MARYLAND DO NOT WRITE or STAPLE FORM Application for 2021

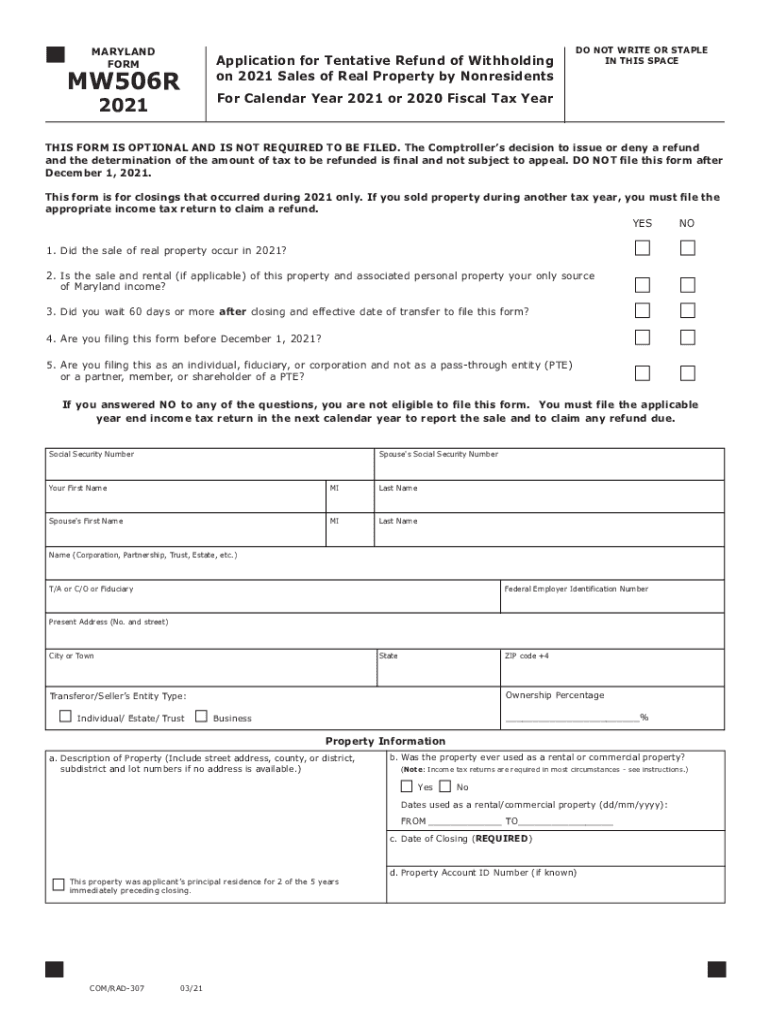

What is the Maryland MW506R Form?

The Maryland MW506R form is an application for a tentative refund of withholding tax. This form is essential for individuals and businesses seeking to recover excess state income tax withheld from their earnings. The MW506R is particularly relevant for those who may have overpaid their taxes throughout the year or who qualify for specific tax credits. By submitting this form, taxpayers can request a prompt refund, streamlining the process of reclaiming their funds.

Steps to Complete the Maryland MW506R Form

Completing the Maryland MW506R form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information, including your Social Security number, income details, and withholding amounts.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the calculations to confirm the amount of refund requested is correct.

- Sign and date the form to validate your submission.

- Submit the form electronically or via mail, depending on your preference.

Eligibility Criteria for the Maryland MW506R Form

To qualify for filing the Maryland MW506R form, certain eligibility criteria must be met. Taxpayers must have had state income tax withheld from their wages or payments during the tax year. Additionally, the amount withheld must exceed the taxpayer's actual tax liability. Individuals who have experienced changes in their income or tax status may also consider this form to ensure they receive any potential refunds.

Form Submission Methods

The Maryland MW506R form can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to complete and submit the form electronically for convenience and speed.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate state tax office.

- In-Person Submission: Taxpayers can also visit designated state offices to submit their forms directly.

