M 8453 Tax Form PDF 2011

What is the M-8453 Tax Form PDF

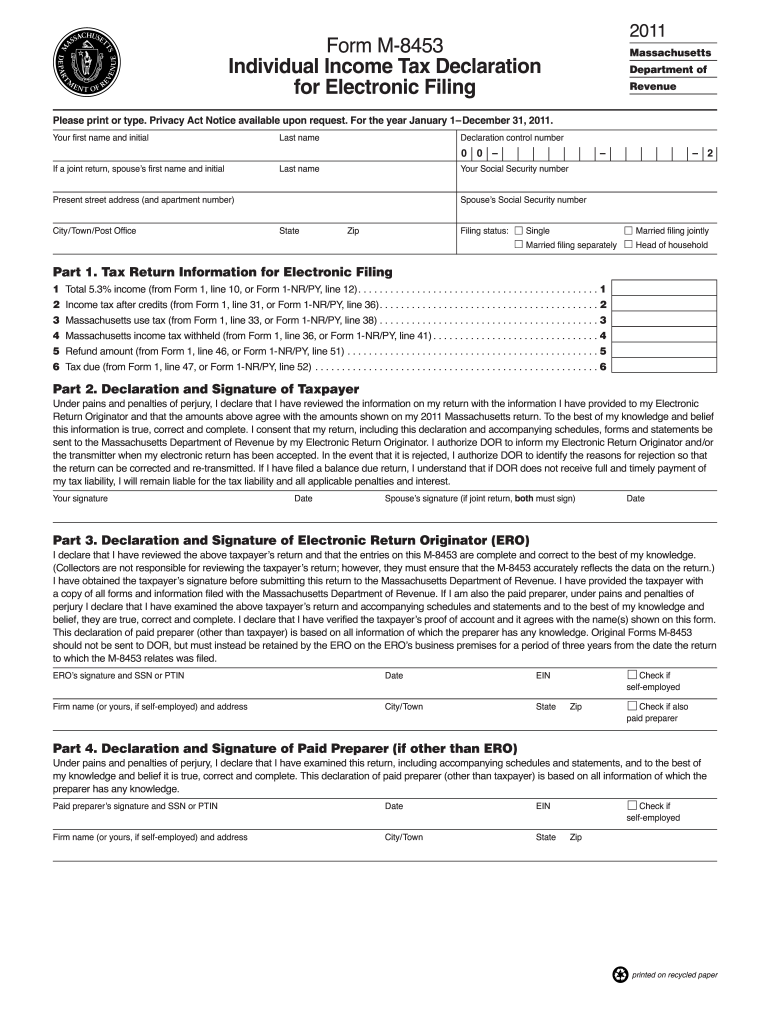

The M-8453 Tax Form PDF is a crucial document used by taxpayers in the United States to verify their electronic tax return submissions. This form acts as a declaration that the taxpayer has reviewed their return and is submitting it electronically. It is particularly relevant for those who e-file their taxes and need to provide a signature to authenticate their submission. The M-8453 serves as a safeguard for both the taxpayer and the IRS, ensuring that the information provided is accurate and authorized.

How to use the M-8453 Tax Form PDF

To use the M-8453 Tax Form PDF effectively, begin by downloading the form from a reliable source. After downloading, fill in the required information, including your name, Social Security number, and details about your tax return. Once completed, you can eSign the document using a secure eSignature solution. This process allows you to submit your tax return electronically while meeting IRS requirements for verification. Ensure that you keep a copy of the signed form for your records.

Steps to complete the M-8453 Tax Form PDF

Completing the M-8453 Tax Form PDF involves several straightforward steps:

- Download the M-8453 Tax Form PDF from a trusted source.

- Open the form and enter your personal information, including your name and Social Security number.

- Provide details regarding your tax return, such as the type of return and the total amount of tax owed or refunded.

- Review the information for accuracy to avoid any errors.

- Use a secure eSignature solution to sign the form electronically.

- Save a copy of the completed form for your records.

Legal use of the M-8453 Tax Form PDF

The M-8453 Tax Form PDF is legally recognized by the IRS as a valid method for verifying electronic tax submissions. When signed electronically, it holds the same legal weight as a handwritten signature, provided it meets the requirements set forth by the IRS. This includes compliance with the ESIGN Act, which allows electronic signatures to be used in place of traditional signatures for tax documents. It is essential to ensure that the form is filled out accurately and submitted within the appropriate deadlines to maintain its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the M-8453 Tax Form PDF align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 each year. If you require additional time, you may file for an extension, but it is crucial to submit the M-8453 form by the extended deadline as well. Keeping track of these dates helps avoid penalties and ensures that your tax return is processed in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The M-8453 Tax Form PDF can be submitted electronically alongside your tax return when e-filing. This method is the most efficient and ensures that your submission is processed quickly. Alternatively, if you choose to file your tax return by mail, you should include a printed copy of the M-8453 form with your paper return. In-person submission is generally not applicable for this form, as it is primarily designed for electronic filing. Always ensure that you follow the submission guidelines provided by the IRS to avoid delays.

Quick guide on how to complete m 8453 tax form pdf 2011

Your assistance manual on how to prepare your M 8453 Tax Form Pdf

If you’re curious about how to finalize and submit your M 8453 Tax Form Pdf, here are some brief instructions on how to simplify tax filing.

First, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and efficient document solution that allows you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures and return to revise details as needed. Optimize your tax organization with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finalize your M 8453 Tax Form Pdf in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your M 8453 Tax Form Pdf in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if needed).

- Review your document and amend any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can elevate return errors and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct m 8453 tax form pdf 2011

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

Create this form in 5 minutes!

How to create an eSignature for the m 8453 tax form pdf 2011

How to create an eSignature for your M 8453 Tax Form Pdf 2011 online

How to create an electronic signature for your M 8453 Tax Form Pdf 2011 in Google Chrome

How to make an electronic signature for signing the M 8453 Tax Form Pdf 2011 in Gmail

How to generate an electronic signature for the M 8453 Tax Form Pdf 2011 straight from your smartphone

How to make an electronic signature for the M 8453 Tax Form Pdf 2011 on iOS devices

How to create an electronic signature for the M 8453 Tax Form Pdf 2011 on Android devices

People also ask

-

What is the M 8453 Tax Form Pdf?

The M 8453 Tax Form Pdf is a crucial document that taxpayers use to submit their electronic tax returns. It serves as a signature authorization for your electronic filing, ensuring that your information is transmitted securely and accurately. Understanding this form is essential for anyone looking to file their taxes efficiently.

-

How can I obtain the M 8453 Tax Form Pdf?

You can easily download the M 8453 Tax Form Pdf from the official IRS website or request it from your tax preparer. Additionally, the form can be completed and signed electronically using airSlate SignNow, making the process smoother and quicker. This helps you save time while ensuring compliance.

-

Are there any costs associated with using airSlate SignNow for the M 8453 Tax Form Pdf?

airSlate SignNow provides a cost-effective solution for handling documents, including the M 8453 Tax Form Pdf. The pricing varies depending on the plan you choose, with options suitable for both individuals and businesses. You can start with a free trial to explore its features before committing.

-

What are the features of airSlate SignNow for managing the M 8453 Tax Form Pdf?

airSlate SignNow offers features such as easy eSigning, document templates, and secure cloud storage, which are perfect for managing the M 8453 Tax Form Pdf. The platform is user-friendly and allows you to quickly upload, sign, and send your tax form electronically. This enhances your workflow and keeps your documents organized.

-

How does airSlate SignNow ensure the security of the M 8453 Tax Form Pdf?

Security is a top priority with airSlate SignNow. The platform employs advanced encryption methods to protect your documents, including the M 8453 Tax Form Pdf, ensuring your sensitive information remains confidential. Additionally, you can track document status and receive notifications for added peace of mind.

-

Can I integrate airSlate SignNow with other applications for the M 8453 Tax Form Pdf?

Yes, airSlate SignNow allows for seamless integrations with various applications, enhancing your workflow when dealing with the M 8453 Tax Form Pdf. You can connect with CRM systems, cloud storage services, and more to streamline data transfer and document management. This ensures that your tax filing process is efficient and effective.

-

What benefits does airSlate SignNow offer for filing the M 8453 Tax Form Pdf?

Using airSlate SignNow to file the M 8453 Tax Form Pdf offers several benefits, including time savings, improved accuracy, and reduced paperwork. The electronic signature feature allows you to sign documents in seconds without the hassle of printing and scanning. This leads to a faster and more organized tax filing experience.

Get more for M 8453 Tax Form Pdf

Find out other M 8453 Tax Form Pdf

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online