Form it 605 Claim for EZ Investment Tax Credit and EZ 2020

What is the Form IT 605 Claim For EZ Investment Tax Credit And EZ

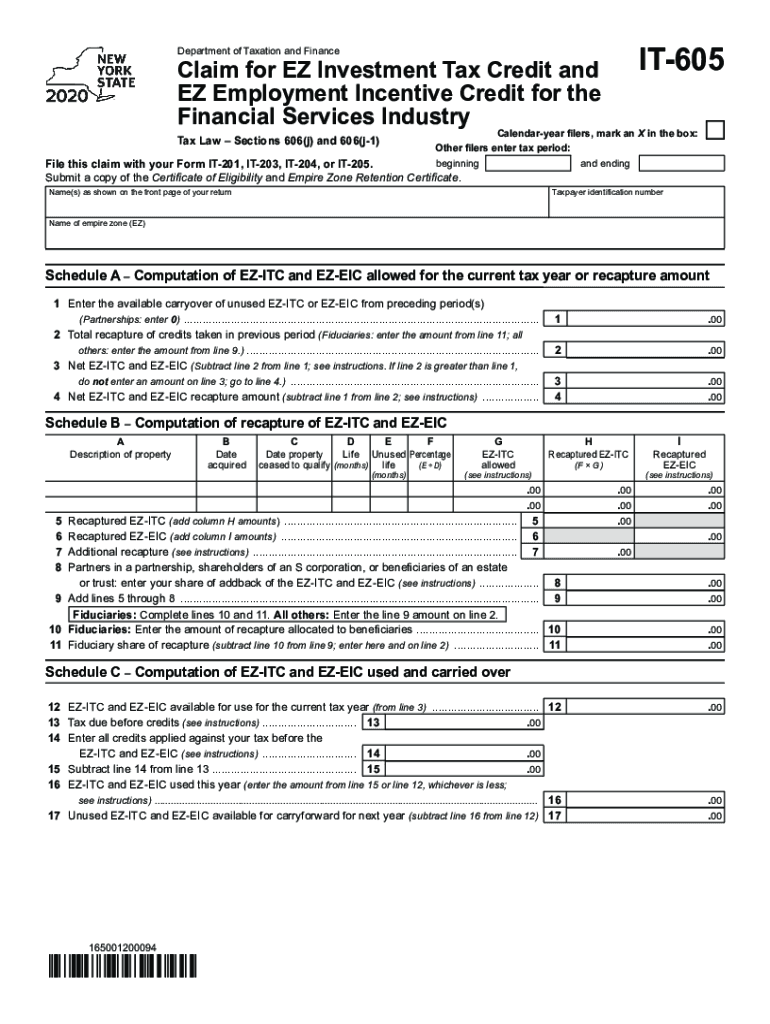

The Form IT 605 Claim For EZ Investment Tax Credit And EZ is a tax document used by eligible businesses in the United States to claim tax credits related to investments in qualified property. This form is specifically designed for entities that meet certain criteria under the EZ Investment Tax Credit program, allowing them to reduce their tax liability significantly. The form captures essential information about the business, the investment made, and the calculations necessary to determine the credit amount.

How to use the Form IT 605 Claim For EZ Investment Tax Credit And EZ

To effectively use the Form IT 605 Claim For EZ Investment Tax Credit And EZ, businesses need to follow a systematic approach. First, ensure that your business qualifies for the EZ Investment Tax Credit by reviewing the eligibility criteria. Next, gather all necessary documentation that supports your claim, including details of the investment and any relevant financial records. Once you have completed the form, you can submit it either electronically or via mail, depending on your preference and the submission guidelines provided by the IRS.

Steps to complete the Form IT 605 Claim For EZ Investment Tax Credit And EZ

Completing the Form IT 605 Claim For EZ Investment Tax Credit And EZ involves several key steps:

- Review the eligibility criteria to ensure your business qualifies for the EZ Investment Tax Credit.

- Gather necessary documentation, including investment details and financial records.

- Fill out the form accurately, ensuring all sections are completed according to the instructions.

- Calculate the tax credit amount based on the investment made.

- Submit the form electronically or via mail, following the IRS guidelines for submission.

Key elements of the Form IT 605 Claim For EZ Investment Tax Credit And EZ

The Form IT 605 includes several key elements that are crucial for a successful claim. These include:

- Business Information: Name, address, and taxpayer identification number.

- Investment Details: Description of the property acquired and the total investment amount.

- Credit Calculation: A detailed breakdown of how the credit is calculated based on the investment.

- Signature Section: Required signatures to validate the claim.