Key Elements of the Maryland MW506R Form

Understanding the key elements of the Maryland MW506R form is crucial for successful completion. Important components include:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Withholding Amounts: Accurate reporting of the total state income tax withheld is necessary for determining the refund.

- Signature: A valid signature is required to authenticate the form and confirm the information provided is accurate.

Legal Use of the Maryland MW506R Form

The Maryland MW506R form is legally recognized for the purpose of claiming a refund of over-withheld taxes. It complies with state regulations governing tax refunds and ensures that taxpayers can reclaim their funds in a lawful manner. Proper completion and submission of this form safeguard against potential legal issues and facilitate a smooth refund process.

Quick guide on how to complete maryland do not write or staple form application for

Finalize MARYLAND DO NOT WRITE OR STAPLE FORM Application For effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate template and securely archive it online. airSlate SignNow provides all the necessary tools to formulate, adjust, and electronically sign your documents promptly and without hindrances. Handle MARYLAND DO NOT WRITE OR STAPLE FORM Application For on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to modify and electronically sign MARYLAND DO NOT WRITE OR STAPLE FORM Application For effortlessly

- Find MARYLAND DO NOT WRITE OR STAPLE FORM Application For and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign MARYLAND DO NOT WRITE OR STAPLE FORM Application For and ensure excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland do not write or staple form application for

Create this form in 5 minutes!

How to create an eSignature for the maryland do not write or staple form application for

The way to generate an e-signature for your PDF file online

The way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the maryland mw506r document?

The maryland mw506r is a specific form used for tax purposes in Maryland, particularly for reporting tax credits. It is essential for businesses and individuals to ensure compliance with state regulations. Utilizing tools like airSlate SignNow can simplify submitting the maryland mw506r by enabling electronic signatures and secure document management.

-

How can airSlate SignNow help with the maryland mw506r?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents, including the maryland mw506r form. This feature streamlines the process, allowing users to complete their tax forms quickly and efficiently. With airSlate SignNow, you can ensure your maryland mw506r is signed and submitted with minimal hassle.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate different business needs, starting from a basic plan to more comprehensive options. Each plan provides features suitable for handling documents like the maryland mw506r at various levels of complexity. You can choose a plan that best fits your volume of document handling and eSigning requirements.

-

Is airSlate SignNow secure for handling sensitive documents like the maryland mw506r?

Yes, airSlate SignNow utilizes advanced encryption and security measures to protect your sensitive documents, including the maryland mw506r. The platform complies with various industry standards to ensure that your data is safe during the signing and submission processes. You can confidently use airSlate SignNow for your important tax forms and documents.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, enhancing your workflow efficiency. This allows for easy transfer of data and documents, including the maryland mw506r, between different tools you use for accounting, communication, and project management. Integrating these systems can simplify your document management processes.

-

What are the key features of airSlate SignNow for managing forms like the maryland mw506r?

Key features of airSlate SignNow include customizable templates, automated workflows, and comprehensive reporting tools. These features allow users to efficiently create, manage, and eSign documents, such as the maryland mw506r, enhancing overall productivity. The user-friendly interface also makes it easier to navigate through various functionalities.

-

Is training available for using airSlate SignNow to manage the maryland mw506r?

Yes, airSlate SignNow provides training resources, including tutorials and customer support, to help users learn how to manage documents like the maryland mw506r effectively. These resources can guide you through the features and functionalities of the platform, ensuring you can utilize it to its full potential. Users can access these materials anytime to increase their proficiency.

Get more for MARYLAND DO NOT WRITE OR STAPLE FORM Application For

- Iowa assignment of mortgage by corporate mortgage holder form

- Iowa termination lease form

- Notice written cure 481379485 form

- Annual minutes board form

- Iowa revocation of general durable power of attorney form

- Iowa annual report of conservator form

- Iowa satisfaction form

- Iowa appearance and answer of defendant form

Find out other MARYLAND DO NOT WRITE OR STAPLE FORM Application For

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document