PDF Form it 605 Claim for EZ Investment Tax Credit and EZ Employment 2021

What is the PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment

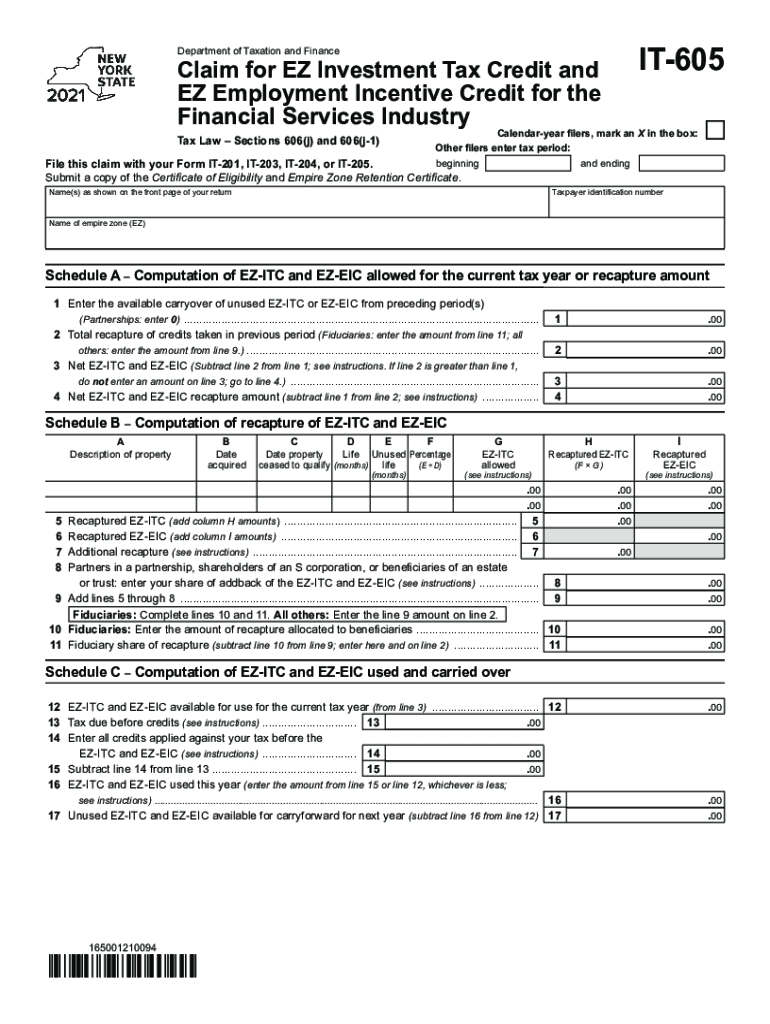

The PDF Form IT 605 is a crucial document used by businesses in the United States to claim the EZ Investment Tax Credit and EZ Employment benefits. This form is specifically designed to assist eligible taxpayers in reporting their investments and employment-related tax credits accurately. By utilizing this form, businesses can potentially reduce their tax liabilities, making it an essential tool for financial planning and compliance.

How to use the PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment

Using the PDF Form IT 605 involves several straightforward steps. First, ensure you have the latest version of the form, which can typically be downloaded from official tax resources. Next, gather all necessary financial documents and information related to your claims. Fill out the form carefully, providing accurate details about your investments and employment credits. Once completed, review the form for any errors before submission to ensure compliance with IRS guidelines.

Steps to complete the PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment

Completing the PDF Form IT 605 requires attention to detail. Here are the steps to follow:

- Download the form from a trusted source.

- Provide your business information, including name, address, and tax identification number.

- Detail the investment amounts and employment credits you are claiming.

- Ensure all calculations are correct and supported by documentation.

- Sign and date the form to validate your claims.

Legal use of the PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment

The legal use of the PDF Form IT 605 is governed by IRS regulations. It is vital to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. This form must be submitted within the designated filing deadlines to be considered valid. Compliance with tax laws not only protects your business but also ensures you receive the credits you are entitled to.

Eligibility Criteria

To qualify for the EZ Investment Tax Credit and EZ Employment benefits, certain eligibility criteria must be met. Generally, businesses must demonstrate that they have made qualifying investments or created eligible employment opportunities. Specific requirements may vary based on state regulations and the nature of the business. It is advisable to review the criteria carefully to ensure compliance before submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the PDF Form IT 605 are critical to ensure timely submission and avoid penalties. Typically, the form must be filed by the tax return due date for the year in which the credits are claimed. Keeping track of these dates is essential for businesses to maximize their tax benefits and maintain compliance with IRS regulations.

Quick guide on how to complete pdf form it 605 claim for ez investment tax credit and ez employment

Complete PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

The easiest method to modify and eSign PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment without hassle

- Find PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment and click on Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new printouts. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form it 605 claim for ez investment tax credit and ez employment

Create this form in 5 minutes!

How to create an eSignature for the pdf form it 605 claim for ez investment tax credit and ez employment

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the it 605 feature in airSlate SignNow?

The it 605 feature in airSlate SignNow allows users to easily send and eSign documents electronically. This feature simplifies the signing process, making it efficient and accessible for businesses of all sizes.

-

How much does airSlate SignNow cost for the it 605 plan?

The pricing for the it 605 plan in airSlate SignNow is competitive and tailored to fit various business needs. Customers can choose from several subscription tiers, each offering unique features and advantages at different price points.

-

What benefits does the it 605 solution offer for document signing?

The it 605 solution provides numerous benefits, including faster document turnaround times and increased security. Businesses can streamline workflows, enhance productivity, and ensure compliance with legal standards using airSlate SignNow.

-

Can I integrate airSlate SignNow's it 605 with other applications?

Yes, airSlate SignNow's it 605 can be integrated with various applications, enhancing its functionality. Connect it with CRM systems, file storage solutions, and productivity tools for a seamless experience.

-

Is there a mobile app for the it 605 feature?

Absolutely! The it 605 feature is accessible through the airSlate SignNow mobile app, allowing users to send and eSign documents on the go. This mobility ensures that you can manage your document signing needs anytime, anywhere.

-

How does it 605 ensure the security of my documents?

AirSlate SignNow's it 605 uses advanced security measures such as encryption and two-factor authentication to protect your documents. This ensures that all signed documents maintain a high level of security and confidentiality.

-

What types of documents can I eSign using the it 605 feature?

Using the it 605 feature, you can eSign a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, making it versatile for different business needs.

Get more for PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment

- Quitclaim deed for four individuals to two individuals as joint tenants california form

- Quitclaim deed from husband and wife to four individuals as joint tenants california form

- Quitclaim deed for individual to a trust california form

- California family trust form

- Quitclaim deed for trust to trust california form

- Deed rescission form 497299573

- Quitclaim deed for four individuals to six individuals as tenants in common california form

- Deed of severance template form

Find out other PDF Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online