Form Et 1 2017

What is the Form Et 1

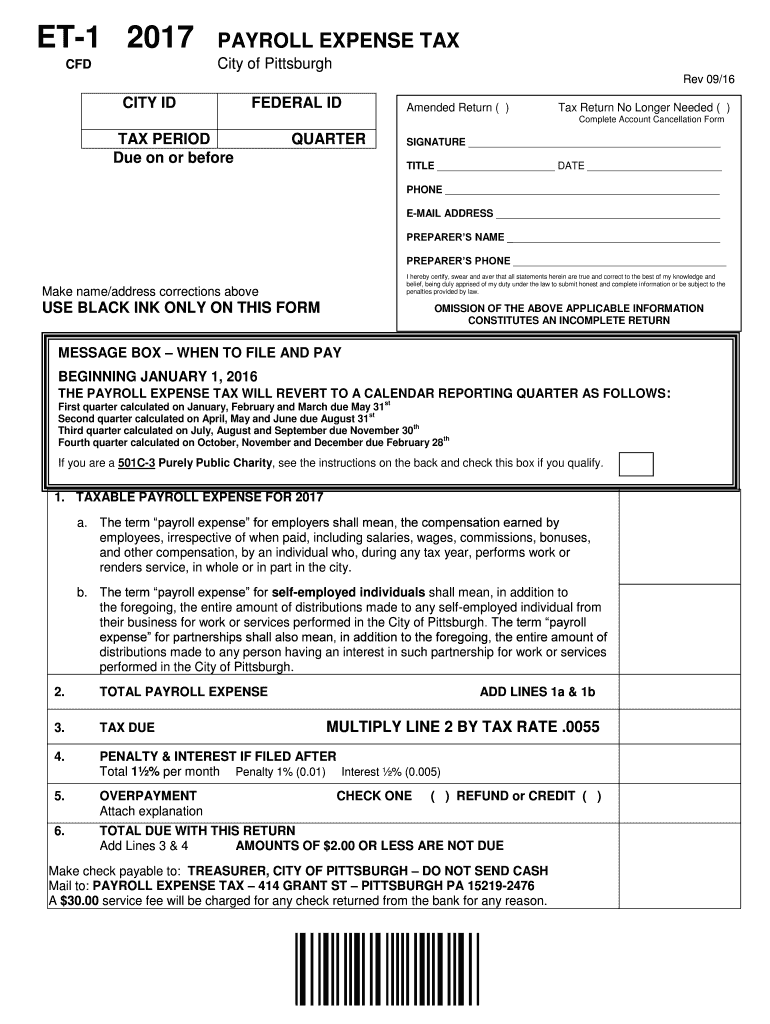

The Form Et 1 is a specific tax form used in the United States for reporting certain income and tax information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It includes various fields that must be filled out accurately to reflect the taxpayer's financial situation. Understanding the purpose and requirements of the Form Et 1 is crucial for timely and correct tax reporting.

How to use the Form Et 1

Using the Form Et 1 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, access the form through official IRS channels or authorized software. Fill out the required fields carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form electronically or via traditional mail, depending on your preference and IRS guidelines.

Steps to complete the Form Et 1

Completing the Form Et 1 requires a systematic approach. Follow these steps for accuracy:

- Gather all relevant financial documents, including W-2s and 1099s.

- Obtain the latest version of the Form Et 1 from the IRS website.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income as specified in the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form electronically or by hand, as required.

- Submit the completed form by the IRS deadline.

Legal use of the Form Et 1

The Form Et 1 is legally recognized by the IRS for tax reporting purposes. It is important to use the form according to IRS guidelines to avoid penalties. The form must be filled out truthfully and accurately, as any discrepancies can lead to audits or legal issues. Understanding the legal implications of the Form Et 1 ensures that taxpayers remain compliant with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form Et 1 are crucial for compliance. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about specific deadlines to avoid late fees or penalties. Mark your calendar with important dates to ensure timely submission of the Form Et 1.

Form Submission Methods (Online / Mail / In-Person)

The Form Et 1 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Submit electronically through IRS-approved e-filing services.

- Mail: Print and send the completed form to the designated IRS address.

- In-Person: Deliver the form to local IRS offices, if necessary.

Choosing the right submission method can streamline the filing process and ensure that the form is received on time.

Quick guide on how to complete form et 1 2017

Your assistance manual on how to prepare your Form Et 1

If you’re interested in learning how to finalize and submit your Form Et 1, here are a few concise instructions on how to simplify tax submission.

To get started, you simply need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and efficient document platform that enables you to edit, generate, and complete your income tax forms effortlessly. Utilizing its editor, you can navigate between text, checkboxes, and eSignatures and return to modify information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Form Et 1 in a matter of minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to open your Form Et 1 in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper may increase return errors and delay refunds. Certainly, before electronically filing your taxes, check the IRS website for declaration rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct form et 1 2017

Create this form in 5 minutes!

How to create an eSignature for the form et 1 2017

How to create an eSignature for your Form Et 1 2017 online

How to generate an electronic signature for the Form Et 1 2017 in Chrome

How to make an eSignature for putting it on the Form Et 1 2017 in Gmail

How to make an eSignature for the Form Et 1 2017 straight from your smart phone

How to create an electronic signature for the Form Et 1 2017 on iOS

How to generate an electronic signature for the Form Et 1 2017 on Android

People also ask

-

What is Form Et 1 and how can airSlate SignNow help with it?

Form Et 1 is a document often required for tax purposes or specific business filings. With airSlate SignNow, you can easily create, send, and eSign Form Et 1, ensuring a smooth and efficient process for your business needs.

-

How much does it cost to use airSlate SignNow for Form Et 1?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. By subscribing to our service, you can streamline the process of sending and signing Form Et 1 at an affordable rate, enhancing overall productivity.

-

What features does airSlate SignNow offer for managing Form Et 1?

airSlate SignNow provides a range of features specifically designed for managing Form Et 1, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your document management process is efficient and compliant with legal standards.

-

Is airSlate SignNow suitable for small businesses needing to handle Form Et 1?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses handling Form Et 1. Our platform simplifies the eSigning process, allowing small teams to manage documents without needing extensive training or resources.

-

Can I integrate airSlate SignNow with other software for Form Et 1 management?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage Form Et 1 effectively. Whether you use CRM systems, cloud storage, or project management tools, our integrations make it easy to incorporate eSigning into your existing workflows.

-

What are the security measures in place for signing Form Et 1 with airSlate SignNow?

Security is a top priority at airSlate SignNow. When signing Form Et 1, your documents are protected with advanced encryption and secure storage, ensuring that your sensitive information remains confidential and compliant with industry standards.

-

How can I track the status of Form Et 1 sent via airSlate SignNow?

airSlate SignNow offers a robust tracking system that allows you to monitor the status of Form Et 1 throughout the signing process. You will receive notifications when the document is viewed, signed, and completed, providing you with full visibility and control.

Get more for Form Et 1

- Virtual office agreement format

- Teis vendor application form

- Mdj op form 2209 1 jan 05 vet svcs doc networker licensing

- Kanawha county magistrate court forms

- Carte solidaire ter grand est en ligne form

- Dog license application form download fill out ampamp sign online

- Real estate associate broker or salesperson license transfer form

- Cable installation service agreement form

Find out other Form Et 1

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online