it 112 R 2020

What is the IT-112-R?

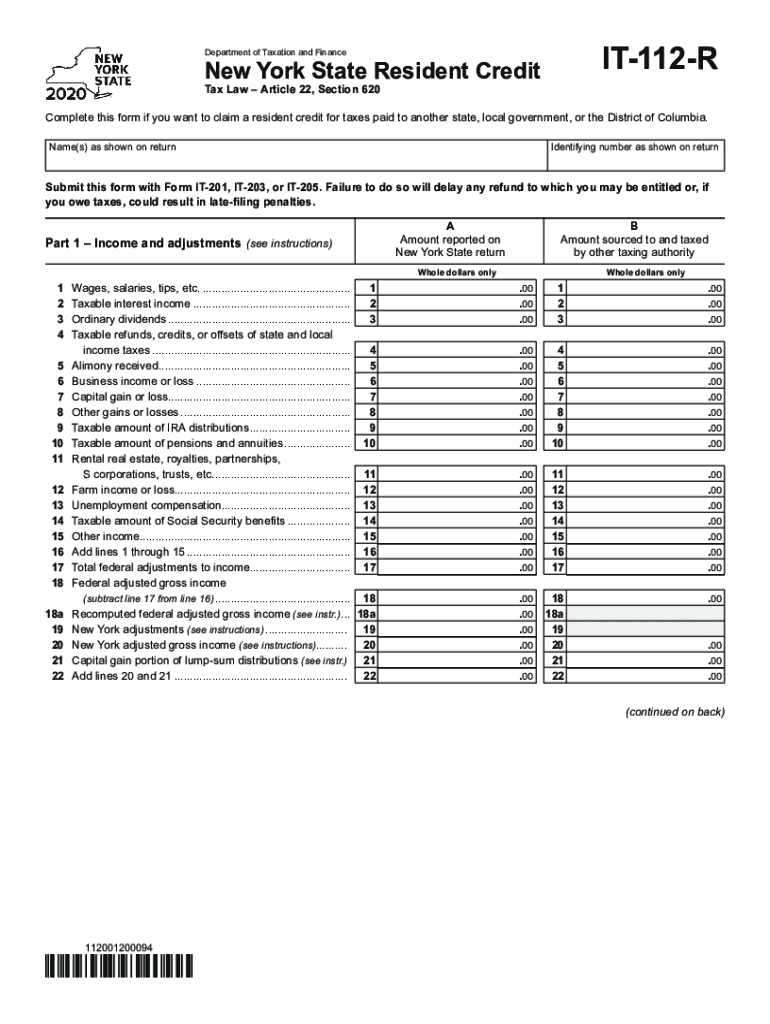

The IT-112-R is a tax form used in the United States, specifically for claiming a credit for taxes paid to New York City. This form is essential for residents who have paid taxes to the city and wish to receive a refund or credit. The IT-112-R allows taxpayers to report their income, deductions, and the amount of tax paid, ensuring they receive the appropriate credits based on their financial situation.

How to Use the IT-112-R

Using the IT-112-R involves filling out the form with accurate information regarding your income and tax payments. First, gather all necessary documents, such as your W-2 forms and any documentation related to your New York City taxes. Next, accurately complete the form by entering your personal information, total income, and tax details. Finally, submit the completed form to the appropriate tax authority, either electronically or via mail, to ensure you receive your credit or refund.

Steps to Complete the IT-112-R

Completing the IT-112-R requires careful attention to detail. Follow these steps:

- Gather all relevant tax documents, including W-2s and proof of NYC tax payments.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and any deductions you qualify for.

- Calculate the total amount of taxes paid to New York City.

- Complete the section for claiming your credit based on the taxes paid.

- Review the form for accuracy before submission.

Legal Use of the IT-112-R

The IT-112-R must be completed and submitted in compliance with relevant tax laws. It is legally binding, meaning that inaccuracies or omissions can lead to penalties or denial of credits. To ensure compliance, it is advisable to follow the guidelines set forth by the New York State Department of Taxation and Finance. Utilizing a reliable eSignature platform can also enhance the legal standing of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the IT-112-R are typically aligned with the annual tax filing season. Taxpayers should be aware of the specific dates for submission to avoid late penalties. Generally, the deadline for filing personal income tax returns, including the IT-112-R, falls on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Required Documents

To complete the IT-112-R, you will need several documents, including:

- W-2 forms from employers showing income and tax withheld.

- Any additional forms related to income, such as 1099s.

- Documentation of taxes paid to New York City.

- Proof of deductions you are claiming.

Form Submission Methods

The IT-112-R can be submitted through various methods to accommodate different preferences. Taxpayers can file the form electronically using approved e-filing services, which often provide a faster processing time. Alternatively, the form can be mailed directly to the appropriate tax authority. In-person submissions may also be possible at designated tax offices, providing another option for those who prefer face-to-face assistance.

Quick guide on how to complete it 112 r

Complete It 112 R effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents swiftly without any holdups. Manage It 112 R on any platform with airSlate SignNow's Android or iOS applications, and simplify any document-related task today.

The easiest way to modify and eSign It 112 R with minimal effort

- Find It 112 R and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign It 112 R and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 112 r

Create this form in 5 minutes!

How to create an eSignature for the it 112 r

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the primary function of airSlate SignNow for IT 112 R?

airSlate SignNow is designed to streamline the document signing process for IT 112 R, enabling users to send, sign, and manage documents effortlessly. Its easy-to-use interface helps businesses reduce paperwork and improve workflow efficiency. By adopting airSlate SignNow, organizations can save time and improve the accuracy of their document handling.

-

How does airSlate SignNow benefit businesses dealing with IT 112 R documentation?

By using airSlate SignNow for IT 112 R documentation, businesses can ensure their contracts and agreements are signed quickly and securely. The platform integrates advanced security features that protect sensitive information while providing a legally binding eSignature. This leads to faster turnaround times and enhances customer trust.

-

What pricing plans does airSlate SignNow offer for users needing IT 112 R solutions?

airSlate SignNow provides various pricing plans tailored to different business needs, making it suitable for managing IT 112 R documents. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to all essential features. Free trials are also available to help you evaluate the service before commitment.

-

Does airSlate SignNow support integration with other tools for IT 112 R processes?

Yes, airSlate SignNow seamlessly integrates with a variety of tools, making it easier to incorporate IT 112 R processes into your existing workflows. This includes CRM systems, productivity tools, and cloud storage services, enhancing operational efficiency. The integration capabilities can help automate processes and improve data consistency across platforms.

-

What security measures does airSlate SignNow implement for IT 112 R documentation?

airSlate SignNow ensures the highest level of security for IT 112 R documentation with encryption, multi-factor authentication, and compliance with major standards. These features protect your documents from unauthorized access while maintaining their integrity. You can rest assured that your sensitive information remains safe throughout the signing process.

-

Can airSlate SignNow handle high volumes of IT 112 R transactions?

Absolutely! airSlate SignNow is built to efficiently manage high volumes of document transactions related to IT 112 R. Its robust infrastructure allows for quick processing and signing, enabling businesses to handle multiple documents simultaneously without delays. This scalability makes it an ideal choice for organizations experiencing rapid growth.

-

Is training required to use airSlate SignNow for IT 112 R?

No extensive training is required to use airSlate SignNow for IT 112 R. The platform is user-friendly, and most users can easily navigate through its features without prior experience. However, airSlate also offers resources and support to assist users in maximizing the benefits of the software.

Get more for It 112 R

- Nominating petition township office ohio secretary of state sos state oh form

- Odjfs 07120 form

- Edchoice scholarship program print form income cincinnatiwaldorfschool

- Ohio department of jobs and family services residential state supplement form

- Student shadow application cuyahoga county medical form

- 3 r prescribed by the ohio secretary of state 09 17 form

- Pdf claim form instructions ohio department of commerce ohiogov

- Ohio nursery license form

Find out other It 112 R

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free