Form it 605 Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit for the Financial Services Industry Tax Year 2023

Understanding the Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

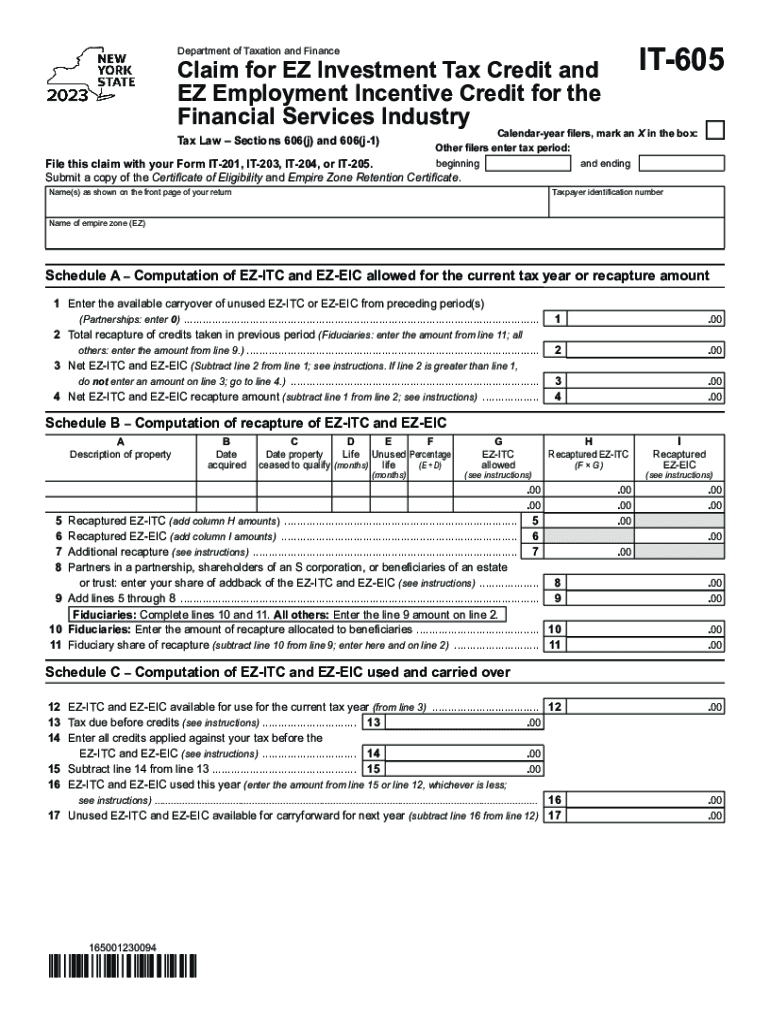

The Form IT 605 is specifically designed for businesses in the financial services industry to claim the EZ Investment Tax Credit and the EZ Employment Incentive Credit. This form allows eligible companies to receive tax benefits that can significantly reduce their tax liability. The EZ Investment Tax Credit incentivizes investments in qualified property, while the EZ Employment Incentive Credit rewards businesses for hiring and retaining employees. Understanding the purpose of this form is crucial for maximizing potential tax savings.

How to Complete the Form IT 605

Filling out the Form IT 605 requires careful attention to detail. Start by gathering all necessary financial documents, including records of investments and employee information. The form consists of sections that require specific data, such as business identification, the type of credits being claimed, and the amounts. Each section must be completed accurately to avoid delays or rejections. Ensure that all calculations are verified, and consider consulting a tax professional if needed to ensure compliance with IRS guidelines.

Eligibility Criteria for the Form IT 605

To qualify for the EZ Investment Tax Credit and EZ Employment Incentive Credit, businesses must meet specific eligibility criteria. Generally, the business must operate within the financial services industry and demonstrate a commitment to investing in qualified property or hiring eligible employees. Additionally, there may be state-specific requirements that need to be fulfilled. Businesses should review these criteria thoroughly to ensure they qualify before submitting the form.

Required Documents for Submission

Completing the Form IT 605 necessitates several supporting documents to validate the claims made. Required documents typically include proof of investment in qualified property, payroll records for employees, and any other relevant financial statements. It is essential to keep these documents organized and readily accessible, as they may be requested by tax authorities during an audit. Having comprehensive documentation will facilitate a smoother application process.

Filing Deadlines for Form IT 605

Timely submission of the Form IT 605 is critical to ensure that businesses can take advantage of the tax credits. The filing deadlines may vary based on the tax year and specific state regulations. Generally, forms must be submitted by the tax filing deadline for the respective year, which is typically April 15 for most businesses. It is advisable to keep track of these dates and plan submissions accordingly to avoid penalties.

Form Submission Methods

Businesses have several options for submitting the Form IT 605. The form can be filed electronically through approved tax software, which may streamline the process and reduce errors. Alternatively, businesses can submit the form via mail or in person, depending on local regulations. Each method has its own advantages, so it is important to choose the one that best fits the needs of the business while ensuring compliance with submission guidelines.

IRS Guidelines for Form IT 605

Adhering to IRS guidelines is essential when completing and submitting the Form IT 605. The IRS provides specific instructions regarding eligibility, required documentation, and filing procedures. Businesses should familiarize themselves with these guidelines to ensure compliance and avoid potential issues. Regular updates from the IRS regarding tax credits and forms should also be monitored to stay informed of any changes that may affect the filing process.

Quick guide on how to complete form it 605 claim for ez investment tax credit and ez employment incentive credit for the financial services industry tax year

Complete Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year with ease

- Locate Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, either by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choosing. Alter and electronically sign Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 605 claim for ez investment tax credit and ez employment incentive credit for the financial services industry tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 605 claim for ez investment tax credit and ez employment incentive credit for the financial services industry tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year?

Form IT 605 is a tax form used by businesses in the financial services industry to claim the EZ Investment Tax Credit and the EZ Employment Incentive Credit for a specific tax year. This form helps businesses benefit from potential tax credits designed to encourage investment and employment in qualifying sectors. By accurately completing this form, businesses can maximize their tax savings.

-

How can airSlate SignNow assist with the completion of Form IT 605?

airSlate SignNow provides an easy-to-use platform that enables users to fill out and eSign Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year efficiently. Our platform simplifies the document management process, ensuring that the form is completed accurately and submitted on time. Additionally, the electronic signature feature streamlines getting necessary approvals.

-

Is there a cost associated with using airSlate SignNow for Form IT 605?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for completing Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year. Our subscription plans provide you access to essential features, ensuring you get great value while managing your documents. Check our pricing page for the most suitable plan for your business.

-

What features does airSlate SignNow offer for managing tax forms like Form IT 605?

airSlate SignNow provides several features that are beneficial for managing tax forms such as Form IT 605. These include document templates, collaboration tools, and robust security measures to protect sensitive data. Additionally, the platform allows you to track the status of your documents, ensuring a smooth workflow from preparation to submission.

-

Can I integrate airSlate SignNow with other software for managing Form IT 605?

Absolutely! airSlate SignNow offers integrations with various third-party applications, enabling seamless data transfer when working on Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year. This ensures that you can synchronize your data with existing accounting or customer relationship management systems, making it easier to manage financial documentation efficiently.

-

What benefits does airSlate SignNow provide for businesses completing Form IT 605?

Using airSlate SignNow for completing Form IT 605 delivers numerous benefits, including enhanced efficiency and accuracy in document handling. The platform's user-friendly interface allows for quick completion of forms and easy signing, which can signNowly reduce turnaround time. Furthermore, eSigning eliminates the need for printing, scanning, and mailing documents, cutting down unnecessary costs and delays.

-

Is airSlate SignNow compliant with legal regulations for electronic signatures on Form IT 605?

Yes, airSlate SignNow ensures compliance with electronic signature laws, making it a secure option for signing Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year. The platform adheres to regulations such as the ESIGN Act and UETA, ensuring that your electronically signed documents are legally binding and valid in court if needed.

Get more for Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

- Oda lucs form

- Oregon replacement fillable form birth certificate

- Oregon advance directive form

- 2 130 1 form

- Fillabe oregon request to energize an electrical form

- 1 of 1 standard boat slip rental agreement form

- Texas homestead exemption explained how to fill out form

- Form bb 1 rev state of hawaii basic business application

Find out other Form IT 605 Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit For The Financial Services Industry Tax Year

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template