Form it 637 Alternative Fuels and Electric Vehicle Recharging Property Credit Tax Year

What is the Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year

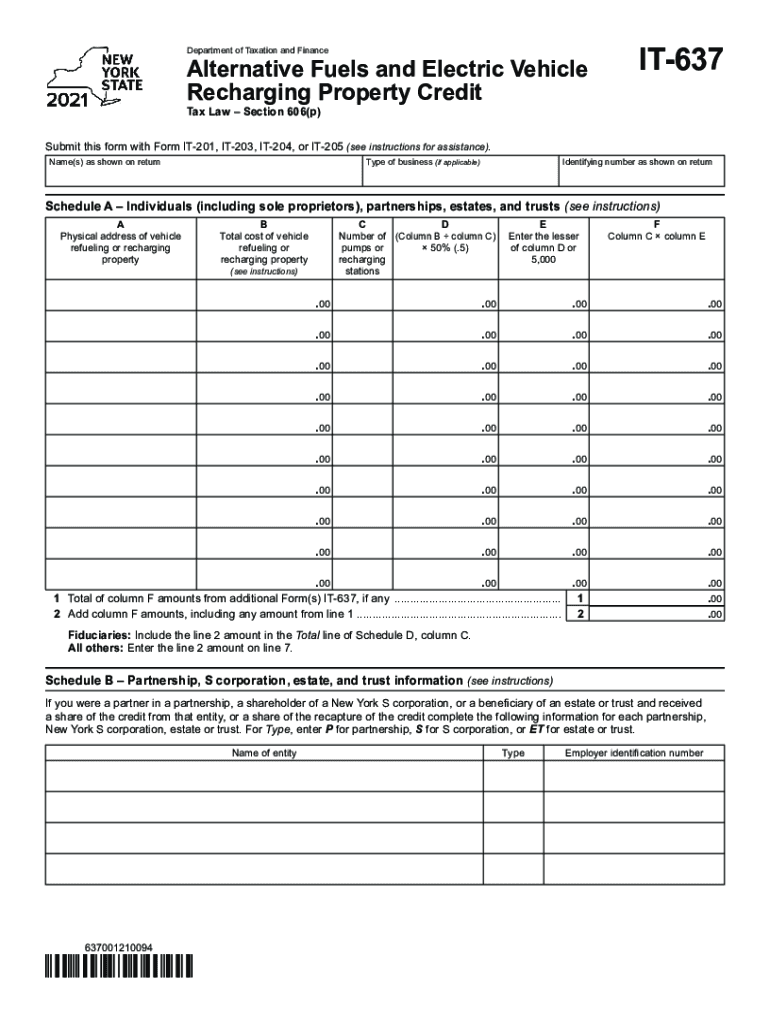

The Form IT 637 is a tax form used in the United States to claim the Alternative Fuels and Electric Vehicle Recharging Property Credit. This credit is designed to incentivize the use of alternative fuels and promote the installation of electric vehicle charging stations. Taxpayers who install qualified property may be eligible for a credit against their state income tax, which can significantly reduce their overall tax liability. Understanding the specifics of this form is essential for ensuring compliance and maximizing potential tax benefits.

How to use the Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year

Using the Form IT 637 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation regarding the installation of alternative fuel property or electric vehicle charging stations. Next, fill out the form with accurate information about the property, including installation costs and any relevant details about the equipment used. After completing the form, review it for accuracy before submitting it with your state tax return. It is important to keep copies of all documents for your records, as they may be needed for future reference or audits.

Steps to complete the Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year

Completing the Form IT 637 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including receipts and proof of installation.

- Enter your personal information, including your name, address, and taxpayer identification number.

- Detail the property installed, including the type of alternative fuel equipment and installation costs.

- Calculate the credit amount based on the eligible expenses and enter this on the form.

- Review the completed form for any errors or omissions.

- Submit the form along with your state tax return.

Eligibility Criteria

To qualify for the Alternative Fuels and Electric Vehicle Recharging Property Credit using Form IT 637, certain eligibility criteria must be met. Taxpayers must have installed qualified property that meets state specifications. This includes electric vehicle charging stations and other alternative fuel infrastructure. Additionally, the installation must have been completed within the specified tax year, and the taxpayer must be able to provide documentation proving the installation and associated costs. It is advisable to review state guidelines to ensure compliance with all requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 637 are typically aligned with the state income tax return deadlines. Taxpayers should be aware of the specific dates for the tax year in which they are claiming the credit. Generally, the deadline for filing state tax returns falls on April fifteenth, but extensions may be available. It is crucial to submit the Form IT 637 by the appropriate deadline to ensure eligibility for the credit and avoid any potential penalties.

Required Documents

When completing the Form IT 637, several documents are required to substantiate the claim. These include:

- Receipts for the purchase and installation of alternative fuel property.

- Proof of payment, such as bank statements or credit card statements.

- Any applicable permits or installation documentation required by local authorities.

- Documentation showing the type and specifications of the equipment installed.

Having these documents readily available will facilitate a smoother filing process and support the validity of your claim.

Quick guide on how to complete form it 637 alternative fuels and electric vehicle recharging property credit tax year 2021

Complete Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to find the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year with ease

- Find Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year and click Get Form to begin.

- Use the tools provided to complete your form.

- Highlight signNow sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all information and then click the Done button to save your changes.

- Choose how you wish to send your form: by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 637 alternative fuels and electric vehicle recharging property credit tax year 2021

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to generate an e-signature straight from your smart phone

How to make an e-signature for a PDF on iOS devices

How to generate an e-signature for a PDF document on Android OS

People also ask

-

What is it 637 and how can it benefit my business?

It 637 refers to a specific feature set within airSlate SignNow that streamlines the eSigning process. By utilizing this feature, businesses can efficiently send documents for electronic signatures, reducing turnaround times and improving overall workflow efficiency. This cost-effective solution not only saves time but also enhances document security.

-

How much does it 637 cost for my business?

The pricing for it 637 depends on the plan you choose within airSlate SignNow. We offer flexible pricing tiers that cater to different business sizes and needs, ensuring that you only pay for what you require. Our plans are designed to provide great value, making it accessible for businesses looking to improve their document management.

-

What features are included in it 637?

It 637 includes essential features such as customizable templates, team collaboration tools, and advanced security options. These functionalities allow users to create, send, and manage documents efficiently while maintaining compliance with industry standards. With it 637, you gain access to a user-friendly interface designed for optimal productivity.

-

Is it 637 secure for sensitive documents?

Yes, it 637 is designed with robust security measures to protect your sensitive documents. It includes encryption, access controls, and audit trails to ensure that your information remains confidential and compliant with regulations. This level of security makes it 637 a trusted choice for organizations handling critical data.

-

Can I integrate it 637 with other software?

Absolutely! It 637 seamlessly integrates with a variety of third-party applications such as CRM systems, project management tools, and cloud storage services. This interoperability allows for a more streamlined workflow, making it easier to send and manage documents directly from the tools you already use.

-

How does it 637 improve the document signing process?

It 637 simplifies the document signing process by allowing users to send and sign documents electronically in just a few clicks. This enhances speed and reduces the reliance on paper-based methods, ultimately resulting in faster approvals and increased productivity. The intuitive design of it 637 further facilitates an effortless user experience.

-

Is support available for users of it 637?

Yes, airSlate SignNow offers comprehensive support for all users of it 637. Our dedicated customer service team is available to assist with any questions or issues you may encounter, ensuring that you can make the most out of your experience. We also provide extensive online resources and tutorials to help users get started.

Get more for Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year

Find out other Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure