Dor W 4 2020

What is the Dor W-4?

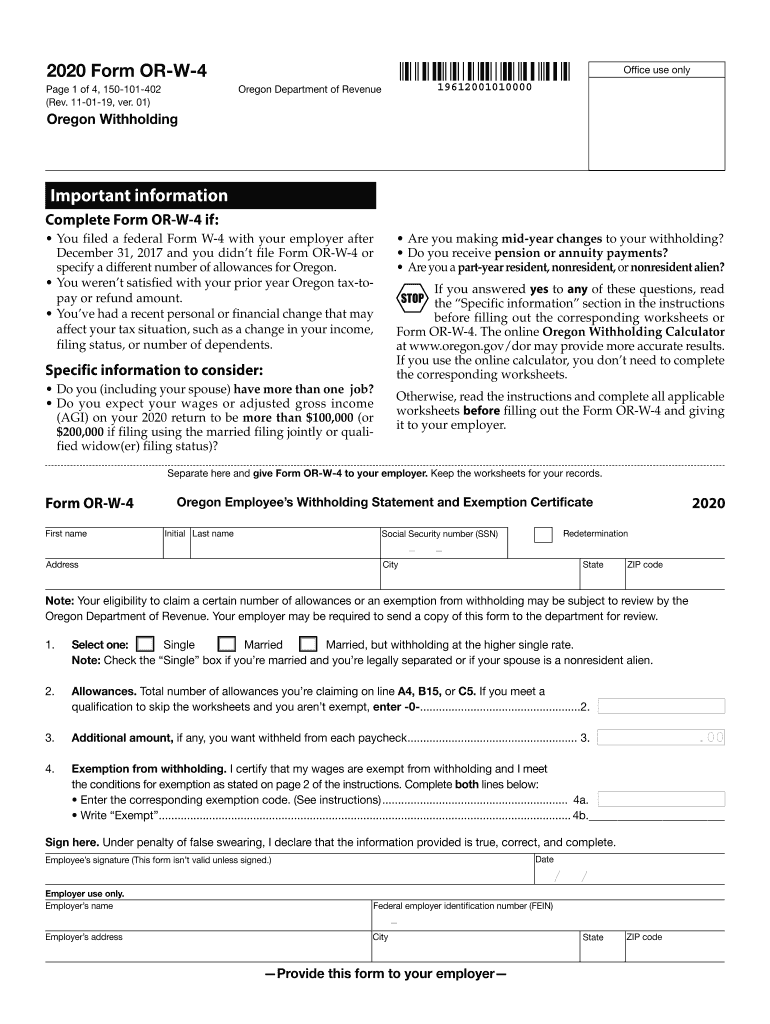

The Dor W-4 form, officially known as the Oregon Withholding Form, is a critical document used by employees in Oregon to determine the amount of state income tax to be withheld from their paychecks. This form is essential for both employees and employers, as it helps ensure compliance with Oregon tax laws. By filling out the Dor W-4, employees provide information regarding their filing status, exemptions, and additional withholding preferences, which ultimately influences their net pay and tax obligations.

How to use the Dor W-4

Using the Dor W-4 involves several straightforward steps. First, employees should obtain the form from their employer or download it from the Oregon Department of Revenue website. Next, individuals must accurately fill out their personal information, including their name, address, and Social Security number. The form also requires the employee to select their filing status and indicate any additional withholding amounts if desired. Once completed, the Dor W-4 should be submitted to the employer, who will use the information to adjust payroll tax withholdings accordingly.

Steps to complete the Dor W-4

Completing the Dor W-4 involves a series of specific steps:

- Obtain the Dor W-4 form from your employer or the Oregon Department of Revenue.

- Fill in your personal information, including your full name, address, and Social Security number.

- Select your filing status from the provided options, such as single, married, or head of household.

- Indicate any allowances you wish to claim, which can reduce the amount of tax withheld.

- Specify any additional amount you want withheld from each paycheck, if applicable.

- Sign and date the form before submitting it to your employer.

Legal use of the Dor W-4

The legal use of the Dor W-4 is governed by Oregon state tax laws. It is essential for employees to provide accurate information on the form to avoid potential penalties for under-withholding or over-withholding taxes. Employers are responsible for ensuring that the form is properly completed and maintained as part of their payroll records. The Dor W-4 must be updated whenever an employee's financial situation changes, such as a change in marital status or the birth of a child, to ensure compliance with state regulations.

Key elements of the Dor W-4

Several key elements are crucial to understanding the Dor W-4 form:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must select their appropriate filing status, which affects tax rates.

- Allowances: The number of allowances claimed will determine the withholding amount.

- Additional Withholding: Employees can request extra amounts to be withheld from their paychecks.

- Signature: A signature is required to validate the information provided on the form.

Form Submission Methods

The Dor W-4 can be submitted to employers through various methods, depending on the employer's preferences. Common submission methods include:

- In-Person: Employees can hand the completed form directly to their payroll department.

- Mail: Some employers may allow the form to be mailed to their HR or payroll office.

- Email: In certain cases, employers may accept scanned copies of the completed form sent via email.

Quick guide on how to complete dor w 4

Easily Prepare Dor W 4 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can locate the suitable form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Dor W 4 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The Easiest Way to Edit and eSign Dor W 4 Effortlessly

- Obtain Dor W 4 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign Dor W 4 and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor w 4

Create this form in 5 minutes!

People also ask

-

What is the Oregon W 4 form?

The Oregon W 4 form is a tax form used by employees to declare their withholding allowances to their employers in Oregon. By completing this form correctly, you ensure that the correct amount of state income tax is withheld from your paycheck. It is essential for compliance with Oregon state tax laws, helping to avoid penalties or unexpected tax liabilities.

-

How can airSlate SignNow help with the Oregon W 4 form?

airSlate SignNow simplifies the process of filling out and signing the Oregon W 4 form electronically. Our platform allows you to complete, sign, and send documents securely, streamlining payroll processes. You can easily store your signed forms for future reference, ensuring that you remain compliant with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the Oregon W 4 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While there may be a subscription fee, the cost is often outweighed by the time savings and efficiencies gained from using our electronic signing solution. This makes it a cost-effective option for managing your Oregon W 4 form and other documents.

-

What features does airSlate SignNow offer for managing the Oregon W 4 form?

airSlate SignNow provides several features to support efficient handling of the Oregon W 4 form including customizable templates, secure electronic signatures, and real-time document tracking. You can also collaborate with team members and clients seamlessly, ensuring that all versions of your forms are managed effectively.

-

Can I integrate airSlate SignNow with other software for the Oregon W 4 form?

Absolutely! airSlate SignNow integrates with various software and platforms, allowing you to streamline your workflow related to the Oregon W 4 form. Whether you're using CRM systems, document management platforms, or HR software, our integrations help to enhance your document signing experience.

-

What are the benefits of using airSlate SignNow for the Oregon W 4 form?

Using airSlate SignNow for the Oregon W 4 form enhances efficiency, security, and accuracy. You can quickly fill out the form, obtain necessary signatures, and store it all in one secure location. This also reduces the risk of errors and improves compliance with Oregon tax regulations.

-

How secure is airSlate SignNow when handling the Oregon W 4 form?

Security is a top priority at airSlate SignNow. We use advanced encryption technology and secure servers to protect your documents, including the Oregon W 4 form. Our compliance with industry standards ensures that your sensitive information is safe during the eSigning process.

Get more for Dor W 4

- Ohio department of bmv site statsorg form

- Form mv 426b penndot

- Oregon dmv accident report form amgazpl

- State of alaska division of motor vehicles application for school form

- Bdvr 153 record request for account holders bdvr 153 record request for account holders form

- Make a high quality logo for you by workkruchok7 fiverr form

- Update my address welcome to the state of new york form

- Aish open government form

Find out other Dor W 4

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe