Form it 112 R New York State Resident Credit Tax Year 2021

What is the Form IT 112 R New York State Resident Credit Tax Year

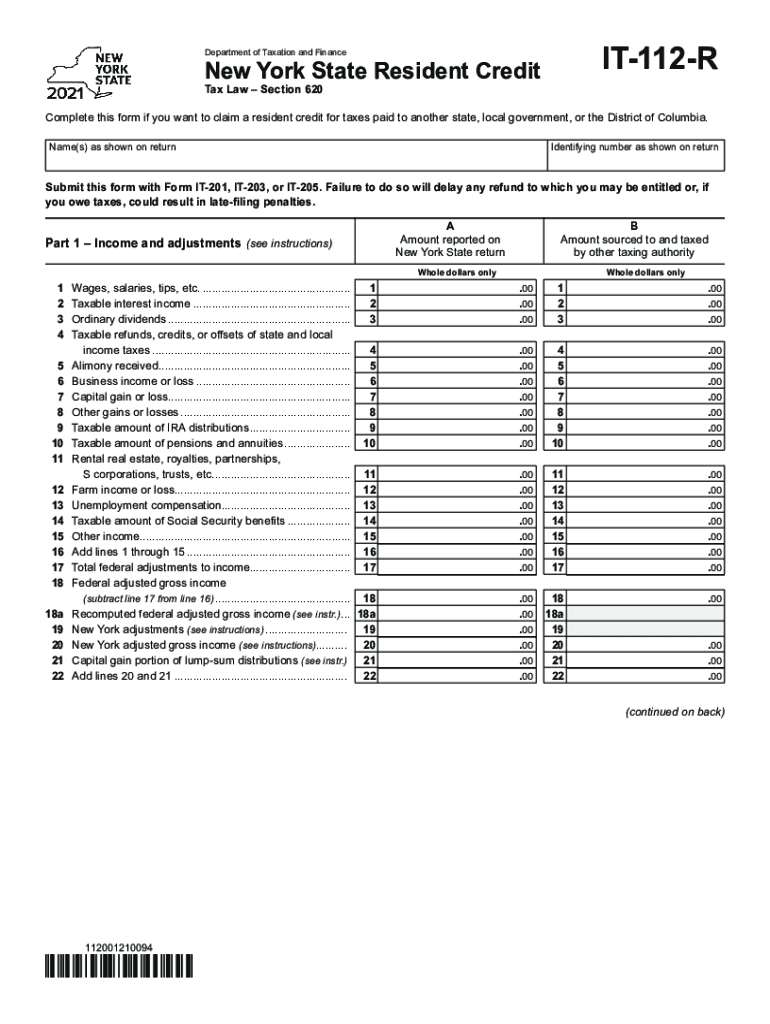

The Form IT 112 R is designed for New York State residents to claim a credit for taxes paid to other jurisdictions. This form is essential for individuals who have earned income in other states while being residents of New York. By filing this form, taxpayers can reduce their New York State tax liability, ensuring they are not taxed twice on the same income. The IT 112 R is specifically tailored for the tax year and must be filled out accurately to reflect the taxpayer's financial situation.

Steps to complete the Form IT 112 R New York State Resident Credit Tax Year

Completing the Form IT 112 R involves several key steps:

- Gather necessary documentation, including W-2 forms and any tax returns from other states.

- Fill out personal information, including your name, address, and Social Security number.

- Report the total income earned in other jurisdictions and the amount of tax paid to those states.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal use of the Form IT 112 R New York State Resident Credit Tax Year

The Form IT 112 R is legally recognized as a valid document for claiming tax credits in New York State. To ensure its legal standing, it must be completed in accordance with New York State tax laws. This includes adhering to the guidelines set forth by the New York State Department of Taxation and Finance. Properly executed, the form provides a legal basis for taxpayers to claim credits, reducing potential tax liabilities.

Eligibility Criteria for the Form IT 112 R New York State Resident Credit Tax Year

To qualify for the Form IT 112 R, taxpayers must meet specific eligibility criteria:

- Must be a resident of New York State for the entire tax year.

- Must have earned income in another state or jurisdiction.

- Must have paid income taxes to that other state.

- Must not be claiming the same income for tax credits in multiple jurisdictions.

Required Documents for the Form IT 112 R New York State Resident Credit Tax Year

When completing the Form IT 112 R, taxpayers should have the following documents ready:

- W-2 forms from all employers, indicating income earned.

- Tax returns from other states where income was earned.

- Documentation of taxes paid to those states, such as payment receipts or tax assessments.

- Any additional forms that may support the claim for credits.

Filing Deadlines / Important Dates for the Form IT 112 R New York State Resident Credit Tax Year

It is crucial to be aware of the filing deadlines for the Form IT 112 R. Typically, the form must be submitted by the same deadline as the New York State personal income tax return. For most taxpayers, this is April 15 of the following year. However, if the deadline falls on a weekend or holiday, it may be extended. Taxpayers should always verify the exact dates for the specific tax year they are filing for.

Quick guide on how to complete form it 112 r new york state resident credit tax year 2020

Complete Form IT 112 R New York State Resident Credit Tax Year effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly replacement to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form IT 112 R New York State Resident Credit Tax Year on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Form IT 112 R New York State Resident Credit Tax Year with ease

- Obtain Form IT 112 R New York State Resident Credit Tax Year and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Edit and eSign Form IT 112 R New York State Resident Credit Tax Year and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 112 r new york state resident credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 112 r new york state resident credit tax year 2020

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the it 112 r feature offered by airSlate SignNow?

The it 112 r feature in airSlate SignNow allows businesses to streamline the signing process for important documents. This functionality enhances efficiency, ensuring that your documents are signed quickly and securely. With it 112 r, you can manage all your signing needs in one place.

-

How does airSlate SignNow's it 112 r compare to other eSignature solutions?

airSlate SignNow's it 112 r stands out due to its user-friendly interface and competitive pricing. Unlike many other eSignature solutions, it provides an intuitive experience that simplifies the signing process for both businesses and their clients. The flexibility of it 112 r allows for seamless integration into existing workflows.

-

What are the pricing options for airSlate SignNow's it 112 r?

airSlate SignNow offers several pricing tiers for its it 112 r feature, catering to businesses of all sizes. Pricing is structured to provide value, ensuring access to advanced features without overwhelming costs. You can choose from monthly or annual plans to fit your budget and needs.

-

Can I integrate airSlate SignNow's it 112 r with other software?

Yes, airSlate SignNow's it 112 r is designed to integrate seamlessly with various other software platforms. This includes CRM systems, document management tools, and productivity applications. The easy integration capabilities allow businesses to enhance their existing workflows without disruption.

-

What benefits does using it 112 r provide for my business?

Utilizing airSlate SignNow's it 112 r can signNowly improve your business's efficiency and productivity. With faster document turnaround times and enhanced security, your team can focus on core activities rather than managing paperwork. Additionally, it helps ensure compliance and reduces the risk of errors.

-

Is it 112 r suitable for small businesses?

Absolutely! The it 112 r feature is tailored for businesses of all sizes, including small businesses. It provides an affordable solution to manage eSignatures effectively, helping small businesses maintain a professional edge without excessive costs.

-

How does airSlate SignNow ensure the security of documents signed with it 112 r?

airSlate SignNow prioritizes document security with its it 112 r feature by employing robust encryption protocols. This ensures that all signed documents are secure and protected from unauthorized access. The platform also complies with legal standards to guarantee the integrity of the signing process.

Get more for Form IT 112 R New York State Resident Credit Tax Year

Find out other Form IT 112 R New York State Resident Credit Tax Year

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure