Kansas K 41 Form 2018

What is the Kansas K-41 Form

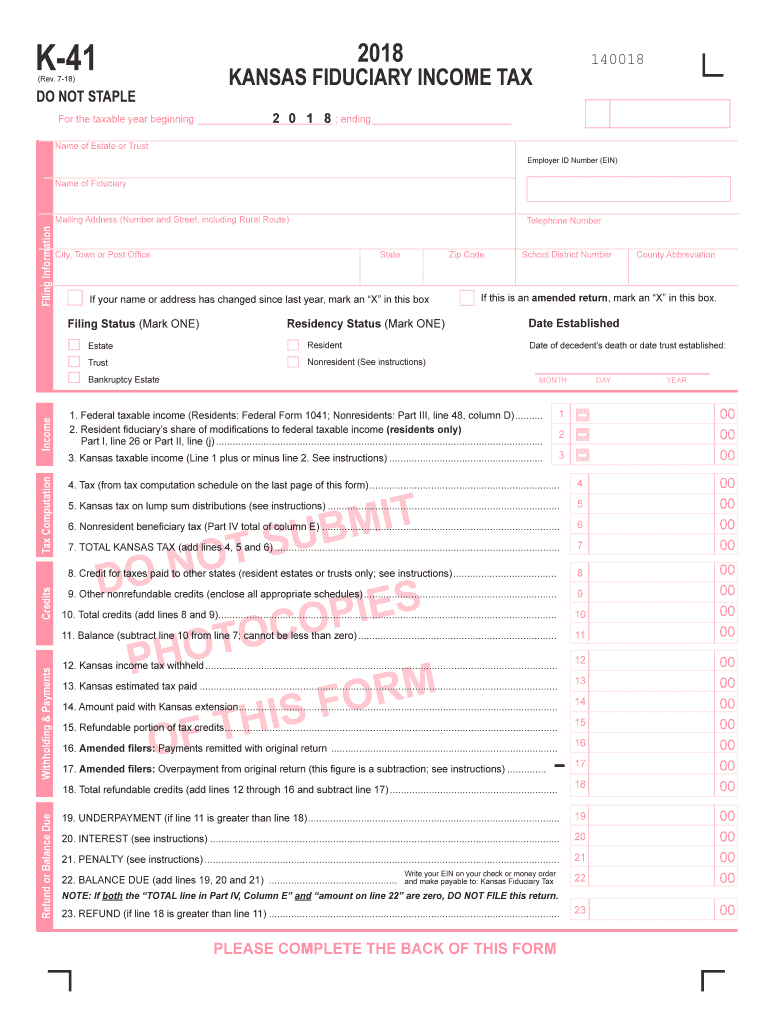

The Kansas K-41 Form is a tax document used for reporting fiduciary income in the state of Kansas. This form is essential for estates and trusts that generate income, allowing them to report their earnings and calculate the tax owed to the state. The K-41 form is specifically designed for fiduciaries, ensuring that the income is taxed appropriately based on Kansas tax laws.

How to use the Kansas K-41 Form

To use the Kansas K-41 Form, fiduciaries must accurately report all income generated by the estate or trust. This includes interest, dividends, and capital gains. The form provides a structured way to detail the income and any deductions that may apply. It is crucial to follow the instructions carefully to ensure compliance with state tax regulations.

Steps to complete the Kansas K-41 Form

Completing the Kansas K-41 Form involves several key steps:

- Gather all necessary financial documents related to the estate or trust income.

- Fill out the identifying information, including the name and address of the fiduciary.

- Report all sources of income on the form, ensuring accuracy in the amounts listed.

- Apply any eligible deductions as specified in the form instructions.

- Review the completed form for any errors before submission.

Legal use of the Kansas K-41 Form

The Kansas K-41 Form is legally recognized for reporting fiduciary income under Kansas state law. To be considered valid, the form must be filled out completely and accurately, adhering to the guidelines set forth by the Kansas Department of Revenue. This ensures that the fiduciary is compliant with tax obligations and can avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas K-41 Form are typically aligned with the federal tax deadlines. Fiduciaries should be aware of the specific due dates, which may vary based on the type of entity and the fiscal year. It is important to file the form on time to avoid late fees and interest charges.

Form Submission Methods (Online / Mail / In-Person)

The Kansas K-41 Form can be submitted through various methods. Fiduciaries may choose to file the form online through the Kansas Department of Revenue's e-filing system, which offers a convenient way to submit documents securely. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements.

Quick guide on how to complete k 41 fiduciary income tax return rev 7 18fillable fiducairy tax

Complete Kansas K 41 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without issues. Manage Kansas K 41 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to alter and eSign Kansas K 41 Form without any hassle

- Obtain Kansas K 41 Form and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize essential parts of the documents or redact sensitive information with tools provided by airSlate SignNow specifically designed for this.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Kansas K 41 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 41 fiduciary income tax return rev 7 18fillable fiducairy tax

Create this form in 5 minutes!

How to create an eSignature for the k 41 fiduciary income tax return rev 7 18fillable fiducairy tax

How to create an electronic signature for your K 41 Fiduciary Income Tax Return Rev 7 18fillable Fiducairy Tax in the online mode

How to generate an eSignature for the K 41 Fiduciary Income Tax Return Rev 7 18fillable Fiducairy Tax in Google Chrome

How to create an electronic signature for signing the K 41 Fiduciary Income Tax Return Rev 7 18fillable Fiducairy Tax in Gmail

How to generate an electronic signature for the K 41 Fiduciary Income Tax Return Rev 7 18fillable Fiducairy Tax from your smart phone

How to create an eSignature for the K 41 Fiduciary Income Tax Return Rev 7 18fillable Fiducairy Tax on iOS

How to make an electronic signature for the K 41 Fiduciary Income Tax Return Rev 7 18fillable Fiducairy Tax on Android OS

People also ask

-

What is the Kansas Form K-41?

The Kansas Form K-41 is a tax form used by individual taxpayers in Kansas to report their income tax and determine their eligibility for certain credits. Understanding how to complete the Kansas Form K-41 is crucial for accurate tax filing, ensuring you maximize your potential refunds and credits.

-

How does airSlate SignNow simplify the signing process for Kansas Form K-41?

airSlate SignNow provides an intuitive platform that allows users to electronically sign and send the Kansas Form K-41 efficiently. Our solution minimizes the hassle of printing and mailing, making it faster to submit your form and receive confirmations.

-

What features does airSlate SignNow offer for handling the Kansas Form K-41?

With airSlate SignNow, users can easily prepare, sign, and share the Kansas Form K-41. Key features include customizable templates, secure document storage, and in-app collaboration tools to streamline the tax filing process for your business.

-

Is there a cost associated with using airSlate SignNow to file the Kansas Form K-41?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when filing the Kansas Form K-41. Each plan provides a range of features and is designed to be cost-effective, ensuring you can efficiently manage your document signing.

-

What benefits does eSigning the Kansas Form K-41 provide?

eSigning the Kansas Form K-41 using airSlate SignNow signNowly reduces turnaround times, providing quicker access to tax refunds. Additionally, it enhances security and compliance, as electronic signatures are legally binding and help eliminate the risks associated with paper documents.

-

Can I integrate airSlate SignNow with other applications for Kansas Form K-41?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing the workflow for filing the Kansas Form K-41. Whether you use CRM systems or accounting software, our integration capabilities ensure your document management process remains streamlined.

-

How do I get started with airSlate SignNow for my Kansas Form K-41?

Getting started with airSlate SignNow for your Kansas Form K-41 is easy. Simply sign up for a free trial on our website, explore the features, and start uploading your forms for eSigning and secure sharing with clients or colleagues.

Get more for Kansas K 41 Form

- Summons custody form

- Verification of eligibility thresholds missouri department of ded mo form

- Tow authorization form

- Motion to set aside default judgment nmsupremecourt nmcourts form

- 4a 204 new mexico supreme court nmsupremecourt nmcourts form

- Petetion 4a 103 new mexico form

- Dld60 form

- Seasonal influenza attestationdeclination form broward health browardhealth

Find out other Kansas K 41 Form

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple