About the Maryland Nonresident Withholding Tax 2023

Understanding the Maryland Nonresident Withholding Tax

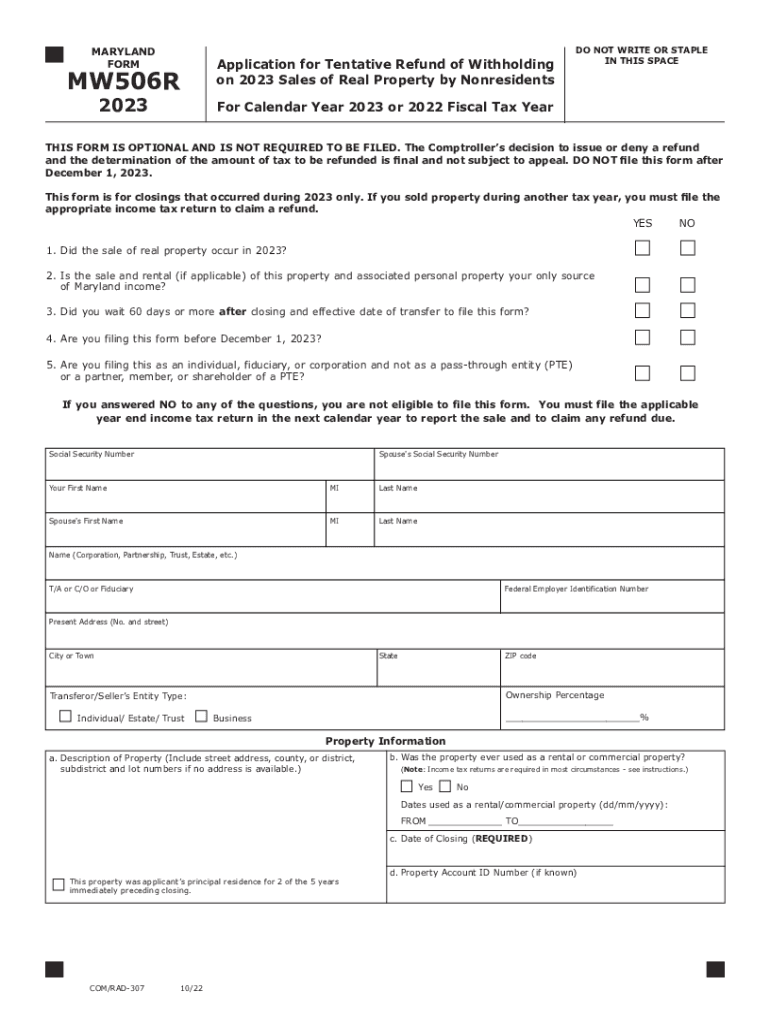

The Maryland Nonresident Withholding Tax applies to nonresidents who earn income from Maryland sources. This tax is designed to ensure that nonresidents contribute to the state's revenue when they engage in business or receive payments within Maryland. The mw506r 2023 form is essential for reporting this withholding tax. It provides a structured way for employers and payers to report the income paid to nonresidents and the tax withheld on that income, ensuring compliance with Maryland tax regulations.

Steps to Complete the Maryland Nonresident Withholding Tax Form

Completing the mw506r 2023 form involves several key steps:

- Gather necessary information, such as the nonresident's name, address, and Social Security number or taxpayer identification number.

- Identify the type and amount of income paid to the nonresident.

- Calculate the amount of withholding tax based on the applicable rate for the income type.

- Fill out the mw506r 2023 form accurately, ensuring all required fields are completed.

- Submit the form by the specified deadline to avoid penalties.

Legal Use of the Maryland Nonresident Withholding Tax Form

The mw506r 2023 form is legally binding when filled out correctly and submitted on time. It complies with Maryland tax laws and serves as a record of withholding for both the payer and the nonresident. To ensure legal validity, it is crucial to adhere to the guidelines set forth by the Maryland Comptroller's office, including proper documentation and timely submission.

Filing Deadlines and Important Dates

Timely filing of the mw506r 2023 form is essential to avoid penalties. The Maryland Comptroller typically sets specific deadlines for submitting withholding tax forms. It is advisable to check the official Maryland tax website for the most current deadlines, as they may vary each year. Generally, forms must be submitted quarterly, with annual reconciliation due by January 31 of the following year.

Required Documents for Filing the Maryland Nonresident Withholding Tax

To file the mw506r 2023 form, certain documents are necessary:

- Proof of income paid to the nonresident.

- Records of withholding tax amounts deducted.

- The nonresident's tax identification information.

- Any relevant contracts or agreements pertaining to the income.

Penalties for Non-Compliance with the Maryland Nonresident Withholding Tax

Failure to comply with the requirements of the mw506r 2023 form can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal action for continued non-compliance. It is crucial for employers and payers to understand their responsibilities and ensure that all forms are submitted accurately and on time to avoid these consequences.

Quick guide on how to complete about the maryland nonresident withholding tax

Complete About The Maryland Nonresident Withholding Tax effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage About The Maryland Nonresident Withholding Tax on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign About The Maryland Nonresident Withholding Tax without hassle

- Find About The Maryland Nonresident Withholding Tax and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign About The Maryland Nonresident Withholding Tax and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about the maryland nonresident withholding tax

Create this form in 5 minutes!

How to create an eSignature for the about the maryland nonresident withholding tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mw506r 2023 and how can it be used with airSlate SignNow?

The mw506r 2023 is an advanced form of digital document signing technology that enhances the efficiency of business operations. By integrating mw506r 2023 with airSlate SignNow, businesses can streamline their document workflows and ensure secure electronic signatures for a variety of documents.

-

What features does airSlate SignNow offer that enhance the mw506r 2023 experience?

airSlate SignNow provides essential features that complement mw506r 2023, including customizable templates, automated workflows, and real-time tracking. These capabilities not only improve document accuracy but also save time for businesses looking to enhance their signing processes with mw506r 2023.

-

Is there a free trial available for airSlate SignNow to test mw506r 2023 functionalities?

Yes, airSlate SignNow offers a free trial that allows users to explore all the features related to mw506r 2023 without any financial commitment. This trial helps businesses understand the platform's capabilities before making a decision to invest.

-

How does airSlate SignNow ensure security when using mw506r 2023?

Security is a top priority for airSlate SignNow, especially when utilizing mw506r 2023. The platform implements advanced encryption technologies and compliance with data protection regulations, ensuring that all documents and signatures remain secure and confidential.

-

What are the pricing options for airSlate SignNow related to mw506r 2023?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses using mw506r 2023. Customers can choose from various tiers based on their required features, allowing for cost-effective solutions that fit their specific use cases.

-

Can airSlate SignNow integrate with other tools when implementing mw506r 2023?

Absolutely! airSlate SignNow is designed to seamlessly integrate with a variety of third-party applications, facilitating the effective use of mw506r 2023 alongside other business tools. This integration enhances overall efficiency and enables users to streamline their document management processes.

-

What industries benefit the most from using mw506r 2023 with airSlate SignNow?

Many industries, including real estate, legal, and finance, benefit signNowly from using mw506r 2023 with airSlate SignNow. The platform's ability to quickly and securely facilitate document signing allows these sectors to operate more efficiently and maintain compliance with industry standards.

Get more for About The Maryland Nonresident Withholding Tax

Find out other About The Maryland Nonresident Withholding Tax

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template