K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate or Trust the Fiduciary of a Resident Estate or Trust Must File a Kansa 2022-2026

Understanding the K-41 Fiduciary Income Tax Return

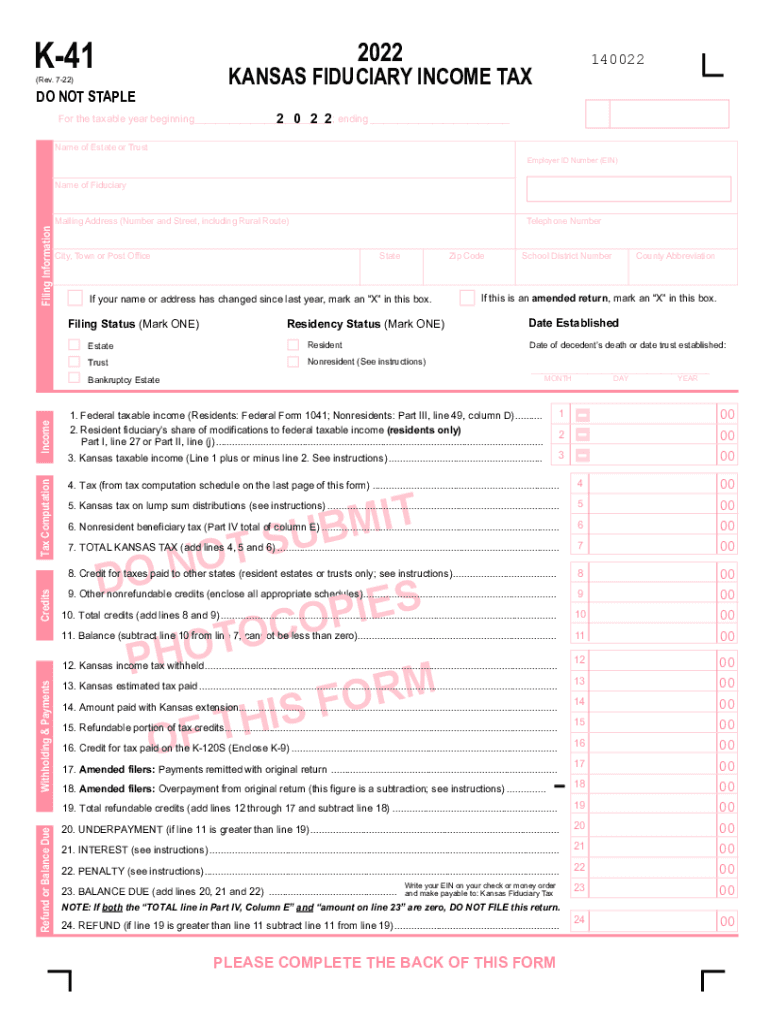

The K-41 Fiduciary Income Tax Return is a crucial document for the fiduciary of a resident estate or trust in Kansas. This form is required to report the income generated by the estate or trust and is essential for ensuring compliance with state tax laws. The fiduciary, typically an executor or trustee, must file this return to accurately account for the income and any distributions made to beneficiaries. Understanding the specifics of this form helps in fulfilling legal obligations while optimizing tax outcomes.

Steps to Complete the K-41 Fiduciary Income Tax Return

Completing the K-41 Fiduciary Income Tax Return involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements, deductions, and any prior year returns. Next, fill out the K-41 form accurately, ensuring all income and expenses are reported. It is important to double-check calculations to avoid errors. Once completed, the form can be submitted either electronically or via mail, depending on the preferred method of filing. Keeping a copy of the submitted form for your records is also advisable.

Required Documents for Filing the K-41

To file the K-41 Fiduciary Income Tax Return, certain documents are necessary. These include:

- Income statements for the estate or trust, such as interest and dividends.

- Records of expenses and deductions related to the estate or trust.

- Prior year tax returns, if applicable, to provide context for the current filing.

- Information on distributions made to beneficiaries during the tax year.

Having these documents organized will facilitate a smoother filing process and help ensure compliance with Kansas tax regulations.

Filing Deadlines for the K-41 Form

It is important to be aware of the filing deadlines for the K-41 Fiduciary Income Tax Return to avoid penalties. Typically, the return is due on the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the return is due by April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Filing on time is crucial to maintain good standing with the Kansas Department of Revenue.

Legal Use of the K-41 Form

The K-41 Fiduciary Income Tax Return is legally binding and must be completed in accordance with Kansas tax laws. This form serves as an official record of the income and expenses of the estate or trust and is used by the state to assess tax liabilities. Failure to file accurately and on time can lead to penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is essential for fiduciaries to protect themselves and the estate or trust they manage.

Digital vs. Paper Submission of the K-41 Form

Filing the K-41 Fiduciary Income Tax Return can be done either digitally or on paper. Digital submission is often preferred due to its convenience and efficiency. Electronic filing allows for quicker processing and confirmation of receipt. However, some fiduciaries may choose to file a paper return for various reasons, such as personal preference or lack of access to electronic filing options. Regardless of the method chosen, ensuring that the form is completed accurately and submitted on time is vital for compliance.

Quick guide on how to complete k 41 fiduciary income tax return rev 7 22 resident estate or trust the fiduciary of a resident estate or trust must file a

Effortlessly prepare K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa without any hassle

- Find K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 41 fiduciary income tax return rev 7 22 resident estate or trust the fiduciary of a resident estate or trust must file a

Create this form in 5 minutes!

How to create an eSignature for the k 41 fiduciary income tax return rev 7 22 resident estate or trust the fiduciary of a resident estate or trust must file a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2023 Kansas fiduciary and how does it relate to airSlate SignNow?

A 2023 Kansas fiduciary is an individual or entity entrusted with managing the financial affairs of another individual, often in a legal capacity. airSlate SignNow supports these fiduciaries by providing a secure and efficient platform for eSigning and managing important documents, ensuring compliance and reliability in transactions.

-

How can airSlate SignNow enhance the efficiency of my 2023 Kansas fiduciary tasks?

With airSlate SignNow, 2023 Kansas fiduciaries can automate document workflows, reducing the time spent on mundane tasks. Its intuitive interface allows fiduciaries to send, sign, and store documents electronically, enabling quicker decision-making and improved productivity.

-

What pricing options are available for airSlate SignNow for fiduciaries in 2023?

airSlate SignNow offers several pricing tiers to accommodate various needs for 2023 Kansas fiduciaries. Each plan provides unique features, ensuring fiduciaries can choose a cost-effective solution that meets their specific eSigning and document management requirements.

-

What features should a 2023 Kansas fiduciary look for in an eSigning solution?

A good eSigning solution for a 2023 Kansas fiduciary should include features like secure document storage, audit trails, and customizable workflows. airSlate SignNow offers these essential functionalities, enabling fiduciaries to maintain compliance and manage their documents effectively.

-

Are there any integrations available with airSlate SignNow for fiduciaries in Kansas?

Yes, airSlate SignNow provides integrations with numerous popular applications that 2023 Kansas fiduciaries often use. These integrations facilitate seamless data transfer and enhance the overall efficiency of document management processes.

-

Can airSlate SignNow help with compliance issues for a 2023 Kansas fiduciary?

Absolutely! airSlate SignNow is designed with compliance in mind, making it suitable for 2023 Kansas fiduciaries who need to adhere to legal standards. Its features include secure encryption and audit trails, which help fiduciaries ensure that all documents are legally binding and properly managed.

-

What benefits does airSlate SignNow provide for 2023 Kansas fiduciaries compared to traditional signing methods?

The primary benefits of airSlate SignNow over traditional signing methods for 2023 Kansas fiduciaries include time savings, reduced costs, and enhanced security. By switching to eSigning, fiduciaries can streamline their processes and minimize the risk associated with paper documents.

Get more for K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa

Find out other K 41 Fiduciary Income Tax Return Rev 7 22 Resident Estate Or Trust The Fiduciary Of A Resident Estate Or Trust Must File A Kansa

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed