EmployerSole ProprietorPartner 2020

Understanding the Employer Sole Proprietor Partner

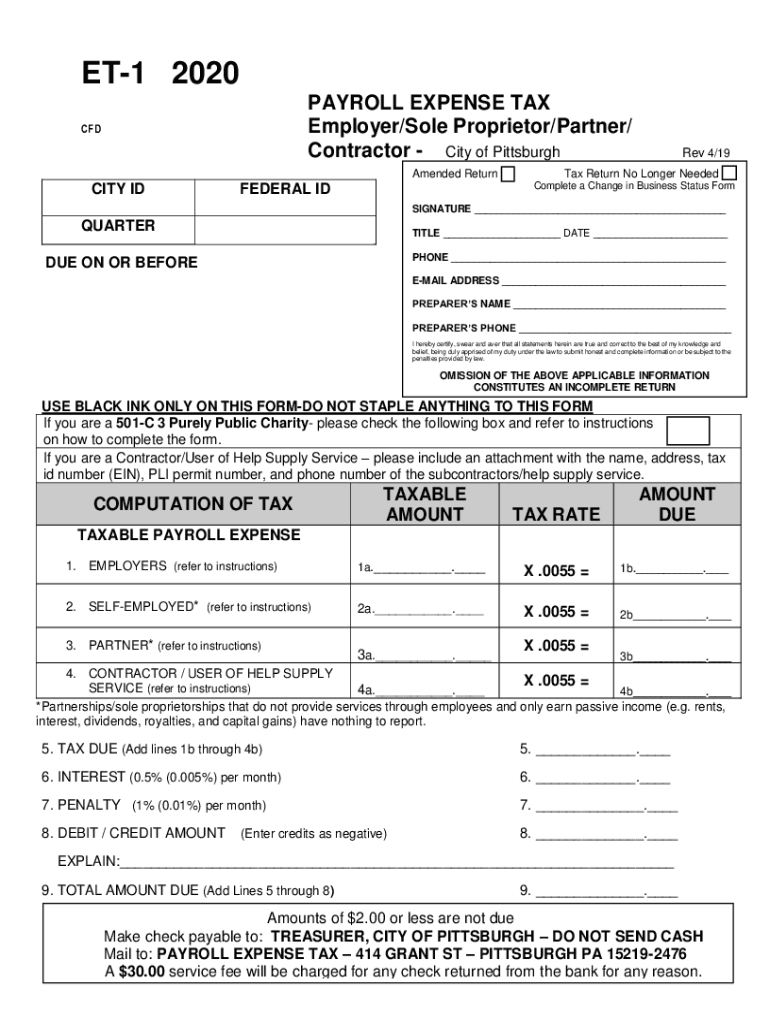

The Employer Sole Proprietor Partner (ESP) is a crucial form for individuals operating as sole proprietors or partners in a business. This form is used to report payroll expenses to the city of Pittsburgh, ensuring compliance with local tax regulations. It is essential for those who employ others or run a business that generates taxable income. Understanding the specifics of this form can help avoid penalties and ensure proper filing.

Steps to Complete the Employer Sole Proprietor Partner

Completing the Employer Sole Proprietor Partner form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, employee information, and payroll records. Next, accurately fill out each section of the form, ensuring that all figures are correct and match your financial records. It is important to review the completed form for any errors before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the Employer Sole Proprietor Partner

The legal use of the Employer Sole Proprietor Partner form is governed by local tax laws and regulations. This form must be completed accurately to reflect the payroll expenses incurred by the business. Failure to comply with these legal requirements can result in fines or penalties. It is advisable to consult with a tax professional or legal advisor to ensure that the form is used correctly and in accordance with all applicable laws.

Filing Deadlines / Important Dates

Filing deadlines for the Employer Sole Proprietor Partner form are critical to avoid penalties. Typically, the form must be submitted by the end of the tax year, but specific deadlines may vary based on local regulations. It is important to stay informed about these dates to ensure timely submission. Mark your calendar with important dates related to payroll tax filings to maintain compliance and avoid late fees.

Required Documents for Submission

When preparing to submit the Employer Sole Proprietor Partner form, several documents are required. These include payroll records, business identification numbers, and any previous tax filings related to payroll expenses. Having all necessary documentation ready can streamline the completion process and ensure that the form is filled out accurately. Double-check that all information is current and correctly reflects your business operations.

Penalties for Non-Compliance

Non-compliance with the requirements for the Employer Sole Proprietor Partner form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for business owners to understand the implications of failing to file or submitting inaccurate information. Regularly reviewing compliance requirements can help mitigate risks associated with non-compliance.

Form Submission Methods

The Employer Sole Proprietor Partner form can be submitted through various methods, including online submission, mailing a physical copy, or delivering it in person to the appropriate tax office. Each method has its own advantages, such as convenience or direct confirmation of receipt. Choose the method that best suits your needs while ensuring that you meet all deadlines and requirements.

Quick guide on how to complete employersole proprietorpartner

Prepare EmployerSole ProprietorPartner effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Oversee EmployerSole ProprietorPartner on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to alter and eSign EmployerSole ProprietorPartner with ease

- Locate EmployerSole ProprietorPartner and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign EmployerSole ProprietorPartner and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employersole proprietorpartner

Create this form in 5 minutes!

How to create an eSignature for the employersole proprietorpartner

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the Pittsburgh Form ET 1 and how is it used with airSlate SignNow?

The Pittsburgh Form ET 1 is a specific document used for tax-related purposes in Pennsylvania. With airSlate SignNow, you can easily prepare, send, and eSign the Pittsburgh Form ET 1, streamlining your workflow and ensuring compliance with local regulations.

-

How does airSlate SignNow simplify the eSigning process for the Pittsburgh Form ET 1?

airSlate SignNow simplifies the eSigning process by providing intuitive tools and templates designed for documents like the Pittsburgh Form ET 1. Users can quickly add signers, set signing orders, and track document status in real-time.

-

What are the pricing options for using airSlate SignNow for the Pittsburgh Form ET 1?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose a monthly or annual subscription that provides seamless access to features required for tasks like managing the Pittsburgh Form ET 1.

-

Can I integrate airSlate SignNow with other tools while handling the Pittsburgh Form ET 1?

Yes, airSlate SignNow provides numerous integrations with popular applications, which helps in managing the Pittsburgh Form ET 1 efficiently. This allows teams to work seamlessly through their preferred platforms while ensuring smooth document flow.

-

What are the key features of airSlate SignNow that benefit users of the Pittsburgh Form ET 1?

Key features of airSlate SignNow include automated workflows, customizable templates, and secure eSigning capabilities for the Pittsburgh Form ET 1. These tools help enhance productivity and reduce the time spent on document management.

-

Is it safe to use airSlate SignNow for my Pittsburgh Form ET 1?

Absolutely! airSlate SignNow utilizes advanced encryption and security protocols to protect your documents, including the Pittsburgh Form ET 1. You can rest assured that your data is secure during each step of the signing process.

-

How can the Pittsburgh Form ET 1 be shared with multiple signers using airSlate SignNow?

With airSlate SignNow, you can easily share the Pittsburgh Form ET 1 with multiple signers by adding them directly to the document. You can set the signing order, ensuring that each person completes their part efficiently and securely.

Get more for EmployerSole ProprietorPartner

Find out other EmployerSole ProprietorPartner

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document