New Mexico Form CIT 1 Instructions Instructions for Form Overview NM Taxation and Revenue DepartmentFiling Requirements NM Taxat 2020

Overview of New Mexico Form CIT 1 Instructions

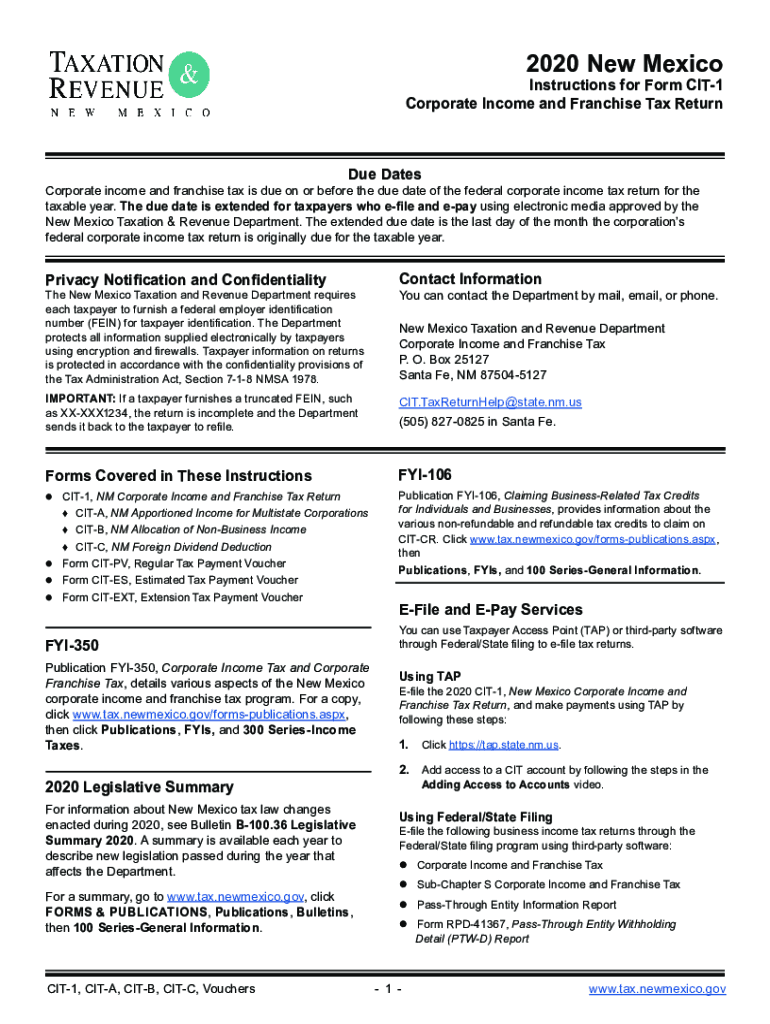

The New Mexico Form CIT 1 is essential for businesses operating within the state, providing the necessary instructions for compliance with state tax regulations. This form is utilized by corporations to report their income and calculate the corporate income tax owed to the New Mexico Taxation and Revenue Department. Understanding the requirements and details outlined in the CIT 1 instructions is crucial for accurate filing and avoiding penalties.

Steps to Complete the New Mexico Form CIT 1 Instructions

Completing the New Mexico Form CIT 1 requires careful attention to detail. Here are the steps to ensure proper completion:

- Gather all necessary financial documents, including income statements and expense reports.

- Follow the line-by-line instructions provided in the form to report your income accurately.

- Calculate the total corporate income tax based on the reported income.

- Review all entries for accuracy before submission.

- Sign and date the form as required.

Key Elements of the New Mexico Form CIT 1 Instructions

The key elements of the New Mexico Form CIT 1 instructions include specific guidelines on how to report various types of income, allowable deductions, and credits. It is important to pay attention to:

- Definitions of taxable income and non-taxable income.

- Details on deductions that can be claimed.

- Instructions for calculating tax credits available to corporations.

Filing Deadlines and Important Dates

Timely filing of the New Mexico Form CIT 1 is essential to avoid penalties. The filing deadline typically aligns with the federal tax return due date, which is usually the fifteenth day of the fourth month following the end of the tax year. It is advisable to confirm specific dates each year, as they may vary.

Legal Use of the New Mexico Form CIT 1 Instructions

The legal use of the New Mexico Form CIT 1 instructions is governed by state tax laws. Proper adherence to these instructions ensures that the submitted forms are valid and compliant with the New Mexico Taxation and Revenue Department's requirements. This compliance is critical for maintaining good standing with state tax authorities.

Form Submission Methods

Businesses can submit the New Mexico Form CIT 1 through various methods, including:

- Online submission via the New Mexico Taxation and Revenue Department's website.

- Mailing a hard copy of the form to the designated address provided in the instructions.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete new mexico form cit 1 instructions instructions for form overview nm taxation and revenue departmentfiling requirements nm

Complete New Mexico Form CIT 1 Instructions Instructions For Form Overview NM Taxation And Revenue DepartmentFiling Requirements NM Taxat with ease on any device

The management of online documents has gained signNow traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate forms and securely save them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without any hold-ups. Manage New Mexico Form CIT 1 Instructions Instructions For Form Overview NM Taxation And Revenue DepartmentFiling Requirements NM Taxat on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign New Mexico Form CIT 1 Instructions Instructions For Form Overview NM Taxation And Revenue DepartmentFiling Requirements NM Taxat effortlessly

- Find New Mexico Form CIT 1 Instructions Instructions For Form Overview NM Taxation And Revenue DepartmentFiling Requirements NM Taxat and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require new document copies to be printed. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and electronically sign New Mexico Form CIT 1 Instructions Instructions For Form Overview NM Taxation And Revenue DepartmentFiling Requirements NM Taxat and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico form cit 1 instructions instructions for form overview nm taxation and revenue departmentfiling requirements nm

Create this form in 5 minutes!

How to create an eSignature for the new mexico form cit 1 instructions instructions for form overview nm taxation and revenue departmentfiling requirements nm

How to make an e-signature for your PDF document online

How to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What are New Mexico CIT 1 instructions?

New Mexico CIT 1 instructions refer to the guidelines provided by the state for filing the Corporate Income Tax Return. Understanding these instructions is crucial for businesses to comply with tax regulations while using airSlate SignNow for their document needs.

-

How does airSlate SignNow simplify following New Mexico CIT 1 instructions?

airSlate SignNow streamlines the process of managing your New Mexico CIT 1 instructions. With our platform, you can easily eSign and send documents needed for tax filing, ensuring seamless compliance and document management.

-

Are there any costs associated with using airSlate SignNow for New Mexico CIT 1 instructions?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs, including those specifically for handling New Mexico CIT 1 instructions. We provide an affordable, cost-effective solution that simplifies document signing without compromising on features.

-

What features does airSlate SignNow offer for managing New Mexico CIT 1 instructions?

airSlate SignNow offers features like document templates, bulk sending, and cloud storage that are beneficial when managing New Mexico CIT 1 instructions. These features ensure your document workflow is efficient, organized, and readily accessible.

-

Can airSlate SignNow integrate with other tools for New Mexico CIT 1 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing your capability to manage New Mexico CIT 1 instructions. This means you can connect your existing systems to streamline workflows and ensure compliance.

-

What are the benefits of using airSlate SignNow for New Mexico CIT 1 instructions?

Using airSlate SignNow for your New Mexico CIT 1 instructions offers numerous benefits, such as reduced paperwork, faster processing times, and improved accuracy. Our platform allows for easy tracking of document status, ensuring you stay on top of your tax obligations.

-

Is airSlate SignNow compliant with New Mexico regulations for CIT 1 submissions?

Yes, airSlate SignNow is designed to comply with New Mexico regulations surrounding CIT 1 submissions. We continually update our platform to adhere to state requirements, helping businesses stay compliant and avoid penalties.

Get more for New Mexico Form CIT 1 Instructions Instructions For Form Overview NM Taxation And Revenue DepartmentFiling Requirements NM Taxat

- Statement of decline of vocational rehabilitation for workers compensation california form

- Order show cause 497299497 form

- Order injunction form

- Order restraining form

- California preliminary injunction form

- New resident guide california form

- Ca workers compensation 497299502 form

- Ca workers compensation 497299503 form

Find out other New Mexico Form CIT 1 Instructions Instructions For Form Overview NM Taxation And Revenue DepartmentFiling Requirements NM Taxat

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now