Form 1019, Notice of Assessment, Taxable State of Michigan Michigan 2020

What is the Form 1019, Notice Of Assessment, Taxable State Of Michigan

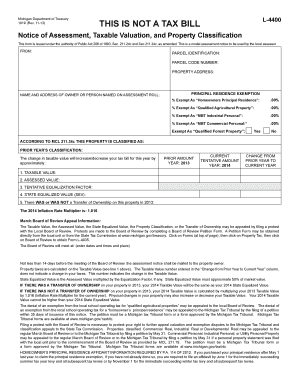

The Form 1019, also known as the Notice of Assessment, is a crucial document issued by the State of Michigan. It serves as a formal notification to taxpayers regarding their tax assessment. This form outlines the amount of tax owed and provides details about the taxpayer's financial obligations to the state. Understanding this form is essential for compliance with Michigan tax laws and for ensuring that taxpayers are aware of their rights and responsibilities.

How to use the Form 1019, Notice Of Assessment, Taxable State Of Michigan

Using the Form 1019 involves several steps to ensure that the information is accurately reported and submitted. Taxpayers should carefully review the assessment details provided in the form. If there are discrepancies or if the taxpayer believes the assessment is incorrect, they have the right to appeal the assessment. It is important to follow the instructions included with the form to ensure proper handling and submission.

Steps to complete the Form 1019, Notice Of Assessment, Taxable State Of Michigan

Completing the Form 1019 requires attention to detail. First, taxpayers should gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form by entering the required information accurately. This includes personal identification details and the specific amounts as indicated in the assessment. Once completed, the form should be reviewed for accuracy before submission to avoid any potential issues with the state tax authority.

Legal use of the Form 1019, Notice Of Assessment, Taxable State Of Michigan

The legal use of the Form 1019 is governed by Michigan tax laws. This form must be filled out and submitted in accordance with the guidelines set forth by the Michigan Department of Treasury. It is important for taxpayers to understand that this form serves as a legal document, and any inaccuracies or omissions could lead to penalties or legal consequences. Proper use of the form ensures compliance and protects the taxpayer's rights.

State-specific rules for the Form 1019, Notice Of Assessment, Taxable State Of Michigan

Michigan has specific rules regarding the Form 1019 that taxpayers must adhere to. These rules include deadlines for filing the form, the method of submission, and the requirements for supporting documentation. Additionally, taxpayers should be aware of any changes to state tax laws that may affect their assessment or the completion of the form. Staying informed about these regulations is essential for proper compliance.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 1019. The form can be submitted online through the Michigan Department of Treasury's website, which offers a convenient method for electronic filing. Alternatively, taxpayers can mail the completed form to the appropriate tax office or deliver it in person. Each submission method has its own guidelines and deadlines that must be followed to ensure timely processing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 1019 can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action by the state. It is crucial for taxpayers to understand the importance of timely and accurate submission of this form to avoid these potential consequences. Being proactive in addressing any issues related to the assessment can help mitigate risks associated with non-compliance.

Quick guide on how to complete form 1019 notice of assessment taxable state of michigan michigan

Effortlessly Prepare Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, amend, and electronically sign your documents swiftly and without holdups. Handle Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

The easiest way to modify and electronically sign Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan effortlessly

- Find Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive details using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1019 notice of assessment taxable state of michigan michigan

Create this form in 5 minutes!

How to create an eSignature for the form 1019 notice of assessment taxable state of michigan michigan

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan?

Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan, is a documentation issued by the state to notify taxpayers of their assessed property value and the corresponding taxes owed. Understanding this form is crucial for ensuring compliance with state tax requirements. With airSlate SignNow, you can easily eSign and manage this form digitally, streamlining your tax-related processes.

-

How can airSlate SignNow help with filing Form 1019?

airSlate SignNow provides an intuitive platform that allows users to fill out and eSign Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan, efficiently. The solution offers templates and customizable features, ensuring that all information is correctly captured and securely sent. This can help reduce errors and save time during tax season.

-

What are the pricing options for airSlate SignNow related to Form 1019?

airSlate SignNow offers various pricing plans that cater to businesses of different sizes, making it cost-effective for handling Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan. Detailed information about our plans can be found on our website, providing transparency about features included at each level. This ensures you can choose the right option that fits your needs.

-

Are there any integrations available for managing Form 1019 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your ability to manage Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan. Whether you need to sync with popular CRM systems or document storage solutions, our integrations make it simple and efficient. This connectivity ensures your workflow remains uninterrupted.

-

What are the main benefits of using airSlate SignNow for Form 1019?

Using airSlate SignNow for Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan, offers several advantages, including increased efficiency and reduced paperwork. The platform allows for secure electronic signatures and document management, which simplifies the overall filing process. Additionally, our user-friendly interface ensures that any member of your team can navigate the system effectively.

-

Is airSlate SignNow secure for handling sensitive documents like Form 1019?

Absolutely! airSlate SignNow employs high-level security protocols to protect sensitive documents, including Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan. Our platform uses encryption and complies with industry standards to guarantee the safety of your data. You can trust us to maintain confidentiality throughout the eSigning process.

-

Can I track the status of Form 1019 once sent for eSignature?

Yes, airSlate SignNow provides tracking capabilities that allow you to monitor the status of your Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan, after it has been sent for eSignature. You will receive notifications when the form is viewed and signed, enabling you to manage the process efficiently and follow up without hassle.

Get more for Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan

- New jersey park fire form

- New jersey direct deposit form

- Pemberton township recreation department 500 pemberton form

- Assistance for seniorsfood and nutrition service usda form

- South bound brook fire department chili cook off form

- Www countyoffice orglyndhurst police departmentlyndhurst police department lyndhurst nj address and phone form

- Www centuryfarmmeridian com09century farm acc formacc request form centuryfarmmeridian com

- Vendor hold harmless indemnity agreement form

Find out other Form 1019, Notice Of Assessment, Taxable State Of Michigan Michigan

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast