Oklahoma Form Otc 921 2018

What is the Oklahoma Form OTC 921

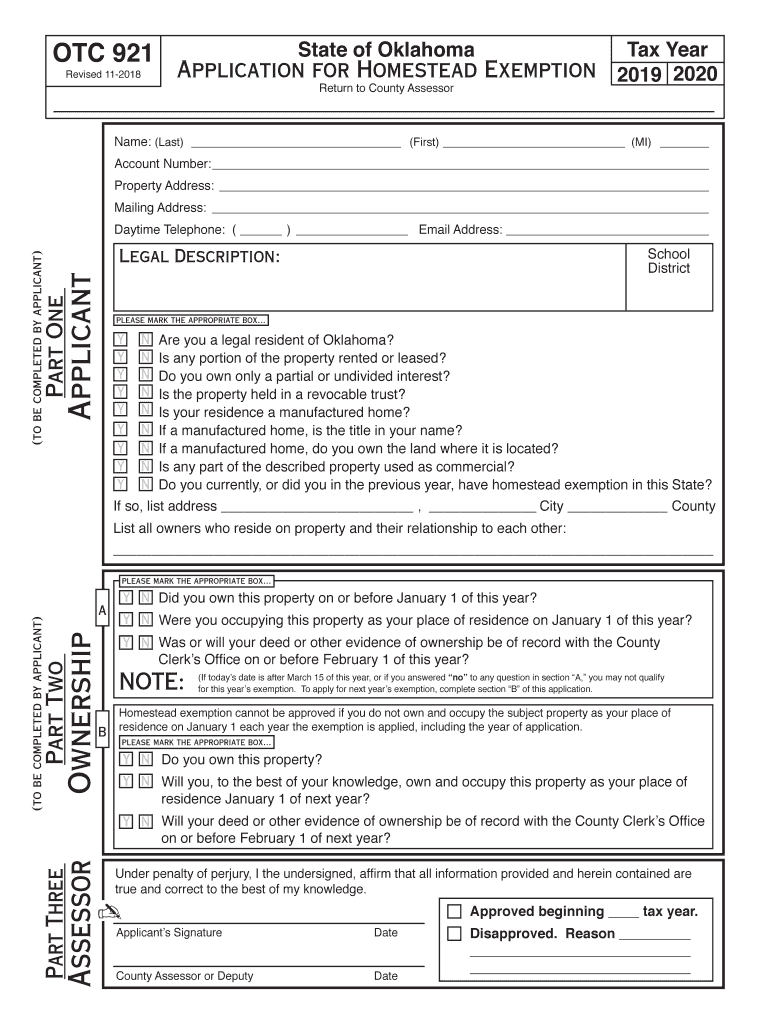

The Oklahoma Form OTC 921 is a tax document used primarily for the purpose of reporting and remitting sales and use tax in the state of Oklahoma. This form is essential for businesses that collect sales tax from customers and must ensure compliance with state tax regulations. The form helps in accurately calculating the amount owed to the state, thereby facilitating proper tax administration. It is critical for both businesses and tax authorities to maintain accurate records of sales tax collected, making the OTC 921 an integral part of the tax filing process in Oklahoma.

How to Use the Oklahoma Form OTC 921

Using the Oklahoma Form OTC 921 involves several steps to ensure accurate completion and submission. First, gather all necessary sales data, including total sales, exemptions, and the amount of sales tax collected. Next, fill out the form by entering the required information in the designated fields, ensuring that all figures are accurate and reflect your business's sales activities. After completing the form, review it for any errors before submitting it to the Oklahoma Tax Commission. This form can be submitted electronically or via mail, depending on your preference and the tools available to you.

Steps to Complete the Oklahoma Form OTC 921

Completing the Oklahoma Form OTC 921 requires a systematic approach to ensure accuracy. Follow these steps:

- Collect all relevant sales data for the reporting period, including total sales and tax collected.

- Obtain the OTC 921 form from the Oklahoma Tax Commission website or through authorized channels.

- Fill in the required fields, including your business name, address, and sales figures.

- Calculate the total sales tax due based on the rates applicable to your business.

- Double-check all entries for accuracy and completeness.

- Submit the completed form either electronically or by mail, ensuring it is sent before the deadline.

Legal Use of the Oklahoma Form OTC 921

The Oklahoma Form OTC 921 is legally binding when completed and submitted in accordance with state regulations. It serves as an official record of sales tax collected and remitted, which is crucial for compliance with Oklahoma tax laws. Businesses must ensure that they use the form correctly to avoid penalties and maintain good standing with the state tax authority. Proper use includes timely submission and accurate reporting of sales tax, which can protect businesses from audits and potential legal issues.

Key Elements of the Oklahoma Form OTC 921

Several key elements are essential to understand when working with the Oklahoma Form OTC 921. These include:

- Business Information: This section requires the name, address, and tax identification number of the business.

- Sales Data: Accurate reporting of total sales, exempt sales, and taxable sales is crucial.

- Tax Calculation: The form includes fields for calculating the total sales tax due based on reported figures.

- Signature: The form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Form Submission Methods

The Oklahoma Form OTC 921 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Businesses can file the form electronically through the Oklahoma Tax Commission's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address specified by the Oklahoma Tax Commission.

- In-Person: Businesses may also choose to submit the form in person at designated tax commission offices.

Quick guide on how to complete otc 921 2018 2019 form

Complete Oklahoma Form Otc 921 effortlessly on any device

Digital document organization has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Oklahoma Form Otc 921 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Oklahoma Form Otc 921 with ease

- Obtain Oklahoma Form Otc 921 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Oklahoma Form Otc 921 and assure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct otc 921 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the otc 921 2018 2019 form

How to create an electronic signature for your Otc 921 2018 2019 Form in the online mode

How to generate an eSignature for the Otc 921 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the Otc 921 2018 2019 Form in Gmail

How to make an electronic signature for the Otc 921 2018 2019 Form from your smart phone

How to make an eSignature for the Otc 921 2018 2019 Form on iOS

How to generate an electronic signature for the Otc 921 2018 2019 Form on Android devices

People also ask

-

What is the OTC Form 921 and how do I use it with airSlate SignNow?

The OTC Form 921 is a document used for various administrative purposes. With airSlate SignNow, you can easily upload, eSign, and manage this form electronically. Our platform streamlines the process, ensuring that you can complete the OTC Form 921 quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the OTC Form 921?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost can vary based on the features you select and the number of users. However, using airSlate SignNow to manage the OTC Form 921 is generally a cost-effective solution compared to traditional paper methods.

-

What features does airSlate SignNow provide for managing the OTC Form 921?

airSlate SignNow provides a variety of features to simplify the handling of the OTC Form 921, including customizable templates, advanced eSignature capabilities, and secure document storage. This ensures that you can manage your forms efficiently while maintaining compliance and security.

-

Can airSlate SignNow integrate with other tools for processing the OTC Form 921?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, allowing you to enhance your workflow when working with the OTC Form 921. This includes CRM systems, cloud storage solutions, and various productivity applications.

-

How does using airSlate SignNow for the OTC Form 921 benefit my business?

By using airSlate SignNow for the OTC Form 921, your business can save time and reduce errors associated with manual processing. The digitization of the form simplifies collaboration and speeds up turnaround times, ultimately improving your operational efficiency.

-

Is it easy to get started with airSlate SignNow for the OTC Form 921?

Getting started with airSlate SignNow for the OTC Form 921 is very straightforward. You can sign up for a free trial and start uploading your documents right away. Our user-friendly interface is designed to help you navigate the process with ease.

-

Are there any security measures in place for the OTC Form 921 on airSlate SignNow?

Yes, airSlate SignNow prioritizes security and privacy for all documents, including the OTC Form 921. We use advanced encryption and secure access protocols to ensure your sensitive information remains protected throughout the signing process.

Get more for Oklahoma Form Otc 921

- Motion response form missoula county home co missoula mt

- Foc50 form

- Texas security id form

- Probation referral form oakland county

- High mileage appeal form orangeburg county orangeburgcounty

- Listing agreement standard form new orleans undersigned client 2005

- Printable lease form

- The justice ronald b lester memorial bursary thunder bay community form

Find out other Oklahoma Form Otc 921

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement