Kansas Department of Revenue Fiduciary 2020

What is the Kansas Department of Revenue Fiduciary?

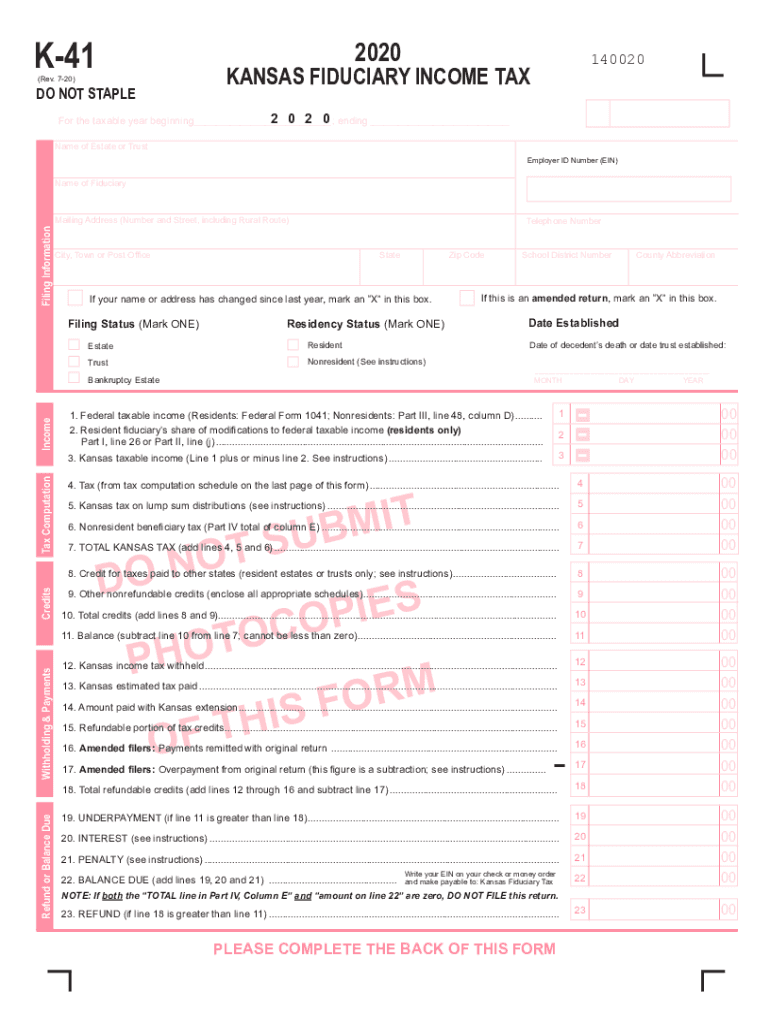

The Kansas Department of Revenue Fiduciary refers to the tax obligations and forms required for fiduciaries managing estates, trusts, or other entities in Kansas. These fiduciaries are responsible for filing the appropriate tax returns on behalf of the entities they manage. The key document for this purpose is the Kansas Form K-41, which is specifically designed for fiduciary tax reporting in Kansas. Understanding the requirements and procedures associated with this form is essential for compliance and accurate tax reporting.

Steps to Complete the Kansas Department of Revenue Fiduciary

Completing the Kansas Form K-41 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records for the estate or trust, including income statements and expense reports. Next, accurately fill out the form, detailing all income, deductions, and credits applicable to the fiduciary entity. Be mindful of the specific instructions provided for the 2018 form K-41, as they may differ from previous years. Once completed, review the form for any errors before submitting it to the Kansas Department of Revenue.

Legal Use of the Kansas Department of Revenue Fiduciary

The legal use of the Kansas Form K-41 is governed by state tax laws, which outline the obligations of fiduciaries. To ensure that the form is legally binding, it must be filled out accurately and submitted by the appropriate deadlines. Additionally, electronic signatures can be used, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This legal framework supports the validity of eSignatures, making it easier for fiduciaries to manage their obligations digitally.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Form K-41 are crucial for fiduciaries to avoid penalties. Typically, the form is due on the same date as the federal income tax return for estates and trusts. For 2018, this means the form must be filed by April 15 of the following year, unless an extension is granted. It is important for fiduciaries to keep track of these dates to ensure timely submission and compliance with state regulations.

Required Documents

To complete the Kansas Form K-41, fiduciaries must gather several required documents. These include the financial records of the estate or trust, such as income statements, expense reports, and prior year tax returns. Additionally, any documentation supporting deductions or credits claimed on the form should be collected. Having all necessary documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Kansas Form K-41 can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal repercussions for the fiduciary. It is essential for fiduciaries to understand these risks and take proactive steps to ensure timely and accurate filing of the form to avoid any complications.

Digital vs. Paper Version

Fiduciaries have the option to file the Kansas Form K-41 either digitally or on paper. The digital version offers advantages such as faster processing times and the ability to use electronic signatures, which can simplify the submission process. However, some fiduciaries may prefer the paper version for its tangible nature. Regardless of the method chosen, it is important to ensure that all information is accurately reported and that the submission complies with state regulations.

Quick guide on how to complete kansas department of revenue fiduciary

Easily Prepare Kansas Department Of Revenue Fiduciary on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Kansas Department Of Revenue Fiduciary on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign Kansas Department Of Revenue Fiduciary Effortlessly

- Locate Kansas Department Of Revenue Fiduciary and click Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Kansas Department Of Revenue Fiduciary and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas department of revenue fiduciary

Create this form in 5 minutes!

How to create an eSignature for the kansas department of revenue fiduciary

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Kansas fiduciary 2018?

AirSlate SignNow is a digital solution for sending and eSigning documents, designed to streamline workflows. In the context of Kansas fiduciary 2018, it ensures compliance with local regulations while enhancing document management efficiency.

-

How does airSlate SignNow ensure compliance with Kansas fiduciary 2018 laws?

AirSlate SignNow provides tools that are tailored to meet the legal requirements of Kansas fiduciary 2018. By using secure eSignature and storage features, users can maintain compliance with state regulations and safeguard sensitive information.

-

What are the pricing options for airSlate SignNow for users focusing on Kansas fiduciary 2018?

AirSlate SignNow offers competitive pricing plans suited for businesses needing to adhere to Kansas fiduciary 2018 standards. Each plan includes essential features like eSigning and document tracking, ensuring both affordability and compliance.

-

What features does airSlate SignNow provide for Kansas fiduciary 2018 compliance?

Key features of airSlate SignNow that support Kansas fiduciary 2018 compliance include customizable workflows, secure storage, and robust audit trails. These tools help businesses manage fiduciary documents effectively while ensuring legal adherence.

-

How can airSlate SignNow benefit businesses managing Kansas fiduciary 2018 requirements?

By using airSlate SignNow, businesses can streamline their document signing processes, reducing turnaround times signNowly. This efficient management is crucial for those dealing with Kansas fiduciary 2018, helping to enhance productivity and compliance.

-

Can airSlate SignNow integrate with other software for Kansas fiduciary 2018 processes?

Yes, airSlate SignNow offers integrations with various applications that aid in managing Kansas fiduciary 2018 documents. These integrations facilitate seamless workflows, allowing businesses to connect their existing tools with the eSigning solution.

-

Are there any customer support options for airSlate SignNow users focused on Kansas fiduciary 2018?

AirSlate SignNow provides dedicated customer support for users navigating Kansas fiduciary 2018 requirements. This support includes access to online resources, FAQs, and direct assistance for any compliance-related inquiries.

Get more for Kansas Department Of Revenue Fiduciary

- Mutual wills package with last wills and testaments for married couple with adult children wisconsin form

- Mutual wills package with last wills and testaments for married couple with no children wisconsin form

- Mutual wills package with last wills and testaments for married couple with minor children wisconsin form

- Legal last will and testament form for married person with adult children wisconsin

- Wi married form

- Wi last will 497431442 form

- Codicil will form 497431443

- Legal last will and testament form for married person with adult and minor children from prior marriage wisconsin

Find out other Kansas Department Of Revenue Fiduciary

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online