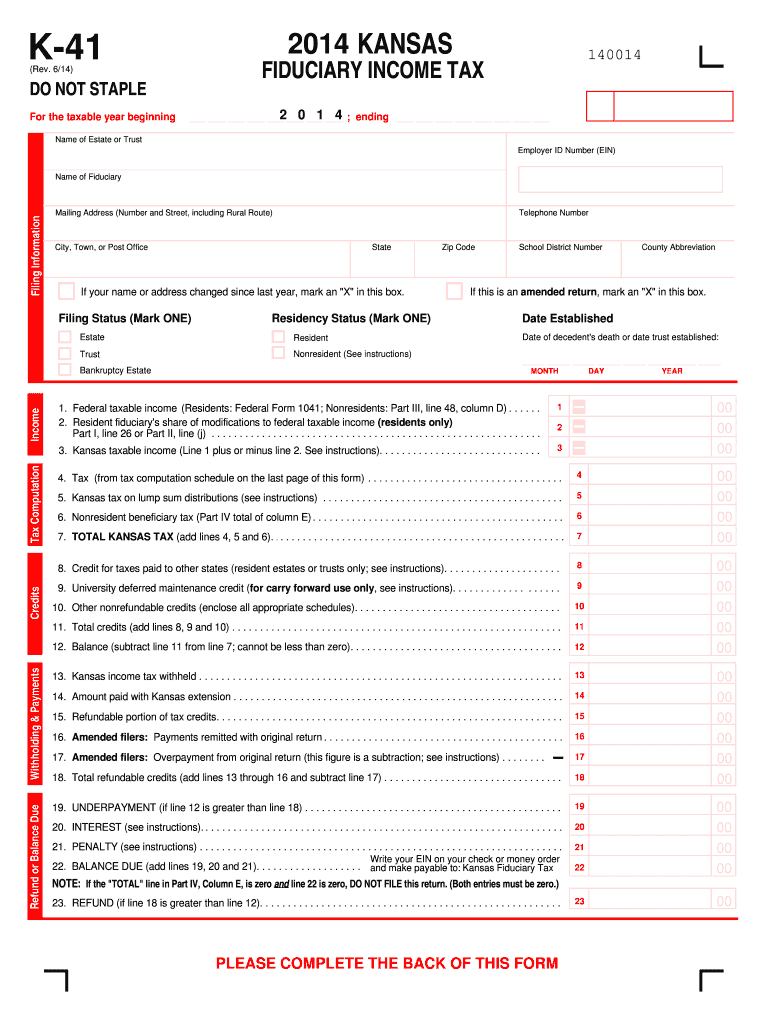

K 41 Form 2014

What is the K-41 Form

The K-41 Form is a tax document used primarily in the United States for reporting specific financial information to state tax authorities. It is often associated with various tax obligations and is essential for individuals or businesses that need to disclose income, deductions, or other relevant financial data. Understanding the purpose of the K-41 Form is crucial for ensuring compliance with state tax regulations.

How to use the K-41 Form

Using the K-41 Form involves filling it out accurately and submitting it to the appropriate tax authority. The form typically requires detailed information about income, deductions, and any other relevant financial data. Users should ensure they have all necessary documentation at hand, as this will facilitate the completion of the form. It is advisable to review the instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the K-41 Form

Completing the K-41 Form requires a systematic approach to ensure accuracy and compliance. The following steps can guide users through the process:

- Gather all necessary financial documents, including income statements and receipts for deductions.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form with accurate information, ensuring all sections are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline, either online, by mail, or in-person, as applicable.

Legal use of the K-41 Form

The K-41 Form must be used in accordance with state tax laws to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. Failure to comply with these regulations can result in penalties or legal consequences. It is essential for users to understand their obligations under the law when utilizing this form.

Filing Deadlines / Important Dates

Filing deadlines for the K-41 Form can vary based on state regulations and the specific tax year. Typically, forms must be submitted by a set date, often coinciding with the general tax filing deadline. Users should be aware of these dates to avoid late penalties. It is advisable to check with state tax authorities for the most current deadlines and any potential extensions that may apply.

Required Documents

To complete the K-41 Form accurately, several documents may be required. These can include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any other documentation that supports the information reported on the form.

Having these documents ready will streamline the completion process and help ensure that all necessary information is included.

Form Submission Methods

The K-41 Form can typically be submitted through various methods, including:

- Online submission through state tax authority websites.

- Mailing a hard copy of the form to the designated address.

- In-person submission at local tax offices, if available.

Choosing the appropriate submission method may depend on personal preferences and the specific requirements of the state in which the form is being filed.

Quick guide on how to complete k 41 form 2014 2018

Prepare K 41 Form effortlessly on any device

Digital document management has gained greater traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without obstacles. Manage K 41 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign K 41 Form effortlessly

- Obtain K 41 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your PC.

Forget about lost or misfiled documents, cumbersome form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign K 41 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 41 form 2014 2018

Create this form in 5 minutes!

How to create an eSignature for the k 41 form 2014 2018

How to create an electronic signature for the K 41 Form 2014 2018 in the online mode

How to create an electronic signature for your K 41 Form 2014 2018 in Google Chrome

How to make an eSignature for signing the K 41 Form 2014 2018 in Gmail

How to make an electronic signature for the K 41 Form 2014 2018 straight from your smartphone

How to make an electronic signature for the K 41 Form 2014 2018 on iOS devices

How to make an electronic signature for the K 41 Form 2014 2018 on Android devices

People also ask

-

What is the K 41 Form and how does it work with airSlate SignNow?

The K 41 Form is a vital document used in various business processes for eSigning and data collection. With airSlate SignNow, you can easily create, send, and eSign the K 41 Form, ensuring compliance and efficiency in your operations. Our platform simplifies the signing process, making it user-friendly for both senders and recipients.

-

Is airSlate SignNow a cost-effective solution for managing the K 41 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the K 41 Form and other documents. Our pricing plans are designed to accommodate businesses of all sizes, allowing you to choose the features that fit your needs without breaking the bank. This ensures that you can streamline your document workflows while staying budget-friendly.

-

Can I integrate the K 41 Form into my existing workflow using airSlate SignNow?

Absolutely! airSlate SignNow allows you to integrate the K 41 Form seamlessly into your existing workflows. Our platform supports various integrations with popular software tools, enabling you to automate processes and improve efficiency while managing your documents effortlessly.

-

What features does airSlate SignNow offer for the K 41 Form?

airSlate SignNow provides several features for the K 41 Form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that you can manage your documents effectively, maintain compliance, and enhance collaboration among team members.

-

How secure is the K 41 Form when using airSlate SignNow?

The security of the K 41 Form is a top priority for airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your documents and sensitive information. This ensures that all eSignatures and data remain confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the K 41 Form?

Using airSlate SignNow for the K 41 Form offers numerous benefits, including increased efficiency, faster turnaround times, and reduced paper usage. By digitizing your document processes, you can streamline approvals and enhance collaboration, leading to better productivity for your business.

-

Can I track the status of my K 41 Form in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your K 41 Form. You can easily monitor the status of your document, from sending to signing, ensuring you are always informed about its progress. This feature helps you stay organized and reduces the chances of delays.

Get more for K 41 Form

Find out other K 41 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors