Montana Employee's Withholding and Exemption 2023

Understanding the Oregon Withholding Form

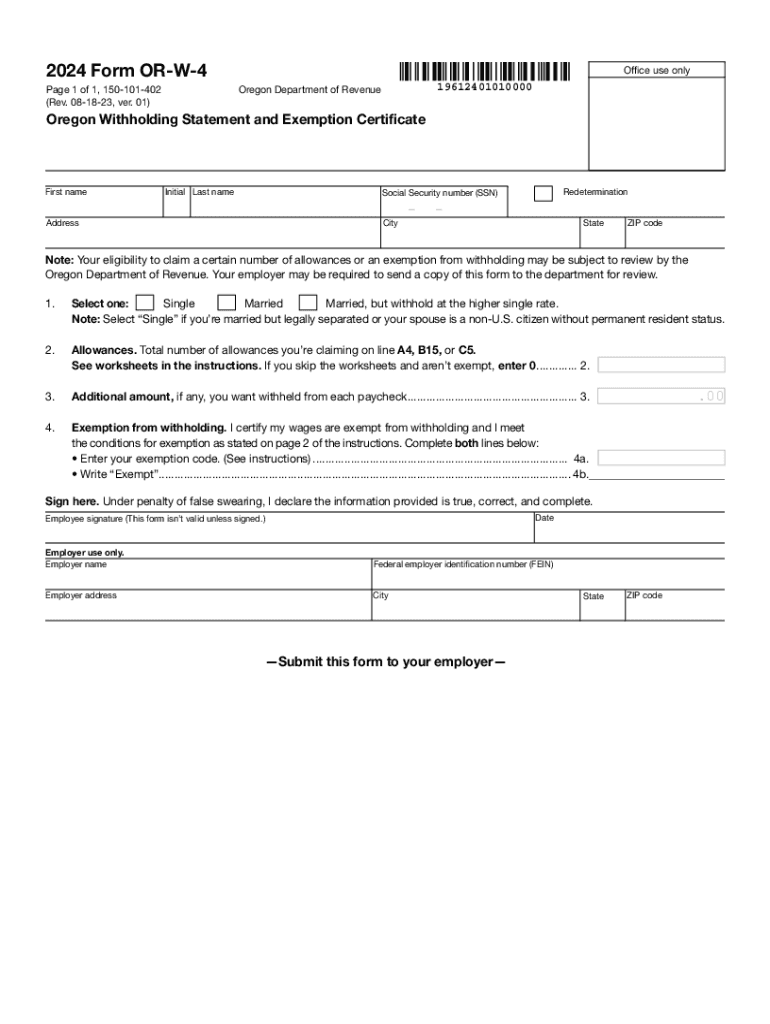

The Oregon withholding form, commonly referred to as the OR W-4, is essential for employees in Oregon to determine the amount of state income tax to withhold from their paychecks. This form allows employees to specify their withholding allowances, which can impact their take-home pay. By accurately completing the OR W-4, employees can ensure they are not overpaying or underpaying their state taxes throughout the year.

Steps to Complete the Oregon Withholding Form

Filling out the OR W-4 is straightforward. Here are the steps to ensure accurate completion:

- Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Withholding Allowances: Calculate and enter the number of allowances you wish to claim. This can be based on your personal situation, such as dependents or other deductions.

- Additional Withholding: If you want to withhold an additional amount, specify that in the designated section.

- Signature: Sign and date the form to validate your submission.

Legal Use of the Oregon Withholding Form

The OR W-4 is a legally recognized document that must be submitted to your employer. It ensures compliance with Oregon state tax regulations. Employers are required to keep this form on file and use it to calculate the appropriate withholding amounts from employees' paychecks. Accurate completion is crucial to avoid potential penalties or issues with the Oregon Department of Revenue.

Filing Deadlines and Important Dates

While the OR W-4 does not have a specific filing deadline, it is important to submit it to your employer as soon as you start a new job or experience a change in your financial situation. Additionally, if you need to update your withholding due to changes in your life circumstances, such as marriage or the birth of a child, it is advisable to submit a new OR W-4 promptly to ensure accurate withholding throughout the year.

Examples of Using the Oregon Withholding Form

Consider a few scenarios where the OR W-4 is applicable:

- New Employment: A new employee fills out the OR W-4 upon starting a job to establish their withholding preferences.

- Change in Family Status: An employee who gets married may want to adjust their allowances to reflect their new filing status.

- Additional Income: If an employee takes on a second job, they might submit a new OR W-4 to increase their withholding to cover additional tax liabilities.

Eligibility Criteria for the Oregon Withholding Form

All employees working in Oregon are eligible to complete the OR W-4. This includes full-time, part-time, and seasonal workers. It is important for employees to understand that even if they expect to owe no state income tax, they should still submit the form to ensure proper withholding practices are followed. Additionally, self-employed individuals may need to consider other forms for estimated tax payments, as the OR W-4 is specifically for employees.

Quick guide on how to complete montana employees withholding and exemption

Prepare Montana Employee's Withholding And Exemption easily on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Montana Employee's Withholding And Exemption on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign Montana Employee's Withholding And Exemption with ease

- Obtain Montana Employee's Withholding And Exemption and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Montana Employee's Withholding And Exemption and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct montana employees withholding and exemption

Create this form in 5 minutes!

How to create an eSignature for the montana employees withholding and exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an 'or w 4 form' and why is it important?

The 'or w 4 form' is a tax form used by employees to indicate their tax withholding preferences. It plays a critical role in ensuring that the correct amount of taxes is withheld from your paycheck. Understanding how to complete this form correctly is essential for managing your tax obligations effectively.

-

How can airSlate SignNow help me with the 'or w 4 form'?

airSlate SignNow streamlines the process of filling out and signing the 'or w 4 form.' Our platform allows you to electronically complete and eSign this document, ensuring that it is filed quickly and securely, which saves you time and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for the 'or w 4 form'?

airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that allows unlimited access to use features like eSigning the 'or w 4 form' effectively, ensuring you get excellent value for your investment.

-

Can I access the 'or w 4 form' templates on airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for the 'or w 4 form' that you can access anytime. These templates simplify the process of preparing necessary documents and ensure compliance with IRS requirements.

-

How secure is airSlate SignNow when handling my 'or w 4 form'?

Security is a top priority for airSlate SignNow. Our platform uses advanced encryption methods to protect your data and information, including the 'or w 4 form,' ensuring that all your documents remain confidential and secure at all times.

-

Can I integrate airSlate SignNow with other software for managing the 'or w 4 form'?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, simplifying the management of the 'or w 4 form.' This integration allows you to streamline document workflows across multiple platforms, enhancing efficiency.

-

What is the process to sign the 'or w 4 form' using airSlate SignNow?

To sign the 'or w 4 form' using airSlate SignNow, simply upload the document to our platform, fill in the required fields, and add your eSignature. The process is intuitive and designed to be user-friendly, ensuring a smooth experience for everyone involved.

Get more for Montana Employee's Withholding And Exemption

Find out other Montana Employee's Withholding And Exemption

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure