Oklahoma Individual Income Tax Forms and Inst 2024-2026

Understanding the Oklahoma Individual Income Tax Forms and Instructions

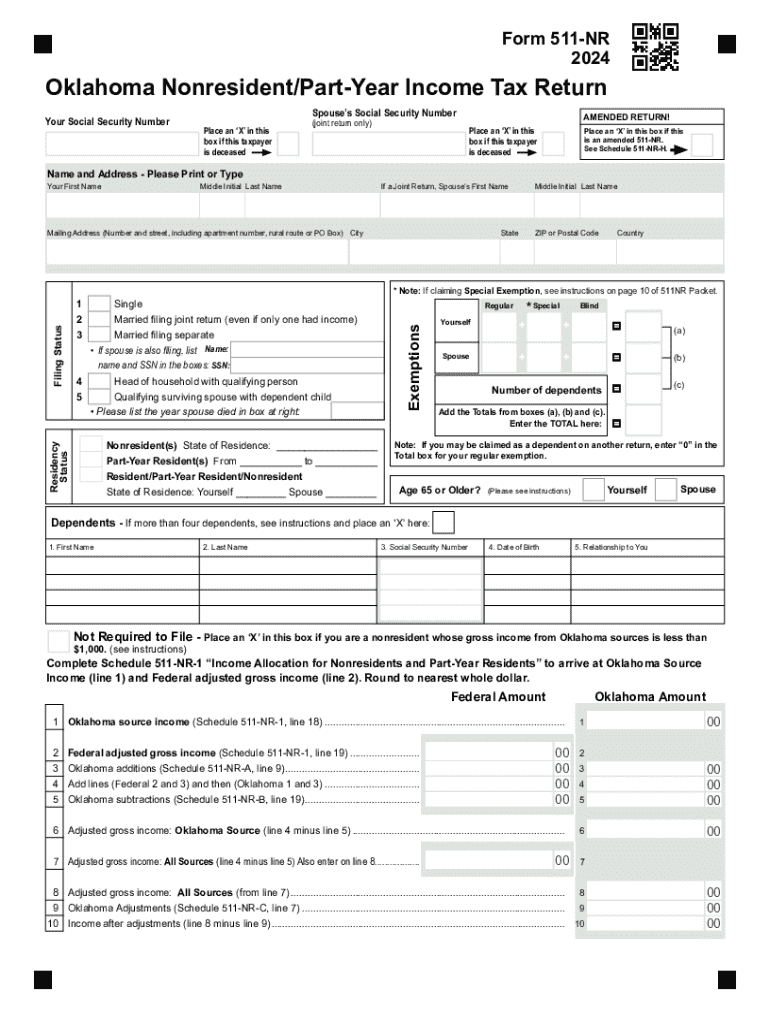

The Oklahoma Individual Income Tax Forms and Instructions are essential documents for residents and individuals earning income in Oklahoma. These forms are used to report income, calculate tax liability, and ensure compliance with state tax laws. The primary form for individual income tax is the Oklahoma Form 511, which is designed for residents. Non-residents and part-year residents may need to use Form 511NR. Each form comes with specific instructions to guide taxpayers through the filing process, detailing how to report various types of income, deductions, and credits available under Oklahoma law.

How to Complete the Oklahoma Individual Income Tax Forms

Completing the Oklahoma Individual Income Tax Forms requires careful attention to detail. Start by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Follow the instructions provided with the form to accurately fill out each section. Key areas include personal information, income sources, deductions, and tax credits. Ensure that all calculations are correct, as errors can lead to delays or penalties. Once completed, review the form thoroughly to confirm that all information is accurate and complete before submission.

Obtaining the Oklahoma Individual Income Tax Forms

Taxpayers can obtain the Oklahoma Individual Income Tax Forms through several channels. The most convenient way is to visit the Oklahoma Tax Commission's official website, where forms are available for download. Additionally, forms can be requested via mail or picked up at local tax offices. Many tax preparation services also provide these forms as part of their services. It's important to ensure that you are using the most current version of the form, as tax laws and requirements may change annually.

Filing Deadlines for Oklahoma Individual Income Tax Forms

Filing deadlines for the Oklahoma Individual Income Tax Forms are crucial to avoid penalties. Typically, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who require additional time can file for an extension, but it's important to note that this does not extend the time to pay any taxes owed. Payments must still be made by the original deadline to avoid interest and penalties.

Submission Methods for Oklahoma Individual Income Tax Forms

Taxpayers have multiple options for submitting their Oklahoma Individual Income Tax Forms. Forms can be filed electronically through approved e-filing software, which is often the fastest and most efficient method. Alternatively, individuals may choose to mail their completed forms to the appropriate address provided in the instructions. In-person submissions are also possible at designated tax offices throughout the state. Each submission method has its benefits, including the ability to track the status of e-filed returns more easily.

Key Elements of the Oklahoma Individual Income Tax Forms

Understanding the key elements of the Oklahoma Individual Income Tax Forms is essential for accurate filing. Important sections include personal identification information, income reporting, and deduction claims. Taxpayers must also be aware of available tax credits, such as the Oklahoma Earned Income Credit, which can significantly reduce tax liability. Familiarity with these elements helps ensure that all relevant information is reported and that taxpayers maximize their potential refunds or minimize their tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma individual income tax forms and inst

Create this form in 5 minutes!

How to create an eSignature for the oklahoma individual income tax forms and inst

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Oklahoma Individual Income Tax Forms And Inst.?

Oklahoma Individual Income Tax Forms And Inst. are official documents required for filing personal income taxes in Oklahoma. These forms provide detailed instructions on how to report income, deductions, and credits. Understanding these forms is crucial for accurate tax filing and compliance with state regulations.

-

How can airSlate SignNow help with Oklahoma Individual Income Tax Forms And Inst.?

airSlate SignNow simplifies the process of completing and submitting Oklahoma Individual Income Tax Forms And Inst. by allowing users to eSign documents securely. Our platform streamlines document management, making it easy to fill out and send tax forms electronically. This saves time and reduces the risk of errors in your tax submissions.

-

Are there any costs associated with using airSlate SignNow for Oklahoma Individual Income Tax Forms And Inst.?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our user-friendly platform for managing Oklahoma Individual Income Tax Forms And Inst. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Oklahoma Individual Income Tax Forms And Inst.?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for Oklahoma Individual Income Tax Forms And Inst. These tools enhance efficiency and ensure that your tax documents are organized and easily accessible. Additionally, our platform supports collaboration, allowing multiple users to work on forms simultaneously.

-

Can I integrate airSlate SignNow with other software for Oklahoma Individual Income Tax Forms And Inst.?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for Oklahoma Individual Income Tax Forms And Inst. You can connect with popular accounting and tax software to streamline data transfer and improve overall efficiency in your tax preparation process.

-

Is airSlate SignNow secure for handling Oklahoma Individual Income Tax Forms And Inst.?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your sensitive information, including Oklahoma Individual Income Tax Forms And Inst. You can trust that your data is safe while using our eSigning and document management services.

-

What are the benefits of using airSlate SignNow for Oklahoma Individual Income Tax Forms And Inst.?

Using airSlate SignNow for Oklahoma Individual Income Tax Forms And Inst. offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our platform allows for quick eSigning and easy document sharing, making tax filing less stressful. Additionally, you can track the status of your forms in real-time.

Get more for Oklahoma Individual Income Tax Forms And Inst

- Name of person renting the field form

- Rapid access prostate clinic form bon secours hospital bonsecours

- Byod expression of interest mill park secondary college millparksc vic edu form

- Mutual exchange application form date yhgcouk yhg co

- Aanvraag tot inschrijving proefrittenplaat btw attesten form

- Declaration of source of funds form

- Rmi scholarship form

- Oklahoma gear up college campus evaluation form okgearup

Find out other Oklahoma Individual Income Tax Forms And Inst

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later