K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate or Trust the Fiduciary of a Resident Estate or Trust Must File a Kansa 2021

Understanding the K-41 Fiduciary Income Tax Return

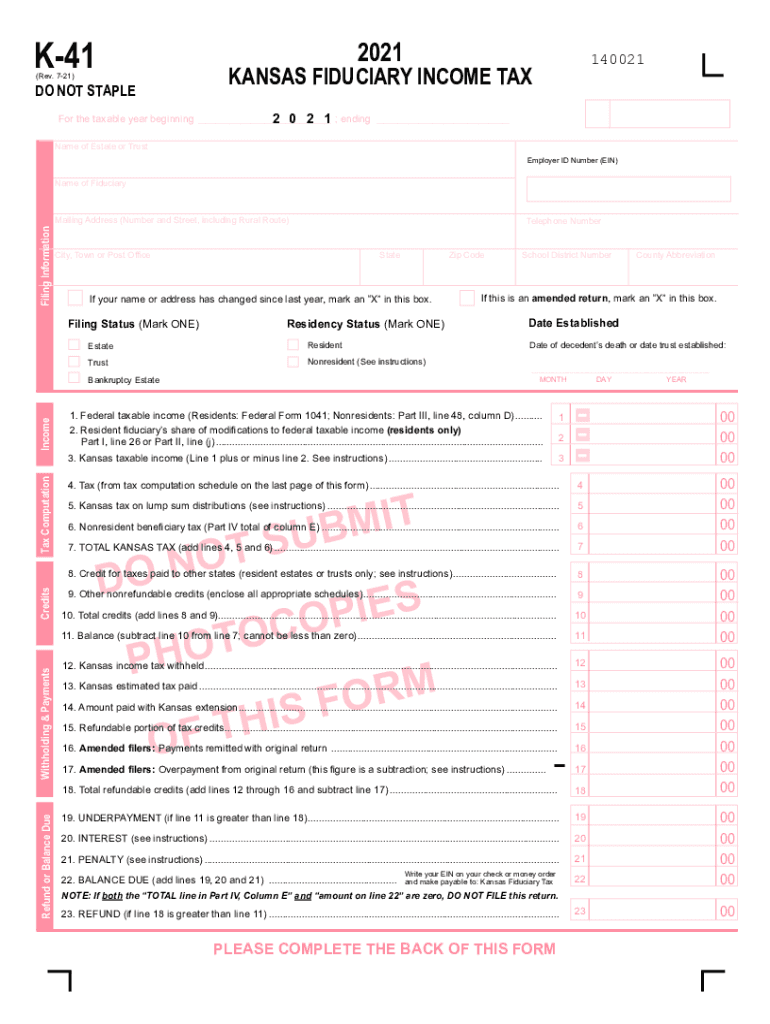

The K-41 Fiduciary Income Tax Return is a crucial document for the fiduciary of a resident estate or trust in Kansas. This form must be filed if the estate or trust has any taxable income or if there is withholding tax due. It serves to report the income, deductions, and credits associated with the estate or trust, ensuring compliance with state tax regulations.

Steps to Complete the K-41 Fiduciary Income Tax Return

Completing the K-41 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the K-41 form accurately, ensuring all income and deductions are reported.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline to avoid penalties.

Legal Use of the K-41 Fiduciary Income Tax Return

The K-41 is legally binding and must be completed in accordance with Kansas tax laws. The fiduciary is responsible for ensuring that the form is filled out correctly and submitted on time. Failure to comply with these legal requirements can result in penalties and interest on any unpaid taxes.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the K-41. Typically, the form is due on April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended. Keeping track of these dates helps ensure timely submission and compliance with state tax laws.

Required Documents for the K-41 Filing

To complete the K-41, several documents are necessary:

- Income statements for the estate or trust.

- Records of deductible expenses.

- Any relevant tax documents that pertain to withholding or credits.

Penalties for Non-Compliance

Non-compliance with K-41 filing requirements can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for fiduciaries to understand their obligations and ensure that the K-41 is filed accurately and on time to avoid these consequences.

Quick guide on how to complete k 41 fiduciary income tax return rev 7 21 resident estate or trust the fiduciary of a resident estate or trust must file a

Effortlessly Prepare K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Modify and eSign K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa with Ease

- Locate K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 41 fiduciary income tax return rev 7 21 resident estate or trust the fiduciary of a resident estate or trust must file a

Create this form in 5 minutes!

How to create an eSignature for the k 41 fiduciary income tax return rev 7 21 resident estate or trust the fiduciary of a resident estate or trust must file a

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the k 41 feature offered by airSlate SignNow?

The k 41 feature in airSlate SignNow streamlines the eSigning process, allowing businesses to send documents quickly and securely. This feature enhances the overall user experience by offering real-time status updates, making it easier to manage transactions. With k 41, you can ensure that important documents are signed and returned efficiently.

-

How much does airSlate SignNow with k 41 cost?

Pricing for airSlate SignNow's k 41 feature is competitive and tailored to fit various business needs. Plans typically start with a basic subscription that includes access to essential eSigning functionalities. Additional pricing options are available for businesses seeking advanced features, providing great value for the capabilities offered.

-

What benefits does k 41 provide for businesses?

The k 41 functionality within airSlate SignNow offers several key benefits, including increased efficiency and reduced turnaround time on document approvals. By simplifying the eSigning process, businesses can improve customer satisfaction and foster quicker decision-making. Additionally, k 41 ensures compliance and security throughout the eSigning workflow.

-

How can I integrate k 41 with other software tools?

Integrating k 41 with other software tools is seamless with airSlate SignNow. The platform supports a variety of integrations, enabling businesses to connect their existing systems for enhanced workflow efficiency. Whether you're using CRM software or cloud storage services, k 41 works in harmony with your tech stack to streamline processes.

-

Is k 41 suitable for all business sizes?

Yes, the k 41 feature in airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises. Its scalable nature allows organizations to customize their eSigning experience based on specific needs. Regardless of your business size, k 41 can enhance document management and signing efficiency.

-

How does k 41 improve document security?

K 41 enhances document security by incorporating advanced encryption and authentication measures within the airSlate SignNow platform. This ensures that sensitive documents are securely transmitted and stored. Additionally, businesses can retain full control over access and permissions, further safeguarding their valuable information.

-

Can k 41 help reduce paper usage in our business?

Absolutely! Utilizing the k 41 feature in airSlate SignNow directly contributes to reducing paper usage by transitioning to a completely digital signing process. This not only saves costs associated with paper and printing but also supports eco-friendly initiatives within your business. By adopting k 41, you can contribute to a greener planet while increasing efficiency.

Get more for K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa

- Colorado lis pendens form

- Demand of supplier of materials machinery tools laborers or services for information regarding owner disburser and principal

- Co llc 497299962 form

- Response to demand of supplier of materials machinery tools laborers or services for information regarding owner disburser and

- Response to demand of supplier of materials machinery tools laborers or services for information regarding owner disburser and 497299964

- Notice disburser form

- Colorado corporation llc 497299966 form

- Lien statement form

Find out other K 41 Fiduciary Income Tax Return Rev 7 21 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement