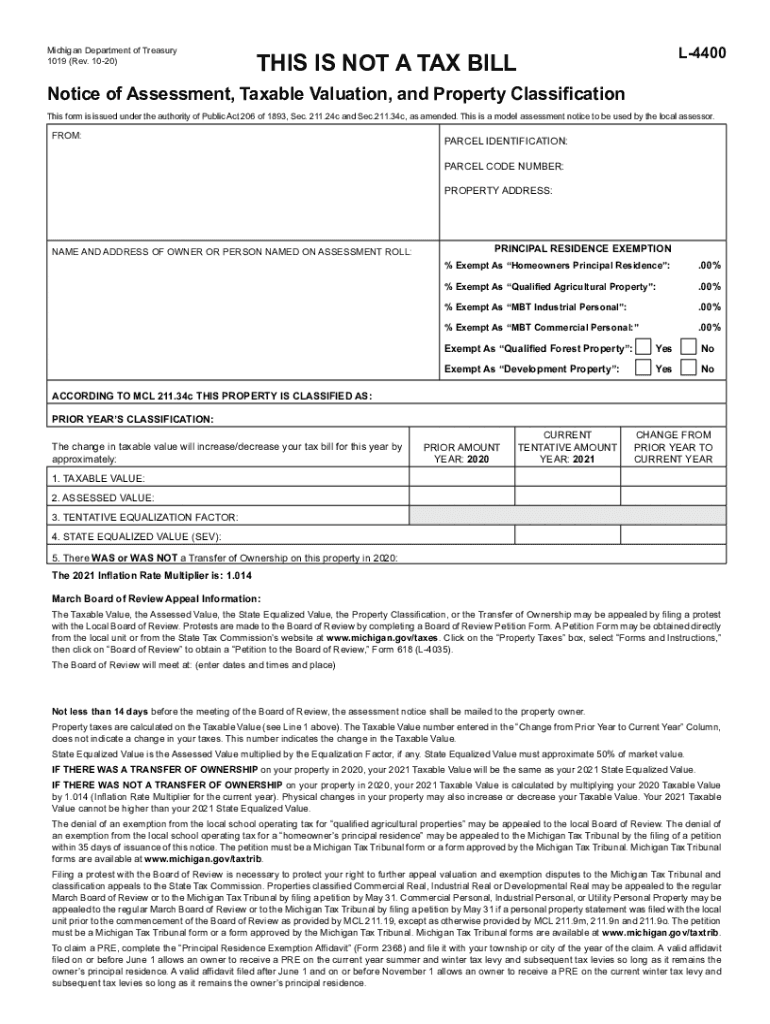

The Michigan Notice Assessment, often referred to as the Form 1019, is a crucial document issued by local assessors to inform property owners about the assessed value of their property. This assessment is essential for determining property taxes. The notice outlines the taxable value, which is used to calculate the amount owed in property taxes. Understanding this form is vital for homeowners to ensure they are aware of their property’s valuation and any potential tax implications.

Steps to Complete the Michigan Notice Assessment

Completing the Michigan Notice Assessment involves several key steps to ensure accuracy and compliance. First, review the assessed value provided on the form. If you believe the value is incorrect, gather supporting documents that justify your claim. Next, fill out any required sections on the form, ensuring all information is accurate and complete. Finally, submit the form to your local assessor’s office by the specified deadline to contest the assessment if necessary.

Key Elements of the Michigan Notice Assessment

The Michigan Notice Assessment includes several important elements that property owners should be aware of. These elements typically include:

- Property Description: Details about the property, including its location and type.

- Assessed Value: The value determined by the assessor, which affects property tax calculations.

- Taxable Value: The portion of the assessed value that is subject to taxation.

- Exemptions: Any exemptions that may apply to the property, reducing its taxable value.

Obtaining the Michigan Notice Assessment

To obtain the Michigan Notice Assessment, property owners can contact their local assessor’s office. Most offices provide the form upon request, and it may also be available on their official websites. If you have not received your notice, it is advisable to reach out directly to ensure you have the necessary information for your property.

Legal Use of the Michigan Notice Assessment

The Michigan Notice Assessment serves a legal purpose in the property tax process. It notifies property owners of their assessed value and provides an opportunity to contest the valuation if there are discrepancies. Proper handling of this document is essential to ensure compliance with local tax laws and to protect property rights.

Form Submission Methods

Submitting the Michigan Notice Assessment can be done through various methods. Property owners may choose to submit the form online, by mail, or in person at their local assessor’s office. Each method has its own requirements and deadlines, so it is important to choose the one that best fits your situation and ensure that all submissions are made timely.

Quick guide on how to complete get the free form 1019 notice of assessment taxable

Complete Get The Form 1019, Notice Of Assessment, Taxable effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Get The Form 1019, Notice Of Assessment, Taxable on any device via airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Get The Form 1019, Notice Of Assessment, Taxable without hassle

- Obtain Get The Form 1019, Notice Of Assessment, Taxable and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you select. Edit and eSign Get The Form 1019, Notice Of Assessment, Taxable and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free form 1019 notice of assessment taxable

Create this form in 5 minutes!

How to create an eSignature for the get the free form 1019 notice of assessment taxable

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Michigan Notice Assessment process?

The Michigan Notice Assessment process involves notifying property owners of their property assessment value, which can impact taxes. Understanding this process is crucial for taxpayers to ensure they are being accurately assessed. By utilizing tools like airSlate SignNow, you can streamline any related documentation and eSigning needs efficiently.

-

How can airSlate SignNow assist with Michigan Notice Assessment documents?

airSlate SignNow simplifies the management of Michigan Notice Assessment documents by allowing users to eSign and send documents securely. With its intuitive interface, businesses can ensure that all required assessments are completed on time, reducing the risk of errors or delays. This electronic solution is designed to enhance your workflow related to property assessments.

-

Are there any fees associated with airSlate SignNow for Michigan Notice Assessment?

airSlate SignNow offers flexible pricing plans that cater to various needs, including those related to the Michigan Notice Assessment. The pricing structure is designed to be cost-effective, providing value for businesses handling multiple assessments. You can choose a plan that fits your budget while accessing all necessary features.

-

What features does airSlate SignNow offer for handling Michigan Notice Assessment?

airSlate SignNow provides numerous features tailored for handling Michigan Notice Assessment documents, such as customizable templates and automatic reminders. Additionally, the platform's robust security measures ensure that sensitive assessment information remains protected. These features help streamline the entire assessment process.

-

Can airSlate SignNow integrate with other platforms for Michigan Notice Assessment?

Yes, airSlate SignNow offers seamless integrations with various platforms helpful for managing Michigan Notice Assessments. Whether you're using accounting software or property management tools, integration capabilities enhance your workflow and eliminate data silos. This ensures that all stakeholders involved in the assessment process remain in sync.

-

What are the benefits of using airSlate SignNow for Michigan Notice Assessment?

Using airSlate SignNow for Michigan Notice Assessment provides several benefits, including improved efficiency in document handling and reduced turnaround times. The electronic signing capability also enhances tracking and compliance, making it easier to adhere to state regulations. Overall, it empowers businesses to manage assessments more effectively.

-

Is airSlate SignNow user-friendly for Michigan Notice Assessment tasks?

Absolutely! airSlate SignNow is designed with user experience in mind, making it especially user-friendly for Michigan Notice Assessment tasks. Its intuitive layout allows users of any skill level to navigate easily, ensuring that sending and signing documents is hassle-free. This ease of use allows teams to focus on their core activities rather than worrying about technology.

Get more for Get The Form 1019, Notice Of Assessment, Taxable

- California change form

- Adult change gender form

- Name change instructions 497298487 form

- Name change forms 497298488

- Name change with form

- Individual credit application california form

- Interrogatories to plaintiff for motor vehicle occurrence california form

- Interrogatories to defendant for motor vehicle accident california form

Find out other Get The Form 1019, Notice Of Assessment, Taxable

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple