DOR Use Tax Wisconsin Department of Revenue 2022

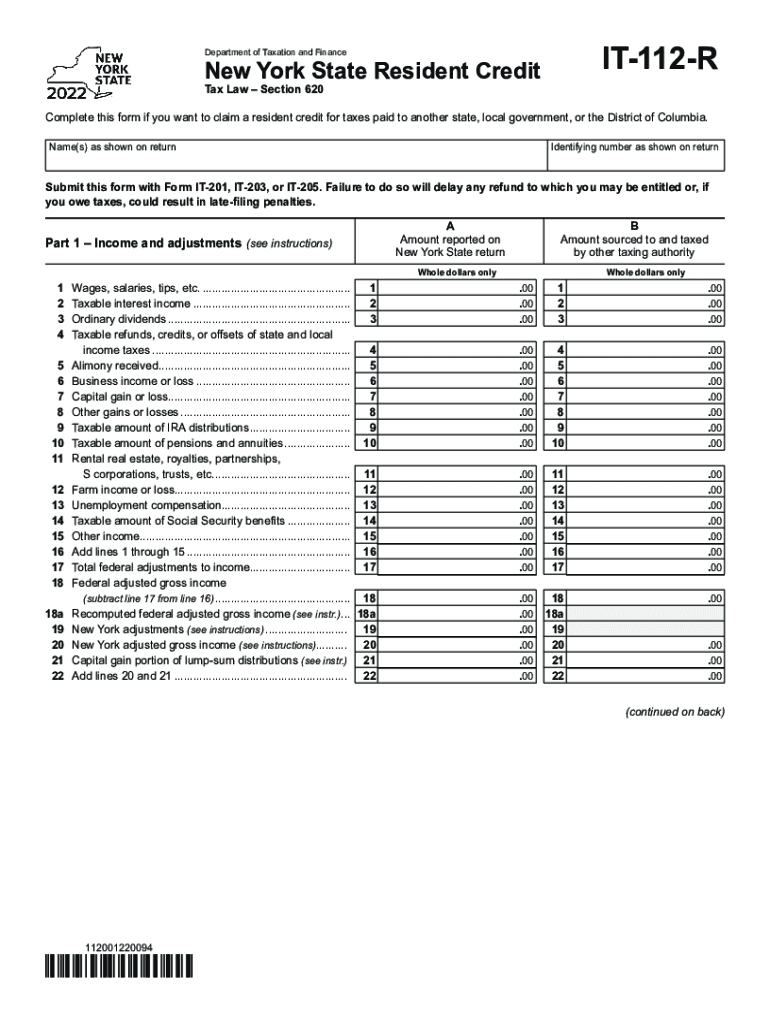

What is the New York IT-112-R Form?

The New York IT-112-R form is a resident credit form used by individuals to claim a credit for taxes paid to other jurisdictions. This form is particularly relevant for residents of New York who have income that is subject to taxation in more than one state. By filing the IT-112-R, taxpayers can reduce their New York State tax liability based on the taxes they have already paid to other states, ensuring they are not taxed twice on the same income.

Steps to Complete the New York IT-112-R Form

Completing the New York IT-112-R form involves several key steps:

- Gather necessary documents, including your federal tax return and any state tax returns from other jurisdictions where you paid taxes.

- Fill out the personal information section, ensuring all details are accurate and up-to-date.

- Calculate the amount of taxes paid to other states and enter this information in the designated sections.

- Complete the calculations to determine your credit amount, following the instructions provided with the form.

- Review the form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Required Documents for Filing the IT-112-R Form

When filing the IT-112-R form, it is essential to have the following documents ready:

- Your federal tax return (Form 1040 or equivalent).

- State tax returns from any other states where you paid income taxes.

- W-2 forms and any other income documentation that supports your earnings.

- Proof of taxes paid to other jurisdictions, such as tax payment receipts or statements.

Filing Deadlines for the IT-112-R Form

The New York IT-112-R form must be filed by the tax deadline for the corresponding tax year. Typically, this deadline aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any updates or changes to the filing schedule each year.

Penalties for Non-Compliance with the IT-112-R Form

Failing to file the IT-112-R form or providing inaccurate information can lead to penalties from the New York State Department of Taxation and Finance. Potential consequences include:

- Late filing penalties, which can accumulate if the form is not submitted by the deadline.

- Interest on any unpaid taxes that may arise from incorrect calculations.

- Increased scrutiny from tax authorities, which may lead to audits or further investigations.

Eligibility Criteria for the IT-112-R Form

To be eligible to file the New York IT-112-R form, taxpayers must meet specific criteria:

- Must be a resident of New York State for the entire tax year.

- Must have income that is subject to taxation in New York and at least one other state.

- Must have paid taxes to another jurisdiction, which can be documented through state tax returns.

Quick guide on how to complete dor use tax wisconsin department of revenue

Effortlessly Prepare DOR Use Tax Wisconsin Department Of Revenue on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage DOR Use Tax Wisconsin Department Of Revenue on any device through the airSlate SignNow applications for Android or iOS, and simplify your document-related tasks today.

How to Modify and Electronically Sign DOR Use Tax Wisconsin Department Of Revenue with Ease

- Obtain DOR Use Tax Wisconsin Department Of Revenue and click on Get Form to begin the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically supplies for that aim.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious searches for forms, or errors that necessitate reprinting. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign DOR Use Tax Wisconsin Department Of Revenue while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor use tax wisconsin department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dor use tax wisconsin department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 112 r?

airSlate SignNow is an efficient eSignature solution that allows businesses to send and sign documents seamlessly. The connection to it 112 r lies in its ability to streamline the documentation process, ensuring compliance and quick turnaround times for various forms and agreements.

-

How does airSlate SignNow pricing for it 112 r work?

airSlate SignNow offers competitive pricing plans that cater to businesses looking for an efficient solution for handling it 112 r forms. Various subscription tiers are available, allowing users to select a plan that meets their volume and feature needs without compromising on quality or functionality.

-

What features does airSlate SignNow provide for it 112 r document management?

The airSlate SignNow platform boasts several features specifically tailored for it 112 r document management, such as advanced security measures, customizable templates, and automated workflows. These features enable users to create, send, and securely store their documents while ensuring compliance with relevant regulations.

-

What are the benefits of using airSlate SignNow for it 112 r?

Using airSlate SignNow for it 112 r brings numerous benefits, including enhanced efficiency and cost savings. By digitizing the signing process, businesses can reduce turnaround times and improve overall productivity, making it easier to manage important transactions and paperwork.

-

Can airSlate SignNow integrate with other software for it 112 r management?

Yes, airSlate SignNow can easily integrate with a variety of software applications that support it 112 r form management. This capability allows businesses to streamline their existing workflows, ensuring that they can manage their documents more effectively across their tech stack.

-

How secure is airSlate SignNow when handling it 112 r documents?

airSlate SignNow prioritizes security, employing multiple measures to protect it 112 r documents during transmission and storage. With features like encryption, audit trails, and user authentication, businesses can trust that their sensitive information is kept safe from unauthorized access.

-

Is airSlate SignNow user-friendly for those managing it 112 r forms?

Absolutely! airSlate SignNow is designed to be intuitive, allowing users to easily navigate the platform, even if they are not tech-savvy. This user-friendly interface means that businesses can adopt it 112 r solutions quickly without extensive training.

Get more for DOR Use Tax Wisconsin Department Of Revenue

- South dakota ucc3 financing statement amendment addendum south dakota form

- Legal last will and testament form for single person with no children south dakota

- Legal last will and testament form for a single person with minor children south dakota

- Legal last will and testament form for single person with adult and minor children south dakota

- Legal last will and testament form for single person with adult children south dakota

- Legal last will and testament for married person with minor children from prior marriage south dakota form

- Legal last will and testament form for married person with adult children from prior marriage south dakota

- Legal last will and testament form for divorced person not remarried with adult children south dakota

Find out other DOR Use Tax Wisconsin Department Of Revenue

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online