Legal use of the Form IT 605 Claim For EZ Investment Tax Credit And EZ

The legal use of the Form IT 605 Claim For EZ Investment Tax Credit And EZ hinges on compliance with IRS regulations and guidelines. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated time frames. Additionally, the signatures must be valid, and the information provided must be truthful and substantiated with appropriate documentation. Compliance with these legal requirements protects the business from potential penalties and ensures the credit is received.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 605 Claim For EZ Investment Tax Credit And EZ are critical to ensure that businesses do not miss out on potential tax credits. Typically, the form must be submitted by the due date of the tax return for the year in which the investment was made. It is advisable to check the IRS website or consult a tax professional for specific dates and any updates regarding filing deadlines.

Quick guide on how to complete form it 605 claim for ez investment tax credit and ez

Prepare Form IT 605 Claim For EZ Investment Tax Credit And EZ effortlessly on any gadget

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to generate, modify, and eSign your documents swiftly without issues. Manage Form IT 605 Claim For EZ Investment Tax Credit And EZ on any gadget with airSlate SignNow's Android or iOS applications and enhance your document-focused processes today.

How to modify and eSign Form IT 605 Claim For EZ Investment Tax Credit And EZ with ease

- Locate Form IT 605 Claim For EZ Investment Tax Credit And EZ and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form IT 605 Claim For EZ Investment Tax Credit And EZ to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 605 claim for ez investment tax credit and ez

Create this form in 5 minutes!

How to create an eSignature for the form it 605 claim for ez investment tax credit and ez

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Form IT 605 Claim For EZ Investment Tax Credit And EZ?

The Form IT 605 Claim For EZ Investment Tax Credit And EZ is a tax document designed to help eligible taxpayers claim tax credits for certain investments. It streamlines the process for claiming these credits, potentially reducing your tax liability. Understanding this form is essential for ensuring compliance and maximizing your benefits.

-

How can airSlate SignNow help with the Form IT 605 Claim For EZ Investment Tax Credit And EZ?

airSlate SignNow provides a user-friendly platform to electronically sign and send the Form IT 605 Claim For EZ Investment Tax Credit And EZ. This digitization simplifies document management, enabling faster submission and reduces the hassle of paperwork. With airSlate SignNow, you can ensure that your tax documents are signed and sent securely.

-

Is there a cost associated with using airSlate SignNow for the Form IT 605 Claim For EZ Investment Tax Credit And EZ?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, which includes features for handling the Form IT 605 Claim For EZ Investment Tax Credit And EZ. You can choose a plan that fits your budget and provides the necessary tools for efficient document handling. There are also free trials available to help you get started.

-

What features does airSlate SignNow offer for managing the Form IT 605 Claim For EZ Investment Tax Credit And EZ?

airSlate SignNow offers several features that enhance your experience with the Form IT 605 Claim For EZ Investment Tax Credit And EZ. You can easily upload, edit, and customize the form, set signing order, and track document status in real time. These features ensure a smoother and more efficient process overall.

-

Can I integrate airSlate SignNow with other applications for the Form IT 605 Claim For EZ Investment Tax Credit And EZ?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to manage the Form IT 605 Claim For EZ Investment Tax Credit And EZ alongside other tools you use. This makes it easy to streamline processes and maintain a unified workflow. Popular integrations include CRM systems, cloud storage solutions, and more.

-

What benefits come with using airSlate SignNow for the Form IT 605 Claim For EZ Investment Tax Credit And EZ?

Using airSlate SignNow for the Form IT 605 Claim For EZ Investment Tax Credit And EZ provides numerous benefits. You can save time, reduce paper usage, and enhance security for your important tax documents. Additionally, it simplifies collaboration and ensures that all signers can access the necessary information easily.

-

Is airSlate SignNow compliant with regulations for the Form IT 605 Claim For EZ Investment Tax Credit And EZ?

Yes, airSlate SignNow is compliant with legal and regulatory requirements, ensuring that your use of the Form IT 605 Claim For EZ Investment Tax Credit And EZ meets industry standards. Our platform uses advanced encryption and security protocols to protect your data. You can confidently rely on airSlate SignNow for compliance and security.

Get more for Form IT 605 Claim For EZ Investment Tax Credit And EZ

- Fillable online retail laundry self certification nycgov fax form

- Multiple worksite report bls 3020 bureau of labor statistics form

- Application for voluntary election form uc 6 alabama

- Unemployment 502 form

- Dws ark 502 rb dws arkansas form

- Edd rancho cordova form

- Human resources el dorado county form

- Victorville transit form

Find out other Form IT 605 Claim For EZ Investment Tax Credit And EZ

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement