Instructions for Completing the 511 NR Income Tax Form 2021

Instructions for Completing the 511 NR Income Tax Form

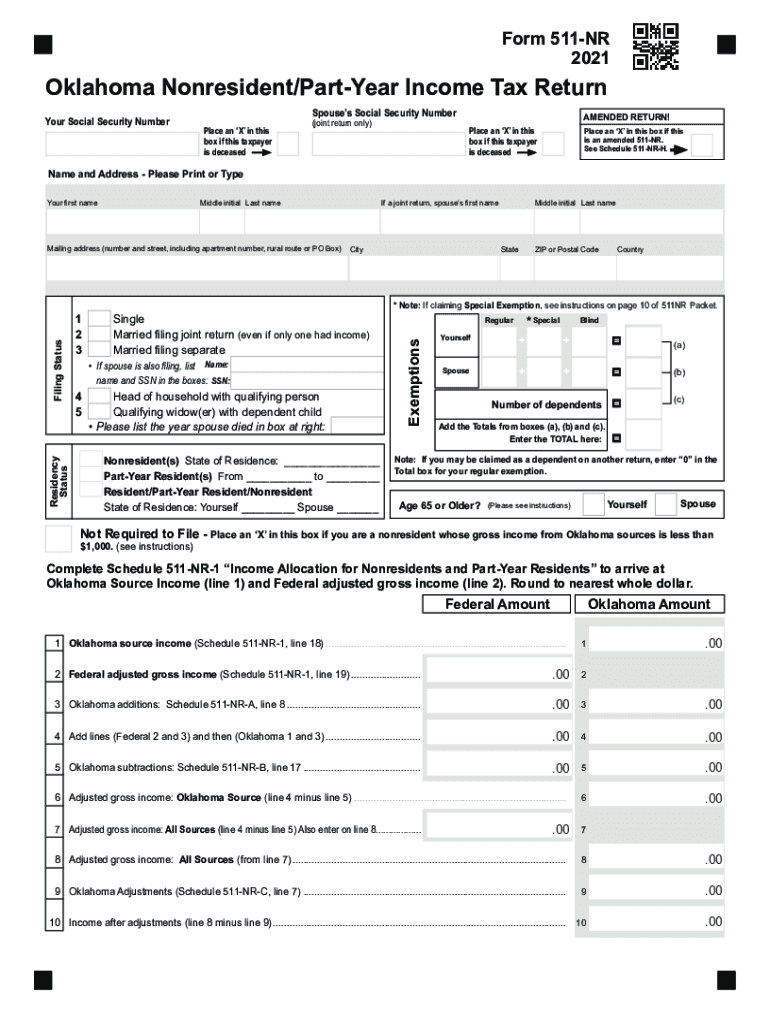

The Oklahoma 511NR form is designed for nonresidents who earn income in Oklahoma. To complete this form accurately, you must first gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Ensure that you have your Social Security number and the details of any income earned in Oklahoma. The form requires you to report your total income, deductions, and any credits you may be eligible for. Follow the instructions carefully to avoid errors that could delay processing.

Steps to Complete the Instructions for Completing the 511 NR Income Tax Form

Completing the Oklahoma 511NR form involves several key steps:

- Gather all necessary documents, including income statements and identification.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income earned in Oklahoma, ensuring to include all relevant sources.

- Calculate your deductions and any applicable tax credits.

- Review the completed form for accuracy before submission.

By following these steps, you can ensure that your form is completed correctly and submitted on time.

Required Documents

To successfully complete the Oklahoma 511NR form, you will need to provide several documents:

- W-2 forms from employers for income earned in Oklahoma.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or interest.

- Proof of deductions, such as receipts or statements related to eligible expenses.

Having these documents ready will streamline the process and help ensure that you report accurate information.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Oklahoma 511NR form to avoid penalties. Generally, the deadline for filing your state income tax return is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you owe taxes, payments are also due by this date to avoid interest and penalties.

Form Submission Methods

The Oklahoma 511NR form can be submitted in several ways:

- Online: Use the Oklahoma Tax Commission's online filing system for a quick and efficient submission.

- By Mail: Print the completed form and send it to the designated address provided in the instructions.

- In-Person: You can also submit the form in person at your local Oklahoma Tax Commission office.

Choosing the right submission method can help ensure that your form is processed in a timely manner.

Penalties for Non-Compliance

Failure to file the Oklahoma 511NR form by the deadline can result in penalties. The state may impose a late filing penalty, which typically amounts to a percentage of the unpaid tax. Additionally, interest may accrue on any unpaid taxes from the due date until payment is made. To avoid these consequences, it is important to file your form on time and ensure that all information is accurate.

Legal Use of the Instructions for Completing the 511 NR Income Tax Form

The Oklahoma 511NR form must be completed in accordance with state tax laws. This includes accurately reporting all income earned in the state and claiming only eligible deductions and credits. Using the form legally ensures that you remain compliant with state regulations, which helps avoid potential audits or legal issues. It is advisable to consult a tax professional if you have questions about your specific situation.

Quick guide on how to complete instructions for completing the 511 nr income tax form

Prepare Instructions For Completing The 511 NR Income Tax Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Instructions For Completing The 511 NR Income Tax Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and eSign Instructions For Completing The 511 NR Income Tax Form with ease

- Locate Instructions For Completing The 511 NR Income Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive details using the tools airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether it be by email, SMS, an invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Completing The 511 NR Income Tax Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for completing the 511 nr income tax form

Create this form in 5 minutes!

How to create an eSignature for the instructions for completing the 511 nr income tax form

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the Oklahoma 511NR form?

The Oklahoma 511NR form is a crucial document used for reporting non-resident income for tax purposes in Oklahoma. This form helps individuals who earn income in the state but reside elsewhere to comply with state tax regulations efficiently.

-

How can I fill out the Oklahoma 511NR form using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the Oklahoma 511NR form by uploading the document and utilizing our user-friendly interface. The platform provides tools for adding signatures and customizing document fields, ensuring you complete the form correctly.

-

Is there a cost associated with using airSlate SignNow for the Oklahoma 511NR form?

airSlate SignNow offers various pricing plans that cater to different needs, including options suitable for occasional users to businesses. You can check our pricing page to find the best plan for submitting your Oklahoma 511NR form affordably.

-

What are the benefits of using airSlate SignNow for the Oklahoma 511NR form?

One of the key benefits of using airSlate SignNow is the convenience it offers, allowing users to fill out and eSign the Oklahoma 511NR form from anywhere at any time. Additionally, the platform ensures security and compliance, providing peace of mind when submitting sensitive documents.

-

Can I save my progress while filling out the Oklahoma 511NR form?

Yes, airSlate SignNow allows you to save your progress while completing the Oklahoma 511NR form. This feature is handy for users who need to gather information or review details before finalizing their submission.

-

Does airSlate SignNow integrate with other apps for filing the Oklahoma 511NR form?

Absolutely! airSlate SignNow integrates with various applications, making it easier to manage your documents. You can connect with accounting software or document management tools to streamline the process of filing your Oklahoma 511NR form.

-

How secure is my information when using airSlate SignNow for the Oklahoma 511NR form?

Data security is a top priority at airSlate SignNow. When utilizing the platform to manage your Oklahoma 511NR form, your information is protected with advanced encryption and robust compliance measures, ensuring your documents remain safe.

Get more for Instructions For Completing The 511 NR Income Tax Form

Find out other Instructions For Completing The 511 NR Income Tax Form

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free