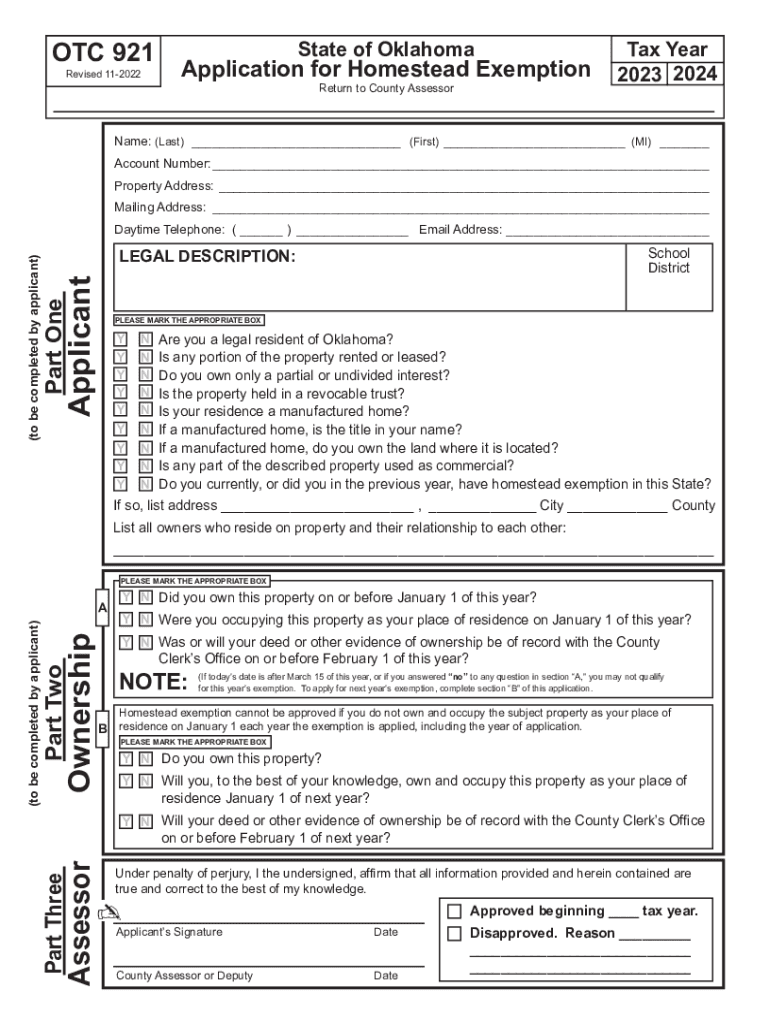

2023 2024 Form 921 Application for Homestead Exemption 2022-2026

What is the 2 Form 921 Application For Homestead Exemption

The 2 Form 921, known as the Application for Homestead Exemption, is a crucial document for homeowners in the United States seeking tax relief on their primary residence. This form allows eligible individuals to apply for a homestead exemption, which can significantly reduce property taxes. The exemption is designed to provide financial assistance to homeowners, making housing more affordable. Understanding the specifics of this form is essential for those looking to benefit from the associated tax savings.

Steps to complete the 2 Form 921 Application For Homestead Exemption

Completing the 2 Form 921 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including property details and personal identification. Follow these steps:

- Obtain the form from your local tax assessor’s office or download it from official state websites.

- Fill out your personal information, including name, address, and contact details.

- Provide information about the property for which you are applying for the exemption, including its location and assessed value.

- Sign and date the application to affirm the information is correct.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

Eligibility Criteria

To qualify for the homestead exemption using the 2 Form 921, applicants must meet specific eligibility criteria. Generally, these include:

- The property must be the applicant's primary residence.

- The applicant must be the owner of the property.

- Applicants may need to provide proof of residency, such as a driver’s license or utility bills.

- Income limits may apply in some states, affecting eligibility.

Required Documents

When applying for the homestead exemption, certain documents are typically required to support your application. These may include:

- Proof of ownership, such as a deed or title.

- Identification documents, like a driver’s license or Social Security card.

- Proof of residency, which can be demonstrated with utility bills or bank statements.

- Any additional documentation requested by the local tax authority.

Form Submission Methods

The 2 Form 921 can be submitted through various methods, depending on local regulations. Common submission options include:

- Online submission through the local tax assessor's website.

- Mailing the completed form to the designated tax office.

- In-person submission at the local tax authority office.

Legal use of the 2 Form 921 Application For Homestead Exemption

The legal use of the 2 Form 921 is governed by state and local laws regarding property tax exemptions. It is essential to complete the form accurately and submit it within the designated timeframe to ensure compliance with these regulations. Misrepresentation or failure to meet the criteria can result in penalties or denial of the exemption.

Quick guide on how to complete 2023 2024 form 921 application for homestead exemption

Complete 2023 2024 Form 921 Application For Homestead Exemption effortlessly on any device

Digital document management has become favored among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage 2023 2024 Form 921 Application For Homestead Exemption on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign 2023 2024 Form 921 Application For Homestead Exemption with ease

- Obtain 2023 2024 Form 921 Application For Homestead Exemption and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the frustration of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Modify and eSign 2023 2024 Form 921 Application For Homestead Exemption and guarantee excellent communication at any point during the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 2024 form 921 application for homestead exemption

Create this form in 5 minutes!

People also ask

-

What is otc 921 and how does it benefit my business?

The otc 921 is a powerful digital signing solution that streamlines the document management process for businesses. By using otc 921, you can send and eSign documents quickly and efficiently, improving workflow and reducing turnaround times.

-

How much does the otc 921 service cost?

Pricing for the otc 921 varies depending on the specific needs of your business and the plan you choose. To get a detailed breakdown of costs, you can visit our pricing page or contact our sales team for personalized information.

-

What features does otc 921 offer?

The otc 921 includes a variety of features such as customizable templates, automated workflows, and secure eSignature capabilities. These features enhance document management and help ensure compliance with legal requirements.

-

Can I integrate otc 921 with other applications?

Yes, otc 921 offers seamless integrations with popular applications like CRM systems, cloud storage services, and more. This allows you to enhance your existing workflows and leverage the benefits of otc 921 across your entire tech stack.

-

Is otc 921 suitable for small businesses?

Absolutely, otc 921 is designed to be user-friendly and cost-effective, making it a great choice for small businesses. Its affordable pricing and intuitive interface help small teams manage documents efficiently without the need for extensive training.

-

What are the security measures in place for otc 921?

Security is a top priority for otc 921. We utilize advanced encryption methods to protect sensitive data, ensuring that your documents are safe during transmission and storage. Additionally, otc 921 complies with industry standards for data protection.

-

How does otc 921 improve document turnaround times?

By utilizing otc 921, businesses can signNowly reduce document turnaround times through automated sending and eSigning features. This speed ensures that contracts and agreements are finalized faster, enabling you to focus on growing your business.

Get more for 2023 2024 Form 921 Application For Homestead Exemption

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy mississippi form

- Warranty deed for parents to child with reservation of life estate mississippi form

- Warranty deed for separate or joint property to joint tenancy mississippi form

- Warranty deed to separate property of one spouse to both spouses as joint tenants mississippi form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries mississippi form

- Warranty deed from limited partnership or llc is the grantor or grantee mississippi form

- Life estate deed 497315764 form

- Mississippi individual 497315765 form

Find out other 2023 2024 Form 921 Application For Homestead Exemption

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself