Www Revenue State Mn Us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents 2021

Understanding the Minnesota M1NR Form

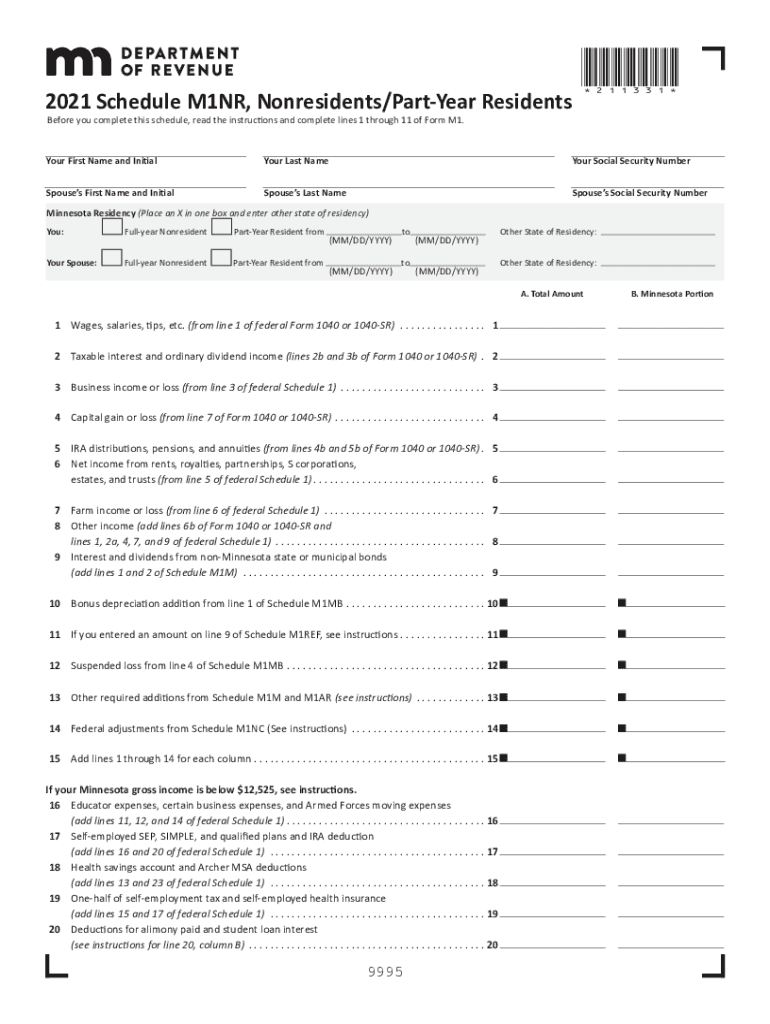

The Minnesota M1NR form is designed for nonresidents and part-year residents who need to report their income earned in Minnesota. This form is essential for individuals who do not reside in Minnesota but have income sourced from the state. It allows taxpayers to accurately calculate their tax liability based on the income earned while residing outside the state. Understanding this form is crucial for compliance with Minnesota tax laws and ensuring that individuals pay the correct amount of tax on their Minnesota-sourced income.

Steps to Complete the Minnesota M1NR Form

Completing the Minnesota M1NR form involves several straightforward steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income earned in Minnesota, ensuring to include only the income sourced within the state.

- Calculate your tax liability using the provided tax tables or software.

- Review your form for accuracy and completeness before submission.

Legal Use of the Minnesota M1NR Form

The Minnesota M1NR form must be filled out and submitted in accordance with state tax laws. It is legally binding and must be completed truthfully to avoid penalties. The form allows nonresidents to claim any applicable deductions and credits, ensuring compliance with Minnesota tax regulations. It is important to understand the legal implications of providing false information on this form, as it may result in fines or legal action.

Filing Deadlines and Important Dates

Filing deadlines for the Minnesota M1NR form typically align with federal tax deadlines. For most taxpayers, the due date is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates to ensure timely submission and avoid penalties for late filing.

Required Documents for the Minnesota M1NR Form

To successfully complete the Minnesota M1NR form, taxpayers must gather specific documents, including:

- W-2 forms from employers for income earned in Minnesota.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any other income sources that are taxable in Minnesota.

- Documentation supporting any deductions or credits claimed.

Eligibility Criteria for Filing the Minnesota M1NR Form

Eligibility to file the Minnesota M1NR form is primarily based on residency status. Taxpayers must be nonresidents or part-year residents who have earned income in Minnesota. Additionally, individuals must meet certain income thresholds to determine their filing requirement. Understanding these criteria helps ensure that only those who need to file do so, thereby streamlining the tax process for nonresidents.

Quick guide on how to complete wwwrevenuestatemnus2020 06m1nr192019 m1nr nonresidentspart year residents

Complete Www revenue state mn us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents rapidly without holdups. Manage Www revenue state mn us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

How to modify and eSign Www revenue state mn us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents with ease

- Obtain Www revenue state mn us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Www revenue state mn us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwrevenuestatemnus2020 06m1nr192019 m1nr nonresidentspart year residents

Create this form in 5 minutes!

How to create an eSignature for the wwwrevenuestatemnus2020 06m1nr192019 m1nr nonresidentspart year residents

The best way to create an e-signature for a PDF file online

The best way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is m1nr and how does it benefit businesses using airSlate SignNow?

m1nr refers to the powerful capabilities offered by airSlate SignNow in managing electronic signatures and document workflows. By utilizing m1nr, businesses can streamline their processes, reduce turnaround times, and enhance overall efficiency, making it easier to send and eSign documents securely.

-

Is there a cost associated with using airSlate SignNow for m1nr functionalities?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including m1nr features. These plans ensure that you get the most value for your investment, with cost-effective options that align with your budget while still providing robust eSigning capabilities.

-

What are the key features of m1nr available in airSlate SignNow?

The key features of m1nr in airSlate SignNow include customizable templates, real-time tracking of document status, and secure cloud storage. These features make it easier for businesses to manage their eSigning processes efficiently and ensure that all document activities are well-organized and accessible.

-

How does m1nr improve the efficiency of document management?

By leveraging m1nr in airSlate SignNow, businesses can automate their document workflows, signNowly reducing manual tasks and human error. This leads to faster processing times and seamless collaboration among team members, enhancing overall productivity.

-

Can I integrate m1nr with other software applications?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to enhance the m1nr experience further. This flexibility enables businesses to connect their eSigning processes with CRM systems, cloud storage, and other essential tools for improved workflow efficiency.

-

What types of documents can be managed with m1nr in airSlate SignNow?

With m1nr, you can manage a wide range of document types, including contracts, agreements, and forms. airSlate SignNow ensures that all document formats are supported, allowing users to send and eSign various documentation easily.

-

Is m1nr compliant with legal eSignature regulations?

Yes, airSlate SignNow's m1nr solutions are fully compliant with key eSignature regulations such as ESIGN and UETA. This compliance guarantees that all electronically signed documents hold the same legal validity as paper documents, providing peace of mind for businesses.

Get more for Www revenue state mn us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property florida form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential florida form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property florida form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property florida form

- Agreed written termination of lease by landlord and tenant florida form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497303165 form

- Notice breach lease form

- Florida violating form

Find out other Www revenue state mn us2020 06m1nr192019 M1NR, NonresidentsPart Year Residents

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors