ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor 2021

What is the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor

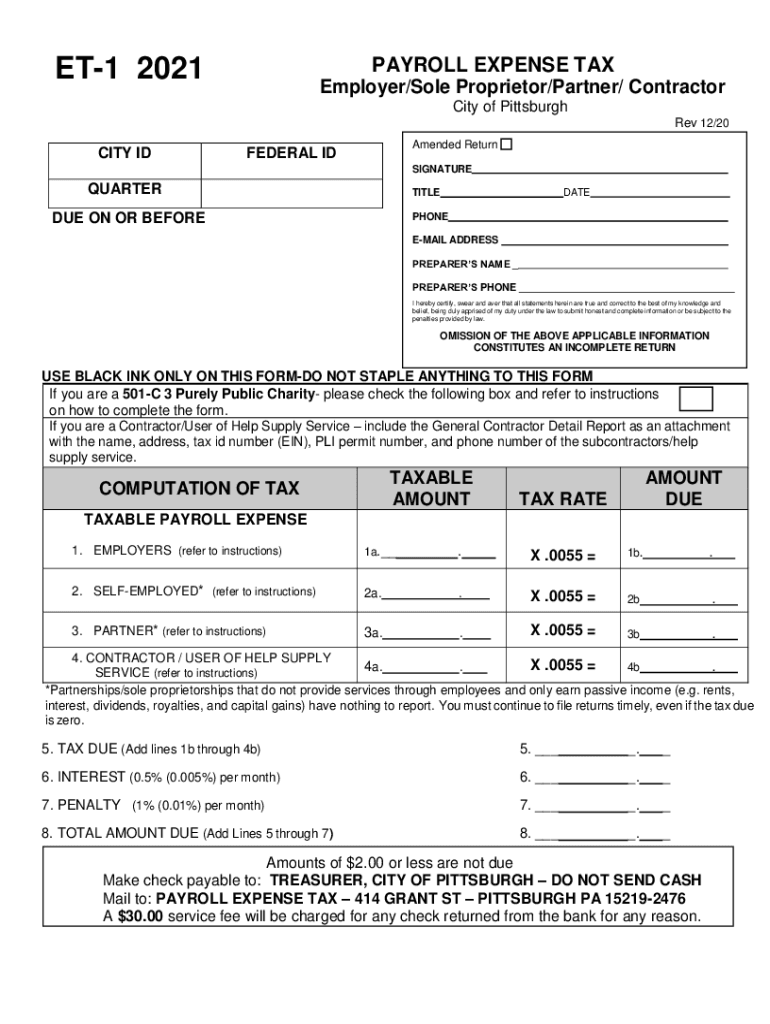

The ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor form is a tax document specifically designed for sole proprietors in the United States. This form is used to report payroll expenses related to employees and is essential for compliance with state and federal tax regulations. By accurately completing this form, sole proprietors can ensure they meet their tax obligations and avoid potential penalties. It provides a clear overview of payroll-related expenses, allowing for proper financial management and reporting.

Steps to complete the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor

Completing the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including payroll records and expense receipts. Next, fill out the form with precise information regarding employee wages, benefits, and taxes withheld. It is crucial to double-check all entries for accuracy before submission. After completing the form, review it once more to ensure all required fields are filled and calculations are correct. Finally, submit the form according to the specified guidelines, either electronically or by mail.

Legal use of the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor

The legal use of the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor form is governed by various tax laws and regulations. To be considered valid, the form must be completed in accordance with state and federal requirements. This includes providing accurate information and ensuring that all necessary signatures are included. The form must also be submitted by the designated deadlines to avoid penalties. Compliance with these legal stipulations is essential for maintaining good standing with tax authorities and ensuring that the submitted information is recognized as legitimate.

Filing Deadlines / Important Dates

Filing deadlines for the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor form can vary depending on state regulations. Typically, forms are due quarterly or annually, depending on the payroll frequency of the business. It is important to stay informed about specific due dates to avoid late fees or penalties. Marking these dates on a calendar can help ensure timely submission. Additionally, if there are any changes in tax laws or filing requirements, staying updated through official state resources is advisable.

Form Submission Methods (Online / Mail / In-Person)

The ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor form can be submitted through various methods, depending on state guidelines. Many states offer online submission options, which can streamline the process and provide immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate tax authority, ensuring that it is sent well before the deadline to allow for processing time. In some cases, in-person submissions may also be accepted at local tax offices. Understanding the preferred submission method can enhance efficiency and ensure compliance.

Key elements of the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor

Key elements of the ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor form include detailed sections for reporting payroll expenses, employee information, and tax withholdings. The form typically requires the business owner to provide their tax identification number, the total wages paid, and any applicable deductions. Additionally, it may require information about employee benefits and contributions to retirement plans. Ensuring that all these elements are accurately reported is crucial for compliance and for the proper calculation of tax liabilities.

Quick guide on how to complete et 1 2021 payroll expense tax employersole proprietor

Prepare ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor on any device using the airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor without hassle

- Locate ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Produce your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor and guarantee outstanding communication throughout every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 1 2021 payroll expense tax employersole proprietor

Create this form in 5 minutes!

How to create an eSignature for the et 1 2021 payroll expense tax employersole proprietor

The way to create an e-signature for a PDF online

The way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor?

ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor refers to the payroll tax obligations that sole proprietors must consider when managing business expenses. Understanding this tax is crucial for compliance and financial planning. airSlate SignNow can assist in facilitating necessary document workflows related to these taxes.

-

How can airSlate SignNow help with ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor?

airSlate SignNow simplifies the process of managing your payroll expense tax documentation for sole proprietors. By using our eSignature solution, you can effortlessly sign and send necessary forms while ensuring compliance. This streamlines your workflow and saves valuable time.

-

What pricing plans does airSlate SignNow offer for managing ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor?

airSlate SignNow provides flexible pricing plans tailored to suit different business needs, including those of sole proprietors dealing with ET 1 PAYROLL EXPENSE TAX. We offer competitive rates designed to provide high value at an accessible cost. Check our website for current pricing and promotions.

-

What features does airSlate SignNow include for ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor?

Our platform includes features such as document templates, automated workflows, and comprehensive tracking capabilities, all essential for managing ET 1 PAYROLL EXPENSE TAX for sole proprietors. These features not only enhance efficiency but also ensure that your tax documents are handled securely and professionally.

-

Are there any integrations available with airSlate SignNow for ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor?

Yes, airSlate SignNow integrates seamlessly with various accounting and business management tools. This enables sole proprietors to sync their ET 1 PAYROLL EXPENSE TAX data directly with their accounting software, simplifying tax preparation and ensuring accuracy in financial reporting.

-

What are the benefits of using airSlate SignNow for ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor?

Using airSlate SignNow for your ET 1 PAYROLL EXPENSE TAX needs provides numerous benefits, including increased efficiency, improved accuracy, and enhanced compliance. Our user-friendly platform allows for quick document turnaround, which is especially beneficial for sole proprietors managing multiple tax obligations.

-

Can I access airSlate SignNow on mobile for ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor?

Absolutely! airSlate SignNow is accessible on both desktop and mobile devices, enabling sole proprietors to manage their ET 1 PAYROLL EXPENSE TAX documentation on the go. This flexibility ensures that you can sign and send important documents anytime, anywhere, enhancing your productivity.

Get more for ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor

- De llc 497301968 form

- De llc 497301969 form

- Delaware disclaimer 497301970 form

- Request lien form

- Quitclaim deed from individual to husband and wife delaware form

- Warranty deed from individual to husband and wife delaware form

- Quitclaim deed from corporation to husband and wife delaware form

- Warranty deed from corporation to husband and wife delaware form

Find out other ET 1 PAYROLL EXPENSE TAX EmployerSole Proprietor

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure