Form 511 NR Oklahoma Individual Income Form for Nonresidents and Part Year Residents Packet & Instructions 2022

Understanding the Form 511 NR for Oklahoma Nonresidents

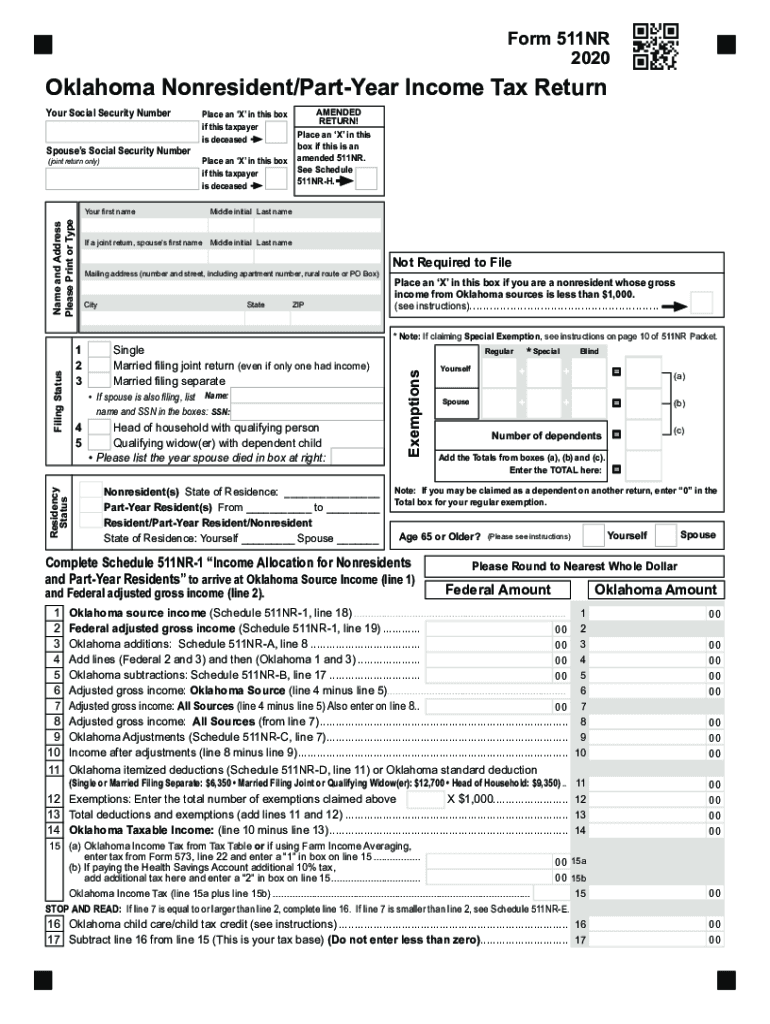

The Form 511 NR is specifically designed for individuals who are nonresidents or part-year residents of Oklahoma. This form is essential for reporting income earned in Oklahoma while residing elsewhere. It allows taxpayers to accurately calculate their Oklahoma state income tax obligations based on the income sourced from within the state. Understanding the purpose and requirements of this form is crucial for compliance with Oklahoma tax laws.

Steps to Complete the Form 511 NR

Completing the Form 511 NR involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your income earned in Oklahoma. This may include W-2 forms, 1099 forms, and any other relevant income statements. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income earned in Oklahoma, ensuring you include all relevant sources.

- Calculate your total Oklahoma tax liability based on the provided tax tables.

- Complete the necessary schedules if you have deductions or credits to claim.

- Review your completed form for accuracy before submission.

Key Elements of the Form 511 NR

The Form 511 NR includes several critical components that taxpayers must pay attention to. These elements help ensure that all necessary information is provided for accurate tax processing. Key elements include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must detail all income earned from Oklahoma sources.

- Deductions and Credits: If applicable, include any deductions or credits that may reduce your tax liability.

- Signature: The form must be signed and dated to validate the information provided.

Filing Deadlines for the Form 511 NR

It is important to be aware of the filing deadlines associated with the Form 511 NR to avoid penalties. Typically, the deadline for submitting this form coincides with the federal tax filing deadline, which is usually April 15. However, if you are unable to file by this date, you may request an extension, but it is essential to ensure that any tax owed is paid by the original deadline to avoid interest and penalties.

Legal Use of the Form 511 NR

The Form 511 NR is legally binding when completed correctly and submitted on time. To ensure its legal validity, it is important to follow all instructions provided by the Oklahoma Tax Commission. This includes maintaining accurate records of all income and deductions claimed, as well as ensuring that the form is signed and dated. Utilizing a reliable eSignature solution can enhance the security and legality of your submission, ensuring compliance with electronic signature laws.

Obtaining the Form 511 NR

The Form 511 NR can be obtained through the Oklahoma Tax Commission's official website or by contacting their office directly. It is available in a fillable format, allowing taxpayers to complete it digitally. Additionally, printed copies may be available at local tax offices or libraries. Ensuring you have the most current version of the form is essential for accurate filing.

Quick guide on how to complete 2020 form 511 nr oklahoma individual income form for nonresidents and part year residents packet ampamp instructions

Accomplish Form 511 NR Oklahoma Individual Income Form For Nonresidents And Part Year Residents Packet & Instructions seamlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the necessary form and securely save it online. airSlate SignNow equips you with all the features needed to create, adjust, and electronically sign your documents swiftly without hassle. Manage Form 511 NR Oklahoma Individual Income Form For Nonresidents And Part Year Residents Packet & Instructions on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and electronically sign Form 511 NR Oklahoma Individual Income Form For Nonresidents And Part Year Residents Packet & Instructions without effort

- Find Form 511 NR Oklahoma Individual Income Form For Nonresidents And Part Year Residents Packet & Instructions and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers for that specific purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Finished button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 511 NR Oklahoma Individual Income Form For Nonresidents And Part Year Residents Packet & Instructions and guarantee effective communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 511 nr oklahoma individual income form for nonresidents and part year residents packet ampamp instructions

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 511 nr oklahoma individual income form for nonresidents and part year residents packet ampamp instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the 2020 Oklahoma tax process?

airSlate SignNow is an easy-to-use, cost-effective solution that empowers businesses to send and eSign documents. It can streamline the 2020 Oklahoma tax process by allowing you to securely sign and send tax documents electronically, ensuring compliance and saving time.

-

How can airSlate SignNow help with filing the 2020 Oklahoma tax return?

Using airSlate SignNow can simplify the filing of your 2020 Oklahoma tax return by providing a platform to securely eSign necessary documents. This reduces the need for physical paperwork and enhances the efficiency of submitting your tax return.

-

Is airSlate SignNow affordable for small businesses handling 2020 Oklahoma tax filings?

Yes, airSlate SignNow offers pricing plans designed to be cost-effective for small businesses, making it an ideal choice for those handling 2020 Oklahoma tax filings. The platform delivers signNow savings by reducing paper and printing costs associated with traditional document signing.

-

What features does airSlate SignNow offer for managing 2020 Oklahoma tax documents?

airSlate SignNow offers various features such as templates, document storage, and real-time tracking, all beneficial for managing 2020 Oklahoma tax documents. These tools allow users to effortlessly create, send, and sign tax documents while staying organized and compliant.

-

Can airSlate SignNow integrate with accounting software for 2020 Oklahoma tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to prepare and file your 2020 Oklahoma tax. This integration allows you to manage all tax-related documents in one place, enhancing efficiency and accuracy.

-

What are the benefits of eSigning 2020 Oklahoma tax documents with airSlate SignNow?

eSigning your 2020 Oklahoma tax documents with airSlate SignNow offers numerous benefits, including faster processing times, reduced paperwork, and increased security. With eSignatures, you can complete your tax obligations quickly and confidently, knowing your information is protected.

-

How secure is airSlate SignNow for handling sensitive 2020 Oklahoma tax information?

airSlate SignNow employs robust security measures to ensure the safety of sensitive 2020 Oklahoma tax information. Advanced encryption, secure cloud storage, and compliance with industry standards protect your documents, providing peace of mind as you manage your tax filings.

Get more for Form 511 NR Oklahoma Individual Income Form For Nonresidents And Part Year Residents Packet & Instructions

- Limited liability company llc operating agreement rhode island form

- Single member limited liability company llc operating agreement rhode island form

- Rhode island organization form

- Renunciation and disclaimer of property received by intestate succession rhode island form

- Rhode island notice form

- Quitclaim deed from individual to husband and wife rhode island form

- Warranty deed from individual to husband and wife rhode island form

- Quitclaim deed from corporation to husband and wife rhode island form

Find out other Form 511 NR Oklahoma Individual Income Form For Nonresidents And Part Year Residents Packet & Instructions

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure