Form it 112 R New York State Resident Credit Tax Year 2024-2026

What is the Form IT 112 R New York State Resident Credit Tax Year

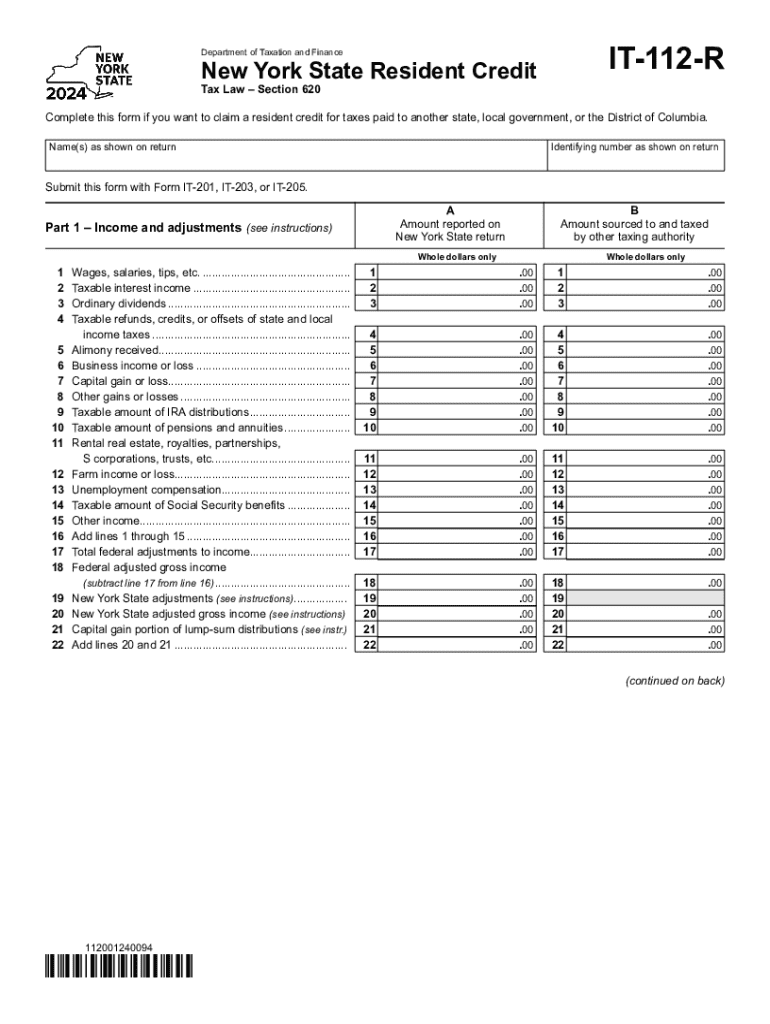

The Form IT 112 R is a tax form used by residents of New York State to claim a credit for taxes paid to other jurisdictions. This form is specifically designed for individuals who have income that is taxed by both New York State and another state or local jurisdiction. The credit helps to alleviate the burden of double taxation, ensuring that taxpayers do not pay taxes on the same income in multiple places. The IT 112 R form is applicable for the tax year 2024 and is essential for accurate tax reporting and compliance.

How to use the Form IT 112 R New York State Resident Credit Tax Year

To effectively use the IT 112 R form, taxpayers need to gather relevant information about their income and the taxes paid to other jurisdictions. The form requires details such as the amount of income earned outside of New York and the taxes paid to those jurisdictions. Once this information is collected, taxpayers can fill out the form, ensuring that they accurately report their income and the corresponding credits they are eligible for. After completing the form, it should be submitted along with the New York State tax return to ensure that the credit is applied correctly.

Steps to complete the Form IT 112 R New York State Resident Credit Tax Year

Completing the IT 112 R form involves several key steps:

- Gather necessary documents, including W-2s and 1099s that reflect income earned in other states.

- Determine the amount of taxes paid to other jurisdictions based on your income.

- Fill out the IT 112 R form, providing accurate information about your income and taxes.

- Calculate the credit amount based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

- Submit the form along with your New York State tax return by the designated deadline.

Eligibility Criteria for the Form IT 112 R New York State Resident Credit Tax Year

To be eligible to use the IT 112 R form, taxpayers must meet specific criteria. They must be residents of New York State for the entire tax year and have income that is subject to taxation in both New York and another jurisdiction. Additionally, the taxes paid to the other jurisdiction must be eligible for credit under New York State law. Taxpayers should ensure they have documentation of the taxes paid to other jurisdictions to support their claim for the credit.

Filing Deadlines / Important Dates

The filing deadline for the IT 112 R form coincides with the general tax filing deadline for New York State residents. Typically, this is April fifteenth of the following year. Taxpayers should be aware of any changes to the deadline that may occur, especially in light of any extensions or special circumstances that may arise. It is crucial to submit the form on time to avoid penalties and ensure the credit is applied to the tax return.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the IT 112 R form through various methods. The form can be filed online using approved tax software that supports New York State tax forms. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate tax authority. In-person submission is also an option at designated tax offices, although this method may require an appointment. Each submission method has its own processing times, so taxpayers should select the one that best fits their needs.

Create this form in 5 minutes or less

Find and fill out the correct form it 112 r new york state resident credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 112 r new york state resident credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 it 112r and how does it benefit my business?

The 2024 it 112r is a comprehensive eSignature solution that streamlines document management for businesses. By utilizing airSlate SignNow, you can easily send, sign, and manage documents, enhancing efficiency and reducing turnaround times. This tool is designed to empower your team with a user-friendly interface and robust features.

-

How much does the 2024 it 112r cost?

The pricing for the 2024 it 112r varies based on the plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes, ensuring you get the best value for your investment. You can explore our pricing page for detailed information on each plan.

-

What features are included in the 2024 it 112r?

The 2024 it 112r includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document workflow and ensure compliance with legal standards. With airSlate SignNow, you can also integrate with other tools to further streamline your processes.

-

Can the 2024 it 112r integrate with other software?

Yes, the 2024 it 112r seamlessly integrates with various software applications, including CRM systems and cloud storage services. This integration capability allows you to enhance your existing workflows and improve overall productivity. airSlate SignNow supports numerous integrations to fit your business needs.

-

Is the 2024 it 112r secure for sensitive documents?

Absolutely, the 2024 it 112r prioritizes security with advanced encryption and compliance with industry standards. airSlate SignNow ensures that your sensitive documents are protected throughout the signing process. You can trust that your data is safe and secure with our platform.

-

How does the 2024 it 112r improve document turnaround times?

The 2024 it 112r signNowly improves document turnaround times by allowing users to send and sign documents electronically. This eliminates the delays associated with traditional paper-based processes. With airSlate SignNow, you can expect faster approvals and quicker access to completed documents.

-

What support options are available for the 2024 it 112r?

For the 2024 it 112r, airSlate SignNow offers various support options, including live chat, email support, and a comprehensive knowledge base. Our dedicated support team is ready to assist you with any questions or issues you may encounter. We aim to ensure a smooth experience for all users.

Get more for Form IT 112 R New York State Resident Credit Tax Year

- G4s application form pdf 27457385

- Personal financial strategy mastery team form

- Yabatech student id card form

- Ultrasonic testing report form

- Sprinter credit application form

- Trade secret license agreement template form

- Trade secrets non disclosure agreement template form

- Trade union recognition agreement template form

Find out other Form IT 112 R New York State Resident Credit Tax Year

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement