Form or W 4, Oregon Withholding, 150 101 402 2021

What is the Oregon W-4 Form?

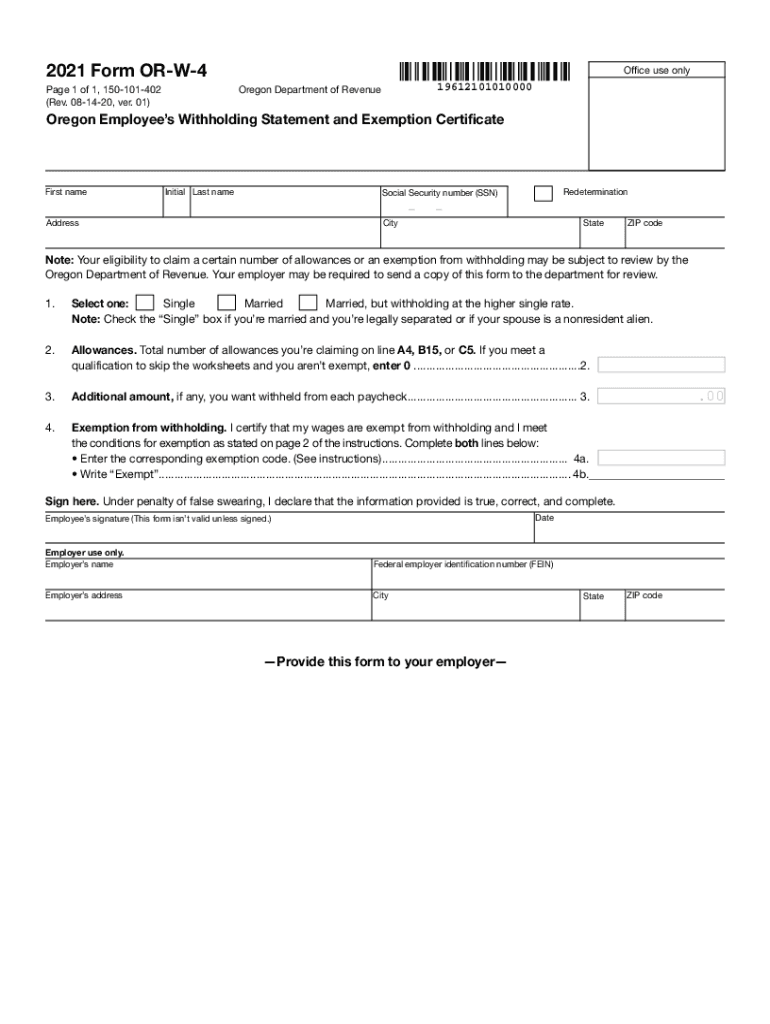

The Oregon W-4 form, also known as the Oregon Withholding form, is a crucial document for employees working in Oregon. It is used to determine the amount of state income tax that should be withheld from an employee's paycheck. By accurately completing this form, employees can ensure that the correct amount of taxes is withheld based on their individual financial situations. The form is essential for both employees and employers to maintain compliance with state tax regulations.

Steps to Complete the Oregon W-4 Form

Completing the Oregon W-4 form involves several straightforward steps:

- Personal Information: Begin by filling in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming. This number affects the amount of tax withheld.

- Additional Withholding: If you want to withhold an additional amount, specify that in the designated section.

- Signature: Sign and date the form to validate your information.

Once completed, the form should be submitted to your employer for processing.

How to Obtain the Oregon W-4 Form

The Oregon W-4 form can be easily obtained from the Oregon Department of Revenue's website. It is available as a downloadable PDF, allowing you to print it for completion. Additionally, many employers provide this form to new employees during the onboarding process. If you need a physical copy, you may also request one directly from your employer's human resources department.

Legal Use of the Oregon W-4 Form

The Oregon W-4 form is legally binding when completed accurately and submitted to your employer. It is essential for ensuring that the correct amount of state income tax is withheld from your paycheck. Compliance with the instructions provided on the form is necessary to avoid potential penalties or under-withholding issues. Employers are required to keep the completed forms on file for their records and to ensure proper withholding practices.

State-Specific Rules for the Oregon W-4 Form

Oregon has specific rules regarding the use of the W-4 form that differ from federal guidelines. For instance, the state allows employees to claim a certain number of allowances based on their personal and financial circumstances. Additionally, Oregon residents may face different tax rates compared to non-residents. It is important to stay updated on any changes to state tax laws that may affect the completion of the Oregon W-4 form.

Form Submission Methods

Once you have completed the Oregon W-4 form, it must be submitted to your employer. This can typically be done in person, or you may be able to submit it via email, depending on your employer's policies. It is advisable to check with your employer for their preferred submission method. Once submitted, ensure you keep a copy for your personal records.

Quick guide on how to complete 2021 form or w 4 oregon withholding 150 101 402

Easily Prepare Form OR W 4, Oregon Withholding, 150 101 402 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily access the right form and securely store it in the cloud. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Form OR W 4, Oregon Withholding, 150 101 402 across any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Edit and eSign Form OR W 4, Oregon Withholding, 150 101 402 with Ease

- Find Form OR W 4, Oregon Withholding, 150 101 402 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow meets all your document management requirements in just a few clicks from your device of choice. Edit and eSign Form OR W 4, Oregon Withholding, 150 101 402 to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form or w 4 oregon withholding 150 101 402

Create this form in 5 minutes!

How to create an eSignature for the 2021 form or w 4 oregon withholding 150 101 402

The way to make an e-signature for a PDF document online

The way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is an Oregon W4 form?

The Oregon W4 form is a crucial document for employees in Oregon, used to determine the state's withholding tax from your paycheck. It allows employees to specify the number of allowances they wish to claim and any additional withholding amounts. Accurately filling out the Oregon W4 ensures that your tax withholdings are correct, preventing any surprises during tax season.

-

How can airSlate SignNow help with the Oregon W4?

airSlate SignNow simplifies the process of completing and submitting the Oregon W4 form by providing a user-friendly interface for electronic signatures. With our platform, users can easily fill out their Oregon W4 and securely send it to employers. This streamlines the workflow, saving time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Oregon W4?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Whether you're looking for basic features or advanced functionalities for handling the Oregon W4 and other documents, our cost-effective solutions make it accessible for organizations of all sizes. Sign up today to find a plan that fits your requirements.

-

What features does airSlate SignNow offer for handling the Oregon W4?

With airSlate SignNow, you get features such as electronic signatures, document templates, and secure cloud storage, all designed to facilitate the management of the Oregon W4 form. Our platform also supports real-time collaboration, allowing multiple users to work on the document simultaneously. This ensures that your Oregon W4 processes are efficient and error-free.

-

Can I integrate airSlate SignNow with other software to manage the Oregon W4?

Absolutely! airSlate SignNow offers integration capabilities with various popular applications and workflow tools. This means you can easily connect your existing systems to manage the Oregon W4 alongside other essential documents, enhancing overall productivity within your organization. Explore our integrations to streamline your processes.

-

What are the benefits of using airSlate SignNow for the Oregon W4?

Using airSlate SignNow for your Oregon W4 has numerous benefits, such as reducing paperwork, increasing efficiency, and ensuring compliance with state regulations. Our platform's secure environment gives you peace of mind when handling sensitive information. Plus, the ease of use allows employees to complete their Oregon W4 without hassle.

-

How secure is the airSlate SignNow platform for handling the Oregon W4?

Security is a top priority for airSlate SignNow. Our platform employs robust encryption and complies with industry standards to protect your personal and financial information while managing the Oregon W4. You can have confidence in our commitment to maintaining the security and confidentiality of your documents.

Get more for Form OR W 4, Oregon Withholding, 150 101 402

- Standby guardianship affidavit of consent of a child s parent delaware form

- Stipulation of dismissal additional participants delaware form

- Stipulation of dismissal delaware form

- Delaware praecipe form

- Waiver of notice and consent guardianship fill in form pro se only delaware

- Waiver of rights under the quotservicemembers civil relief actquot delaware form

- Petition specific performance

- Affidavit of mailing delaware 497302414 form

Find out other Form OR W 4, Oregon Withholding, 150 101 402

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure