760PY Schedule of Income for Part Year Residents Virginia Form

What is the 760PY Schedule of Income for Part-Year Residents in Virginia?

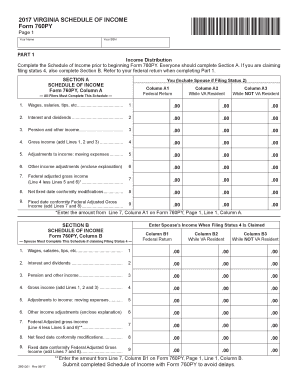

The 760PY form is a tax document specifically designed for individuals who are part-year residents of Virginia. This form allows taxpayers to report income earned while residing in the state, as well as any income earned while living outside of Virginia during the tax year. The 760PY is essential for ensuring that individuals accurately reflect their tax obligations based on their residency status, providing a clear breakdown of income sources and tax liabilities.

Steps to Complete the 760PY Schedule of Income for Part-Year Residents in Virginia

Completing the 760PY form involves several key steps to ensure accuracy and compliance with Virginia tax regulations. Begin by gathering all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, distinguishing between Virginia-source income and non-Virginia income.

- Calculate your Virginia taxable income by applying any relevant deductions or credits.

- Review your calculations to ensure all figures are accurate and complete.

- Sign and date the form before submission.

Legal Use of the 760PY Schedule of Income for Part-Year Residents in Virginia

The 760PY form is legally recognized as a valid method for part-year residents of Virginia to report their income. To ensure its legal standing, it must be filled out accurately and submitted by the state's tax deadline. Compliance with Virginia tax laws is crucial, as failure to file correctly can result in penalties or interest charges. Utilizing a reliable eSignature solution can further enhance the legal validity of your submission, ensuring that all signatures are authenticated and documented.

State-Specific Rules for the 760PY Schedule of Income for Part-Year Residents in Virginia

Virginia has specific rules that apply to the 760PY form, particularly regarding residency status and income reporting. Part-year residents must accurately report only the income earned while residing in Virginia. Additionally, the state allows certain deductions that may differ from federal guidelines. It is essential to familiarize yourself with these state-specific rules to ensure compliance and optimize your tax outcome.

Examples of Using the 760PY Schedule of Income for Part-Year Residents in Virginia

Understanding how to apply the 760PY form can be enhanced through practical examples. For instance, if an individual moves to Virginia in June and earns a salary from a Virginia employer, they would report that salary as Virginia-source income. Conversely, any income earned from a previous job in another state during the first half of the year would not be included in the Virginia income calculation. These examples illustrate the importance of accurately distinguishing between income sources to fulfill tax obligations correctly.

Filing Deadlines and Important Dates for the 760PY Schedule of Income in Virginia

Filing deadlines for the 760PY form align with Virginia's tax calendar. Typically, the form must be submitted by May first of the year following the tax year in question. It is crucial to be aware of these deadlines to avoid late fees or penalties. Additionally, if you anticipate needing more time to prepare your taxes, you may file for an extension, but this does not extend the time to pay any taxes owed.

Quick guide on how to complete column sign

Prepare column sign effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the correct form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage 760py on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 760 py with ease

- Locate 760py form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 760py instructions and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs form 760py instructions

-

How much amount to fill in amount of transaction column of form 60/61?

You are required to write the amount for which you are filling this form. Nil in case of debit card requests as now it is mandatory to have PAN card to apply for a debit card from the Bank.

-

What should I fill in the column of subject in an intermediate column while filling out the form of a BA?

A2AYou have to fill the names of the subjects you were having in your class 12th.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

As an atheist, how do you fill the religion column on a form?

As an atheist, how do you fill the religion column on a form?With a ball pen and in print uppercase letters. But I do this not as an atheist but as a human being that wants to make the job of the people reading the form easier.Actually, I don’t know how it would be in your country but in mine (Argentina) the chance of being asked your religion in a form is minimal, almost inexistent. It would be a discriminatory rude question to ask if it not in a census, a survey about religiosity of the population or something where the religiosity (or lack of it) is important.In these rare particular cases I guess that I will put atheist in that question if I have the chance to write the word. And if I had not the chance because there is a checkbox or something, I will choose the box with that option or an equivalent one (let’s say: “none/agnostic/atheist”).That, obviously, being a survey that is well designed and with the scientific objective of surveying the belief of the population or something pertinent to the question.If I find that question in a form from a bank, a job position or any other impertinent objective I will stop filling the form, go to the next antidiscrimination office and fill a complain, besides releasing the form to the press, radio, tv, social networks and other media so everybody knows that the person/organization behind that form discriminates people because of religious motives.

Related searches to virginia 760 instructions

Create this form in 5 minutes!

How to create an eSignature for the 760py

How to create an eSignature for your Form 760py Column A online

How to generate an electronic signature for the Form 760py Column A in Chrome

How to make an eSignature for putting it on the Form 760py Column A in Gmail

How to create an eSignature for the Form 760py Column A straight from your smart phone

How to make an electronic signature for the Form 760py Column A on iOS devices

How to create an electronic signature for the Form 760py Column A on Android OS

People also ask 760py form

-

What is 760py and how does it relate to airSlate SignNow?

760py is a feature within airSlate SignNow that enhances the electronic signing process. This innovative solution allows businesses to streamline document workflows, making it easy to send, sign, and store documents securely. By leveraging 760py, users can increase efficiency and reduce turnaround times.

-

How much does airSlate SignNow cost for accessing 760py features?

The pricing for airSlate SignNow varies depending on the plan selected, but it offers cost-effective options that include access to 760py features. Users can choose from monthly or annual subscriptions, with volume discounts available for larger teams. It's designed to fit within business budgets while providing robust eSignature capabilities.

-

What are the key benefits of using 760py with airSlate SignNow?

Using 760py with airSlate SignNow streamlines the signing process, improving productivity and reducing errors. Businesses benefit from enhanced document tracking, user-friendly interfaces, and secure cloud storage. Additionally, it helps in maintaining compliance with legal standards for electronic signatures.

-

Can I integrate 760py with other software solutions?

Yes, 760py within airSlate SignNow can be seamlessly integrated with various software applications such as CRM systems, project management tools, and cloud storage services. This integration capability allows businesses to enhance their workflow further and keep their processes streamlined. It ensures that companies can customize their document management systems effectively.

-

What types of documents can I send using 760py?

With 760py, users can send a wide range of documents, including contracts, agreements, and forms that require signatures. This flexibility ensures that businesses can utilize airSlate SignNow for various purposes, from legal documents to HR forms. The versatility of 760py makes it ideal for nearly any document-centric operation.

-

How secure is the signing process with 760py?

The signing process using 760py in airSlate SignNow is highly secure, employing encryption and robust authentication measures. This ensures that documents are protected from unauthorized access and tampering. Businesses can have peace of mind knowing that their sensitive information is safeguarded throughout the signing process.

-

Is it easy to set up airSlate SignNow to use 760py?

Yes, setting up airSlate SignNow to access the 760py features is straightforward and user-friendly. The platform provides step-by-step guidance for users to configure their accounts quickly. This ease of setup is designed to ensure that even those unfamiliar with electronic signatures can start using 760py with minimal hassle.

Get more for 760py instructions

- State farm authorization and direction to pay form

- Iowa first report of injury form

- State of nevada department of business and industry real estate division 2501 east sahara avenue suite 102 las vegas nv 89104 form

- Real estate division property management permit red state nv form

- Durable power of attorney form

- 506 nevada real estate division red state nv form

- Nevada osha green valley photovoltaic renewal form

- Nv affidavit form

Find out other column sign

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT