511NR Packet Instructions Oklahoma Individual Income Form and Instructions for Nonresidents and Part Year Residents 2020

What is the 511NR Packet Instructions Oklahoma Individual Income Form and Instructions for Nonresidents and Part Year Residents

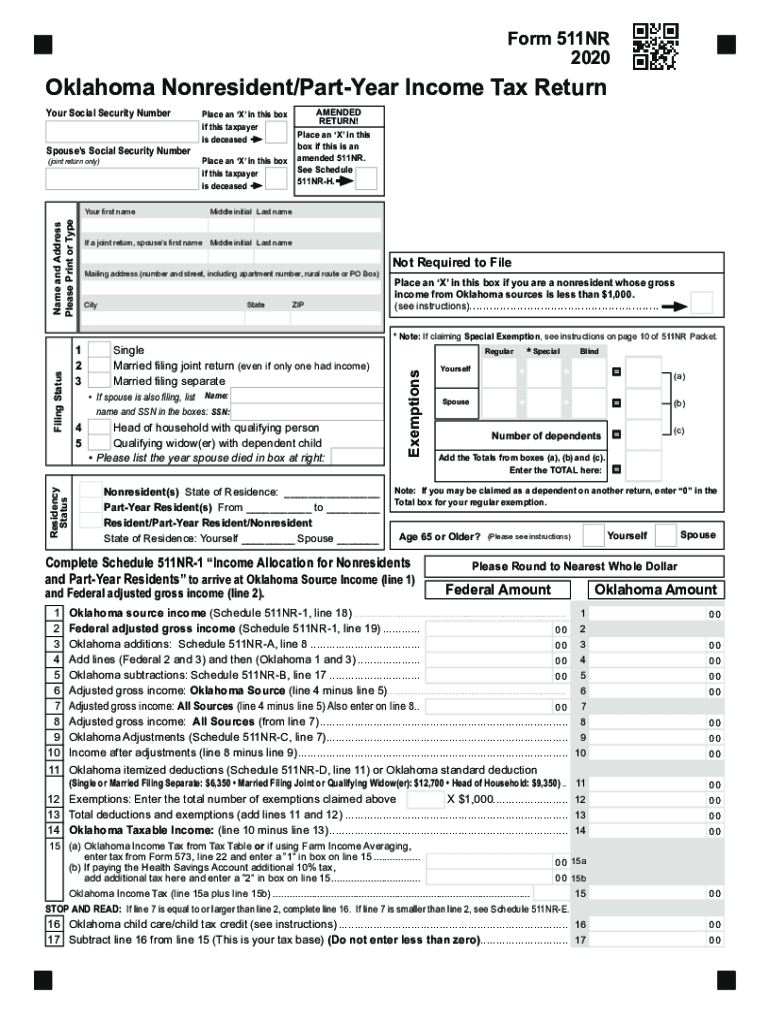

The 511NR Packet is designed specifically for nonresidents and part-year residents of Oklahoma who need to file their state income tax returns. This form allows individuals who earned income in Oklahoma but do not reside in the state for the entire tax year to report their earnings accurately. The packet includes detailed instructions on how to complete the form, ensuring that all necessary information is provided for proper tax assessment. It is essential for taxpayers to understand the specific requirements outlined in the 511NR Packet to avoid potential issues with their tax filings.

Steps to Complete the 511NR Packet Instructions Oklahoma Individual Income Form and Instructions for Nonresidents and Part Year Residents

Completing the 511NR Packet involves several key steps to ensure accurate filing. First, gather all relevant financial documents, including W-2s and 1099s, which report your income earned in Oklahoma. Next, carefully read through the instructions provided in the packet to understand what information is required. Fill out the form by entering your personal details, income information, and any applicable deductions or credits. After completing the form, review it for accuracy and completeness. Finally, submit the form according to the instructions, either electronically or by mail, ensuring that you meet all filing deadlines.

Legal Use of the 511NR Packet Instructions Oklahoma Individual Income Form and Instructions for Nonresidents and Part Year Residents

The 511NR Packet is legally recognized for filing state income taxes in Oklahoma. It complies with state tax laws, allowing nonresidents and part-year residents to report their income correctly. To ensure the legal validity of your submission, it is crucial to follow the instructions carefully and provide accurate information. Any discrepancies or incomplete information may lead to penalties or delays in processing your return. Utilizing a reliable platform for electronic filing can enhance the legal standing of your submission, as it often includes features that ensure compliance with eSignature laws.

Key Elements of the 511NR Packet Instructions Oklahoma Individual Income Form and Instructions for Nonresidents and Part Year Residents

Several key elements are included in the 511NR Packet that taxpayers must be aware of. These include:

- Personal Information: Taxpayers must provide their name, address, and Social Security number.

- Income Reporting: Accurate reporting of income earned in Oklahoma is essential, including wages, interest, and dividends.

- Deductions and Credits: The form outlines available deductions and credits that may reduce taxable income.

- Signature Requirements: Taxpayers must sign the form to certify that the information provided is true and correct.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the 511NR Packet. Typically, the deadline for filing state income tax returns in Oklahoma is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, especially if they are filing electronically or using a tax professional. Meeting these deadlines is crucial to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The 511NR Packet can be submitted through various methods, offering flexibility to taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times and reduce the risk of errors.

- Mail: Completed forms can be sent via postal service to the appropriate state tax office. It is advisable to use certified mail for tracking purposes.

- In-Person: Some individuals may choose to deliver their forms directly to a local tax office, ensuring immediate receipt.

Quick guide on how to complete 2020 511nr packet instructions oklahoma individual income form and instructions for nonresidents and part year residents

Complete 511NR Packet Instructions Oklahoma Individual Income Form And Instructions For Nonresidents And Part Year Residents effortlessly on any device

Online document management has become popular with businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle 511NR Packet Instructions Oklahoma Individual Income Form And Instructions For Nonresidents And Part Year Residents on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign 511NR Packet Instructions Oklahoma Individual Income Form And Instructions For Nonresidents And Part Year Residents with ease

- Locate 511NR Packet Instructions Oklahoma Individual Income Form And Instructions For Nonresidents And Part Year Residents and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select how you would like to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign 511NR Packet Instructions Oklahoma Individual Income Form And Instructions For Nonresidents And Part Year Residents and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 511nr packet instructions oklahoma individual income form and instructions for nonresidents and part year residents

Create this form in 5 minutes!

How to create an eSignature for the 2020 511nr packet instructions oklahoma individual income form and instructions for nonresidents and part year residents

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What are Oklahoma state tax forms 2018, and why are they important?

Oklahoma state tax forms 2018 are the documents required for filing state taxes for the 2018 tax year. These forms are crucial as they help you report your income, deductions, and credits to the Oklahoma Tax Commission, ensuring compliance and accurate tax calculations. Completing these forms accurately can help you avoid penalties and secure any potential refunds.

-

How can airSlate SignNow assist with Oklahoma state tax forms 2018?

airSlate SignNow simplifies the process of managing Oklahoma state tax forms 2018 by allowing users to send and eSign documents electronically. This platform streamlines your tax preparation by providing templates and secure storage, helping you stay organized and compliant with state tax regulations. With SignNow, you can efficiently handle all your tax documentation with ease.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow offers numerous features for managing tax forms, including customizable templates, electronic signatures, and secure document storage. It enables users to automate workflows, ensuring that all necessary Oklahoma state tax forms 2018 are completed and submitted on time. With comprehensive tracking and analytics, you can easily monitor the status of your tax documents.

-

Is there a cost associated with using airSlate SignNow for Oklahoma state tax forms 2018?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, starting from a cost-effective option for individuals to more comprehensive plans for larger organizations. The pricing typically reflects the features and the number of documents you can manage, making it an affordable solution for handling Oklahoma state tax forms 2018. Investing in SignNow can save time and reduce errors in your tax filing process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Oklahoma state tax forms 2018, provides numerous benefits such as increased efficiency, enhanced security, and better collaboration. The electronic signature capability streamlines approvals and reduces the turnaround time for critical tax documents. Additionally, with secure cloud storage, you can access your documents anytime and from anywhere.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow offers integration with various accounting and tax management software, allowing for seamless data transfer and document management. This capability is essential for businesses looking to manage Oklahoma state tax forms 2018 alongside their existing systems. Integrations can help minimize manual data entry, reduce errors, and provide a holistic view of your financial documentation.

-

What formats do Oklahoma state tax forms 2018 come in within airSlate SignNow?

Oklahoma state tax forms 2018 are available in various formats within airSlate SignNow, including PDF and Word. This flexibility allows you to work with the format that suits your needs best, whether for filling out forms electronically or printing them for submission. The platform also ensures that your forms maintain compliance with state guidelines.

Get more for 511NR Packet Instructions Oklahoma Individual Income Form And Instructions For Nonresidents And Part Year Residents

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497429235 form

- Change residence form

- Washington business incorporation package to incorporate corporation washington form

- Washington corporation template form

- Washington pre incorporation agreement shareholders agreement and confidentiality agreement washington form

- Washington bylaws form

- Corporate records maintenance package for existing corporations washington form

- Company llc 497429242 form

Find out other 511NR Packet Instructions Oklahoma Individual Income Form And Instructions For Nonresidents And Part Year Residents

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document