2022 Form 921 Application for Homestead Exemption 2021

What is the 2022 Form 921 Application For Homestead Exemption

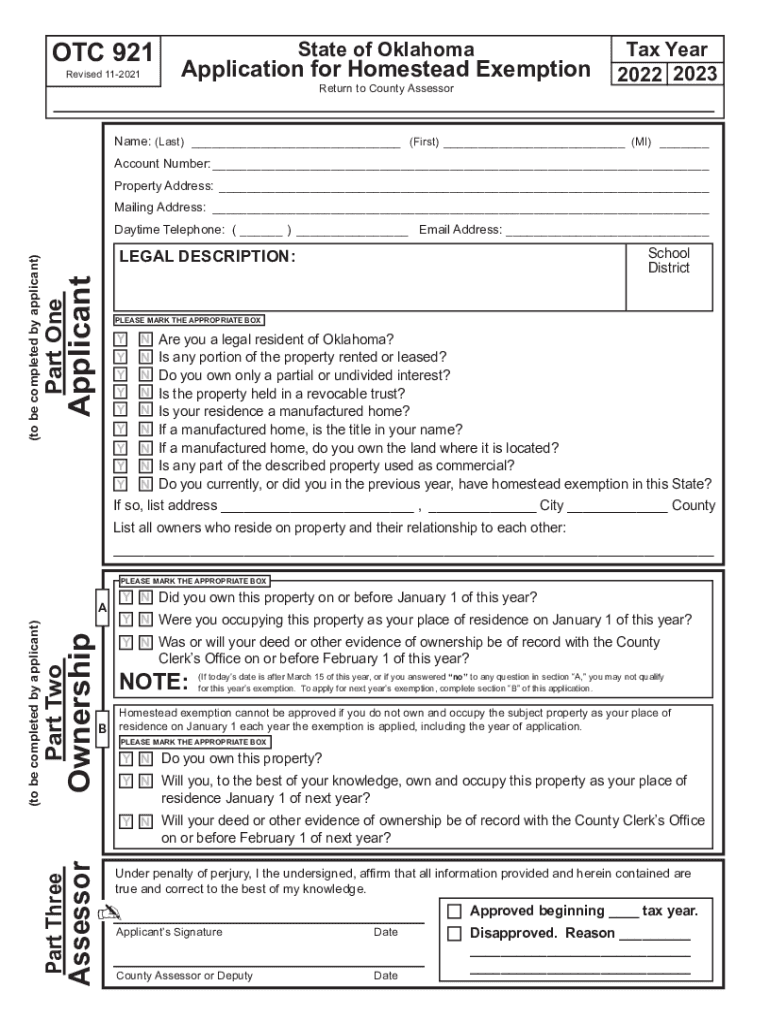

The 2022 Form 921, also known as the Application for Homestead Exemption, is an official document used in Oklahoma to apply for a homestead exemption. This exemption provides property tax relief for eligible homeowners by reducing the assessed value of their primary residence. The form is essential for those seeking to benefit from the Oklahoma homestead exemption laws, which aim to support residents in maintaining homeownership.

Eligibility Criteria for the 2022 Form 921 Application

To qualify for the homestead exemption through the 2022 Form 921, applicants must meet specific criteria. Generally, the applicant must be the owner of the property and occupy it as their primary residence. Additionally, applicants must not have claimed a homestead exemption on any other property. Certain exemptions may also apply to seniors, disabled individuals, and veterans, providing additional tax relief based on their status.

Steps to Complete the 2022 Form 921 Application For Homestead Exemption

Completing the 2022 Form 921 involves several straightforward steps:

- Gather necessary information, including proof of ownership and residency.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Sign and date the application to certify the information provided.

- Submit the completed form to the appropriate county assessor's office by the designated deadline.

Required Documents for the 2022 Form 921 Application

When submitting the 2022 Form 921, applicants must provide specific documentation to support their claim. Required documents typically include:

- Proof of identity, such as a driver's license or state ID.

- Evidence of property ownership, like a deed or tax statement.

- Documentation confirming residency, such as utility bills or lease agreements.

Form Submission Methods for the 2022 Form 921 Application

The 2022 Form 921 can be submitted through various methods to accommodate different preferences. Applicants may choose to:

- Submit the form online through the county assessor's website, if available.

- Mail the completed form to the appropriate county assessor's office.

- Deliver the form in person to the county office during business hours.

Legal Use of the 2022 Form 921 Application For Homestead Exemption

The legal use of the 2022 Form 921 is governed by Oklahoma state laws regarding property tax exemptions. When completed accurately and submitted on time, the form serves as a binding request for tax relief. It is crucial for applicants to ensure compliance with all legal requirements to avoid penalties or denial of the exemption.

Quick guide on how to complete 2021 2022 form 921 application for homestead exemption

Prepare 2022 Form 921 Application For Homestead Exemption effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle 2022 Form 921 Application For Homestead Exemption on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign 2022 Form 921 Application For Homestead Exemption effortlessly

- Obtain 2022 Form 921 Application For Homestead Exemption and click on Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the specialized tools that airSlate SignNow offers for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Edit and electronically sign 2022 Form 921 Application For Homestead Exemption and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 2022 form 921 application for homestead exemption

Create this form in 5 minutes!

How to create an eSignature for the 2021 2022 form 921 application for homestead exemption

How to make an e-signature for a PDF document in the online mode

How to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the otc 921 solution offered by airSlate SignNow?

The otc 921 solution from airSlate SignNow enables businesses to manage their document signing processes efficiently. It combines ease of use with powerful eSignature features, ensuring that every transaction is fast and secure.

-

How does the pricing for the otc 921 work?

airSlate SignNow offers competitive pricing for the otc 921 service, ensuring that businesses of all sizes can access its features. You can select from a variety of plans tailored to your specific needs, allowing for flexibility and cost-effectiveness.

-

What are the key features of otc 921?

The key features of otc 921 include customizable templates, advanced eSignature capabilities, and detailed audit trails. These features are designed to enhance productivity and ensure compliance throughout the document signing process.

-

What benefits does the otc 921 provide for businesses?

The otc 921 provides numerous benefits, including reduced turnaround times for document processing and improved accuracy. By leveraging airSlate SignNow's capabilities, businesses can enhance their operational efficiency and increase customer satisfaction.

-

Can otc 921 integrate with other software solutions?

Yes, the otc 921 solution is highly integrable with various software applications. Whether you're using CRM systems, document management tools, or other business software, airSlate SignNow ensures seamless integration to streamline your workflows.

-

How secure is the otc 921 eSignature solution?

The otc 921 eSignature solution prioritizes security, employing bank-level encryption and strict authentication processes. With these measures, businesses can confidently use airSlate SignNow for their sensitive document transactions.

-

Is it easy to use the otc 921 solution?

Absolutely! The otc 921 solution is designed with user-friendliness in mind. Its intuitive interface allows users to navigate and manage documents effortlessly, making it accessible for users regardless of their technical expertise.

Get more for 2022 Form 921 Application For Homestead Exemption

- Final judgment change name form

- Florida petition change 497303007 form

- Final judgment change name 497303008 form

- 3 day notice to pay rent or lease terminated for residential property florida form

- 7 day notice of material noncompliance with lease or rental agreement residential 7 days to cure from landlord to tenant florida form

- 7 day notice of material noncompliance with lease or rental agreement nonresidential 7 days to cure from tenant to landlord form

- 3 day notice 497303012 form

- Assignment of mortgage by individual mortgage holder florida form

Find out other 2022 Form 921 Application For Homestead Exemption

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document