State of New Mexico Taxation and Revenue Department Tax Form

Understanding the New Mexico ACD 31102 Form

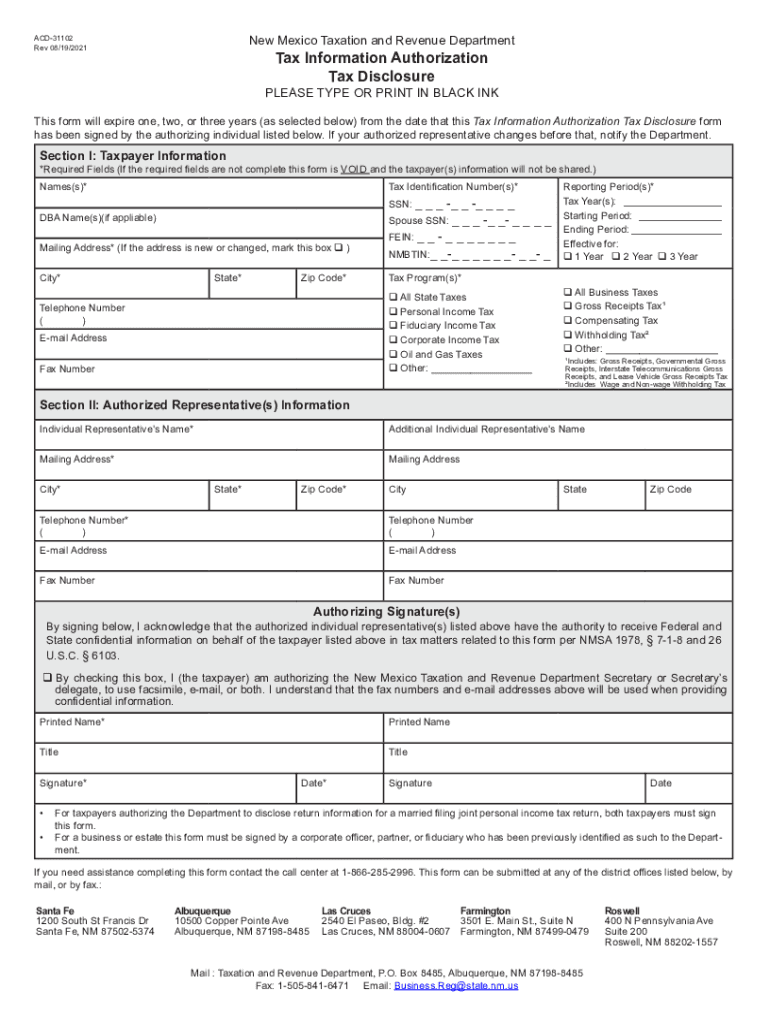

The New Mexico ACD 31102 form, also known as the NM Revenue Authorization, is a crucial document used for tax-related purposes within the state. This form is primarily utilized by taxpayers to authorize the New Mexico Taxation and Revenue Department to disclose specific tax information. It plays a significant role in ensuring that taxpayers can manage their tax affairs efficiently and securely. Understanding its purpose and the information it requires is essential for compliance and effective tax management.

Steps to Complete the New Mexico ACD 31102 Form

Completing the NM ACD 31102 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your taxpayer identification number and details about the information you wish to authorize for disclosure. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is important to review the form for any errors before submission. Finally, submit the form as directed, either electronically or via mail, to ensure it reaches the appropriate department for processing.

Legal Use of the New Mexico ACD 31102 Form

The NM ACD 31102 form is legally binding when completed and submitted according to state regulations. It complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which establishes the legality of electronic signatures and records. This means that when you eSign the form using a compliant platform, it holds the same legal weight as a traditional handwritten signature. Understanding the legal implications of this form is crucial for taxpayers to ensure their rights and obligations are upheld.

Required Documents for the New Mexico ACD 31102 Form

When preparing to fill out the NM ACD 31102 form, it is important to have certain documents on hand to facilitate the process. Key documents include your Social Security number or Employer Identification Number (EIN), any previous tax returns, and specific details about the tax information you wish to authorize for disclosure. Having these documents ready will streamline the completion of the form and help avoid delays in processing.

Form Submission Methods for the New Mexico ACD 31102

The NM ACD 31102 form can be submitted through various methods, providing flexibility for taxpayers. You can choose to submit the form electronically via the New Mexico Taxation and Revenue Department's online portal, which is often the fastest option. Alternatively, you can print the completed form and mail it to the designated address. In-person submission may also be possible at local tax offices, depending on the department's current policies. Each method has its own processing times, so selecting the right one for your needs is important.

Eligibility Criteria for Using the New Mexico ACD 31102 Form

To use the NM ACD 31102 form, taxpayers must meet certain eligibility criteria. Generally, individuals or entities that need to authorize the disclosure of their tax information to the New Mexico Taxation and Revenue Department can use this form. This includes individuals, businesses, and organizations that are subject to New Mexico taxation. It is essential to ensure that you meet these criteria before attempting to complete and submit the form to avoid complications.

Quick guide on how to complete state of new mexico taxation and revenue department tax

Complete State Of New Mexico Taxation And Revenue Department Tax effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage State Of New Mexico Taxation And Revenue Department Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign State Of New Mexico Taxation And Revenue Department Tax with ease

- Find State Of New Mexico Taxation And Revenue Department Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign State Of New Mexico Taxation And Revenue Department Tax and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of new mexico taxation and revenue department tax

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

The best way to generate an e-signature for a PDF on Android devices

People also ask

-

What is new mexico acd 31102?

New Mexico ACD 31102 refers to a specific product offering in the realm of electronic signature solutions, such as those provided by airSlate SignNow. It enables businesses to send and eSign documents efficiently, making it an essential tool for streamlining operations in any industry. Leveraging ACD 31102 can signNowly enhance your document management processes.

-

How does pricing work for new mexico acd 31102?

The pricing for new mexico acd 31102 offered by airSlate SignNow is designed to cater to various business needs. Packages typically range from basic plans to more advanced options, allowing businesses to choose based on their volume and requirements. Understanding the pricing model ensures you can select the most cost-effective solution for your electronic signing needs.

-

What features are included in the new mexico acd 31102 package?

The new mexico acd 31102 package includes a range of features designed to enhance document management, such as customizable templates, robust security measures, and multi-device accessibility. Additionally, it offers seamless integration with various applications, enabling a fully integrated workflow. These features make it easy for businesses to adopt this innovative solution.

-

What are the benefits of using new mexico acd 31102?

Using new mexico acd 31102 can signNowly reduce the time spent on document processing. Companies can enjoy benefits such as faster contract turnaround times and improved efficiency in obtaining signatures. Moreover, businesses often report better compliance and reduced paper usage, contributing to a greener environment.

-

Can new mexico acd 31102 integrate with other platforms?

Yes, new mexico acd 31102 is designed to integrate seamlessly with various platforms such as CRM systems, document management software, and cloud storage solutions. This capability allows businesses to optimize their workflows and centralize their document processes. By utilizing these integrations, companies can maximize the effectiveness of their document signing workflows.

-

Is new mexico acd 31102 compliant with legal standards?

Absolutely. New mexico acd 31102 complies with the latest electronic signature laws, including the ESIGN Act and UETA, ensuring that all signed documents are legally binding. This compliance is crucial for businesses looking to uphold legal standards and maintain credibility. Utilizing airSlate SignNow assures users of consistent legal protection for their electronic transactions.

-

What kind of customer support does new mexico acd 31102 offer?

airSlate SignNow provides robust customer support for users of new mexico acd 31102, including live chat, email support, and comprehensive documentation. Customers can access assistance at any stage of the process, ensuring they maximize their use of the platform. This commitment to customer support enhances user experience and satisfaction.

Get more for State Of New Mexico Taxation And Revenue Department Tax

Find out other State Of New Mexico Taxation And Revenue Department Tax

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free